Market Insights: What Goes Up, Must Come Down

Milestone Wealth Management Ltd. - Jun 16, 2023

Macroeconomic and Market Developments:

- North American markets were higher this week. In Canada, the S&P/TSX Composite Index was up 0.42%. In the U.S., the Dow Jones Industrial Average increased 1.25% and the S&P 500 Index was up 2.58%.

- The Canadian dollar jumped this week to its highest close since September, closing at 75.77 cents vs 74.94 cents last Friday.

- Oil prices were also positive this week. U.S. West Texas crude closed at US$71.64 vs US$70.38 last Friday, and the Western Canadian Select price closed at US$60.49 vs US$50.04 last Friday.

- The price of gold was slightly lower this week, closing at US$1,958 vs US$1,960 last Friday.

- The U.S. Federal Reserve met this week. The central bank decided to leave their key borrowing rate in a target range of 5.0% - 5.25%, after 10 consecutive interest rate increases. But the decision to hold off on a hike at this meeting came with a projection that another two 0.25% moves are on the way before the end of the year. The Fed next meets July 25 - 26.

- The other big economic news out of the U.S. was inflation data. The U.S. Consumer Price Index (CPI) increased by 0.1% for the month of May and cooled to just 4.0% for the last 12 months, the lowest inflation rate since March 2021. However, the Core CPI, excluding volatile segments like food and energy, was still up 5.3% from a year ago.

- The fight for Teck's (TECK.b) steelmaking coal business has taken another turn. Swiss-based natural resources giant Glencore remains willing to pursue its previously proposed merger and coal demerger, but has submitted an alternative proposal to acquire just the coal business for cash.

- U.S. agribusiness Bunge (BG) is buying Viterra for US$8.2 billion in stock and cash, and will assume US$9.8 billion of Viterra debt, creating a trading giant capable of competing with Cargill and Archer-Daniels-Midland. Viterra shareholders will eventually own about 30% of the combined business after the transaction.

- Canaccord Genuity (CF) is walking away from a plan to take the company private after they couldn’t get speedy approval from regulators for the deal. A group led by CEO Dan Daviau and Chairman David Kassie in January offered about $1.1 billion for the Canadian financial firm, with the support of a large outside shareholder.

Weekly Diversion:

Check out this video: Can’t wait to try this

Charts of the Week:

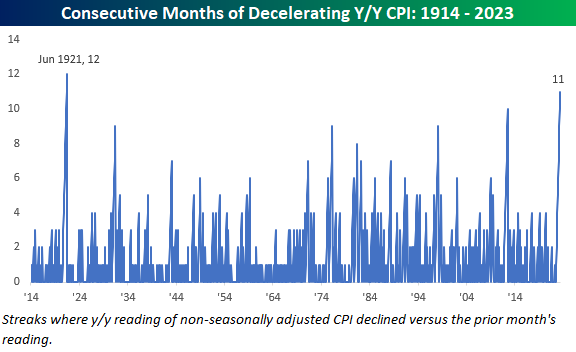

In 2022, inflation was the most discussed economic issue and rightfully so. We have painfully witnessed its impact on economic growth and corporate earnings growth. However, in our quarterly commentary and weekly comments in the third quarter of last year, as well as discussions with clients, we were adamant that we felt we hit peak inflation mid-last year. We also noted that while economic and corporate earnings growth numbers may be worse in 2023, it doesn’t mean the stock market will be, as the market itself is a long leading indicator. In our second quarter commentary we showed that long-term inflation break-evens were already trending down, and rather quickly. Many of our other leading indicators were pointing to inflation declining significantly in 2023. This was one key reason for Milestone bearing a more optimistic, albeit cautious, view for risk assets this year. This forecast has turned out to be mostly correct as we will illustrate in our charts this week. The latest May CPI numbers for the U.S. just hit the tape, and it showed that year-over-year headline CPI (which includes food/energy) is now just 4.0%. This is still relatively high from what we are used to the last 10 years (excluding last year), but much lower than the 9.1% peak (highest since early 1980s) of June last year. However, we have now seen U.S. CPI decline for the 11th straight month, which is the longest consecutive month decline since 1921! The decline itself is not nearly as dramatic as it was after WWI and the Spanish Flu where it dropped from inflation of 23.7% to deflation of 15.8%, nor for some of the other streaks you see below, but the streak is still 11 months long at this point which is impressive and likely supportive of equities to some extent.

Source: Bespoke Investment Group

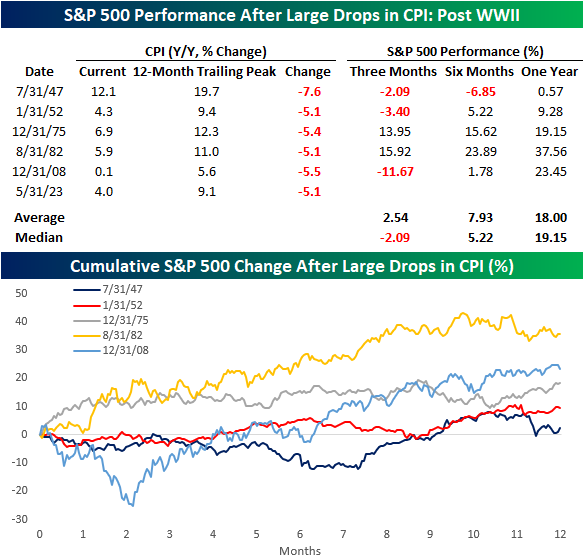

While the increase in inflation last year was extraordinary for recent times, the decline the past year has been just as remarkable. What goes up, must come down as they say. The 5.1% decline in headline CPI from its trailing 12-month high last June is the largest drop since the 2008 Financial Crisis. As the following charts show, for the entire post-WWII period, there has only been five other periods where inflation dropped more than 5% from a trailing 12-month peak.

Source: Bespoke Investment Group

What happened to equity markets in these past occurrences of sharp CPI declines like we are experiencing this year? As the following table shows, generally speaking, we have seen positive equity markets following these times, particularly over the following 12 months, albeit with some volatility and some mixed results over the next three months. In the six-month periods following these instances, the S&P 500 has been higher 80% of the time for an average gain of almost 8% (median 5.2%) which is a bit above average for all periods. One year later, however, returns were very strong with an average advance of 18% (median 19%) and positive 100% of the time. This average one-year return is close to double for all other periods of time. There is no crystal ball and no way to know what 2025 or 2026 will look like in terms of economic and earnings growth or where inflation will be at, but there is some evidence from the past that in sharp disinflationary times like the present (as opposed to inflationary times like last year where equities have tended to perform poorly in the past), equities have tended to respond very positively at least for a period of time.

Source: Bespoke Investment Group

We will finish off this week’s comments with an interesting chart we came across today. As we have noted many times in our weekly comments over the past many months, there has been an extreme amount of pessimism out there. This is only natural after a very difficult market environment in 2022 due to recency bias. Last week we showed the dramatic shift from bearish to bullish views in the recent widely followed AAII Investor Sentiment Survey. In fact, we may be now coming out of the most protracted period of pessimism in the history of this survey. As the following chart illustrates, when persistent pessimism has faded in the past it has usually been great news for equities. The top orange line is the S&P 500 Index (log scale), and the bottom blue line shows the percentage of weeks in the past year where the AAII bearish sentiment has been greater than the bullish sentiment. We are coming off of a record 98% of the time, the largest since at least 1990. You can see in the shaded bars that in the past these periods of time have preceded lengthy bull markets, so one can only hope this time is no different.

Source: Willie Delwiche, CMT, CFA, Hi Mount Research

Sources: CNBC.com, Globe and Mail, Financial Post, BNN Bloomberg, Thomson Reuters, Refinitiv, Business Insider, Bespoke Investment Group, Willie Delwiche, High Mount Research

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.