Market Insights: Streak of Overbought Readings

Milestone Wealth Management Ltd. - Jun 23, 2023

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index declined 2.79%. In the U.S., the Dow Jones Industrial Average retreated 1.67% and the S&P 500 Index shrank 1.39%.

- The Canadian dollar rose slightly this week, closing at 75.87 cents vs 75.77 cents last Friday.

- Oil prices were negative this week. U.S. West Texas crude closed at US$69.45 vs US$71.64 last Friday, and the Western Canadian Select price closed at US$58.18 vs US$60.49 last Friday.

- The price of gold withdrew this week, closing at US$1,922 vs US$1,958 last Friday.

- WestJet is planning to wind down Sunwing Airlines, integrating the low-cost carrier into its mainline business within two years as part of a plan to streamline operations. The decision comes barely a week after WestJet opted to fold budget subsidiary Swoop's operations under its flagship banner as well.

- Eli Lilly (LLY) is acquiring Dice Therapeutics (DICE) for $48.00/share, a roughly 40% premium to the previous day’s closing price. The $2.4 billion deal will give Eli Lilly access to Dice’s proprietary technology platform to develop new oral therapeutic drugs for autoimmune diseases.

- Allied Properties REIT (AP.un) announced it is to sell its Toronto data-center portfolio to Japanese telecommunications company KDDI Corp for $1.35 billion. KDDI owns and operates data centres in Asia, Europe and the United States through its subsidiary, Telehouse. Allied will use approximately $1 billion of the proceeds to retire debt and to fund upgrade and development activity on other buildings in its portfolio during 2023 and 2024.

- The Bank of England on Thursday surprised markets with a 0.50% hike to interest rates, which takes the bank’s base rate to 5.0%. This is the central bank’s 13th consecutive increase, defying market expectations which had priced in only a 60% chance of a 0.25% hike.

- The Ontario Municipal Employees Retirement System (OMERS) is entering a deal to purchase Larry Tanenbaum’s stake in Maple Leaf Sports and Entertainment in a deal that values the Canadian sports company at over $8 billion. The company’s most valuable assets are the Toronto Maple Leafs and the Toronto Raptors. The other owners are BCE and Rogers with 37.5% each.

Weekly Diversion:

Check out this video: Mr. Beast Giving Out iPhones Instead Of Candy on Halloween

Charts of the Week:

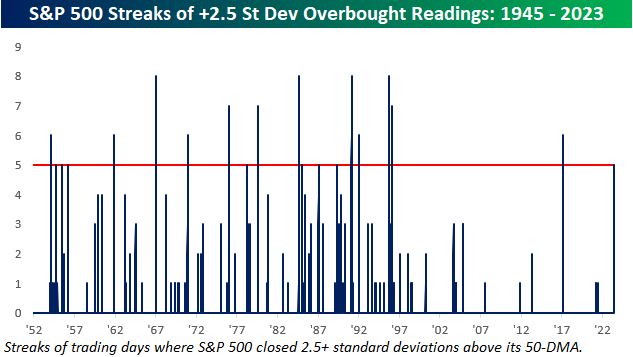

The S&P 500’s rally over the last few weeks, spurred on mostly by the technology sector again, has been impressive. Since early June, the S&P 500 Index has risen above the August 2022 highs and into a new trading range. We should note that the equal-weighted S&P 500 is still below its February 2023 and August 2022 highs, so the strength has certainly not been widespread. Although markets have pulled back this week, the index had closed at overbought levels for fifteen straight trading days through the end of last week, and the last eleven of those have been closes of two or more standard deviations above its 50-day moving average (DMA). A market is considered ‘overbought’ when it sits one or more standard deviations above its 50-DMA. Not only that, but over the last five trading days ending last Friday, the S&P 500 managed to close more than 2.5 standard deviations above its 50-DMA.

As the following chart from Bespoke illustrates, last week’s five straight days of closing 2.5+ standard deviations above its 50-DMA were the longest since a six-day streak back in February 2017, and before that, you need to go all the way back to 1996. Since the five-day trading week began in 1952, these types of streaks occurred much more frequently before the mid-1990s than after the mid-1990s.

Source: Bespoke Investment Group

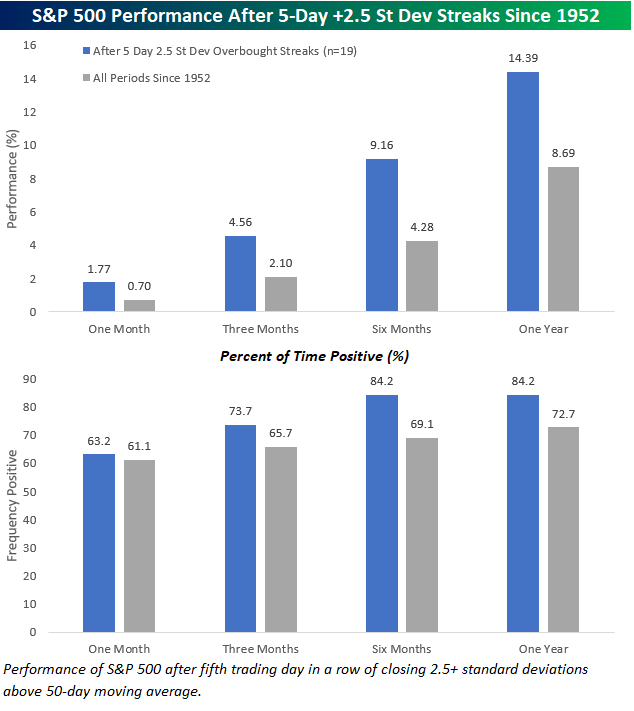

As we have highlighted in past remarks, overbought markets have often been positive signs for markets in general. Perhaps this sounds counterintuitive, but relative strength often brings on more strength. One could argue that overbought readings in conjunction with extended valuations are not a good combination, however, this attribute is likely only mostly present in the technology sector and not most sectors. While overbought markets are usually followed by a short-term pullback, looking back at prior periods where the S&P 500 traded at similarly overbought levels for an extended period were followed by much better-than-average returns.

Since 1952, there have been 19 prior streaks of five or more trading days where the S&P 500 closed at least 2.5 standard deviations above its 50-DMA. The table and bar chart below show each of those periods along with how the S&P 500 performed over the following one-, three-, six-, and twelve-month periods. Over the next month, average returns were higher than the long-term average for all periods since 1952, but the frequency of positive returns was about the same. Also notable is the fact that one month after the fifth day in each of the last four streaks, the S&P 500 was lower. Moving to the next three, six, and twelve months, though, not only were the average returns significantly higher than the same average for all periods since 1952, but the consistency of positive returns was also higher. One year later, for example, the S&P 500 was up 16 out of 19 times for an average gain of 11.4% (median 14.4%) which is about 3% higher than the 8.7% average one-year return for all periods. It’s also interesting to note that of these triggering events, specifically the highest inflation years of the 70s and early 80s, they still posted strong 6-month and 1-year returns.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, BNN Bloomberg, Thomson Reuters, Refinitiv, Business Insider, Bespoke Investment Group,

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.