Market Insights: Earnings Shaping Up Positively

Milestone Wealth Management Ltd. - May 05, 2023

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index fell 0.46%. In the U.S., the Dow Jones Industrial Average decreased 1.24% and the S&P 500 Index shrank 0.80%.

- The Canadian dollar rallied this week, closing at 74.77 cents vs 73.83 cents last Friday.

- Oil prices continued their steep decline this week as global economic growth assumptions continue to be lowered. U.S. West Texas crude closed at US$71.32 vs US$76.73 last Friday, and the Western Canadian Select price closed at US$47.31 vs US$53.51 last Friday.

- The price of gold rose this week, closing at US$2,017 vs US$1,990 last Friday.

- All eyes were on the U.S. central bank this week. On Wednesday, the Federal Reserve approved its 10th interest rate increase in just over a year, raising rates by 0.25% to a target range of 5.00% - 5.25%. Investors were hopeful that the tightening cycle may be coming to an end as the post-meeting statement omitted a sentence saying “the Committee anticipates that some additional policy firming may be appropriate” for the Fed to achieve its 2% inflation goal.

- Last weekend, U.S. regulators took possession of First Republic Bank (FRC), resulting in the third recent failure of an American regional bank, in a string of such events that started with the collapse of Silicon Valley Bank and Signature Bank in March. The Federal Deposit Insurance Corporation (FDIC) was appointed as receiver and accepted a bid from JPMorgan (JPM) to assume all deposits, including all uninsured deposits, and substantially all assets of First Republic Bank.

- Enbridge (ENB) announced that, through a subsidiary, it will acquire FortisBC Midstream Inc., which holds a 93.8% interest in the Aitken Creek Gas Storage facility and a 100% interest in the Aitken Creek North Gas Storage facility, for $400 million.

- The IPO market has been very quiet lately; however, Johnson & Johnson (JNJ) completed a spin off of its consumer products division this week in the biggest IPO since Rivian went public in 2021. The new company named Kenvue (KVUE) has an approximate market cap of $50 billion, with J&J controlling 90.9% of the shares. Kenvue will produce brands such as Aveeno, Tylenol, Listerine, and Band-Aid.

- TD Bank and First Horizon have terminated their previously announced merger agreement, originally announced in February 2022, due to uncertainty as to when and if regulatory approvals could be obtained. Under the terms of the termination agreement, TD will make a $200 million cash payment to First Horizon as a result of the deal not going through, as well as a $25 million fee reimbursement.

- Apple (APPL) released earnings after the close on Thursday, beating estimates. Earnings came in at $1.52/share vs $1.43/share expected, on revenue of $94.84 billion vs $92.96 billion expected. Although overall sales fell for the second quarter in a row, the all-important iPhone sales came in at $51.33 billion, well ahead of the $48.84 billion that had been forecast.

- Employment numbers for April were released on Friday. In Canada, the economy added 41,000 jobs, however all the gains were in part-time employment. The unemployment rate stayed at 5.0% for the fifth straight month. In the U.S., nonfarm payrolls increased by 253,000, well above the 180,000 predicted. The unemployment rate was 3.4%, tied for an all-time low going back to 1969.

Weekly Diversion:

Check out this video: How is this even possible?

Charts of the Week:

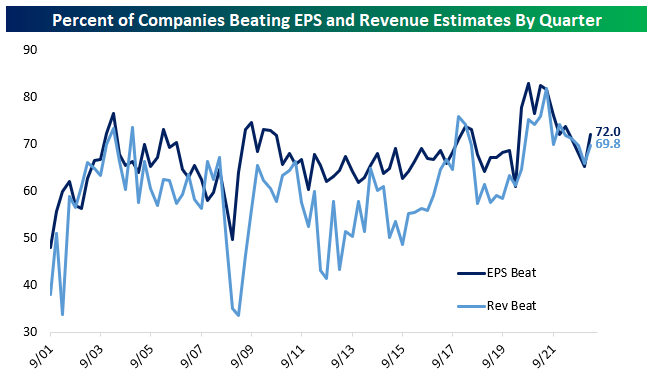

We are currently just over a month into this quarter’s earnings season reports, and so far, the results have been relatively positive, especially when comparing to previous seasons. As of Wednesday, May 3rd, 937 companies had reported earnings in the U.S., and when we compare this quarter to previous reports, we can see a positive trend forming. As represented in the chart below, the beat rate for announcements this quarter is running at 72.0% for earnings per share (EPS) versus 65.3% last quarter, which is in the 80th percentile since 2001. Revenue beat rates are also up, 69.8% versus 65.9% last quarter; that rate is in the 84th percentile of prior periods for this cohort of companies. The improvement breaks a string of weakening results versus expectations dating back to the height of the Covid-19 pandemic during 2020-2021.

Source: Bespoke Investment Group

In addition to improving earnings, we can see a rise in net positive guidance by companies which breaks a string of three consecutive quarters of companies cutting guidance. Company guidance refers to projections made by a company to its shareholders about upcoming earnings details for the next quarter or year. The chart below shows the net guidance raise and cut by companies in the U.S. and, although 7.2% net may seem like a relatively small number of companies, the change in trend is certainly welcome news for investors.

Source: Bespoke Investment Group

Perhaps more impressive, as the next chart illustrates, we also note that with guidance raises higher quarter-over-quarter and an improvement in the EPS beat rate, we're seeing more “Triple Plays” this quarter. Triple Plays, as termed by the astute Bespoke Investment Group, refer to companies that report a beat on EPS, a beat on revenues, and raised guidance, which are a rare occurrence for corporations and typically show favourable strength. There are significantly fewer Triple Plays this quarter compared to the post-pandemic boom, but at 6.3%, the Triple Play rate is still above the historical median and increased from last quarter.

Source: Bespoke Investment Group

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha