Market Insights: Sour Sixteen

Milestone Wealth Management Ltd. - Apr 28, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index declined 0.27%. In the U.S., the Dow Jones Industrial Average rose 0.86% and the S&P 500 Index increased 0.87%.

- The Canadian dollar waned this week, closing at 73.83 cents vs 74.82 cents last Friday.

- Oil prices dropped this week. U.S. West Texas crude closed at US$76.73 vs US$82.64 last Friday, and the Western Canadian Select price closed at US$53.51 vs US$66.86 last Friday.

- The price of gold declined this week, closing at US$1,990 vs US$2,004 last Friday.

- Long-struggling retailer Bed Bath & Beyond (BBBY) has filed for Chapter 11 bankruptcy protection, but said it intends to keep the chain’s 360 Bed Bath and 120 Buy Buy Baby stores open for the moment as it attempts to auction off assets through the restructuring process. In the meantime, the company has secured a commitment for some $240 million in debtor-in-possession financing, listing $5.2B of debts and $4.4B of assets in its bankruptcy filing.

- Suncor Energy (SU) has agreed to purchase TotalEnergies EP Canada Ltd., which holds a 31.23% working interest in the Fort Hills oil sands mining project and a 50% working interest in the Surmont in situ asset for cash consideration of C$5.5B. This will add 135,000 barrels per day of net bitumen production capacity and 2.1B barrels of proved and probable reserves to Suncor's oil sands portfolio. The transaction will have an effective date of April 1, giving Suncor a 100% ownership of Fort Hills.

- Cenovus Energy (CVE) reported lower than expected Q1 cash flow of $0.71/share vs $0.86/share expected, with production of 779.0 Mboe/d vs 790.0 Mboe/d expected. The company also announced it is increasing its quarterly dividend by 33.3% to $0.14 from $0.105.

- TC Energy (TRP) reported better than expected quarterly earnings of $1.21/share vs $1.17/share predicted, coming in with EBITDA of $2.78 billion vs $2.70 billion expected. Capital expenditures were $3.03 billion vs $3.11 billion expected. The company benefited from strong performance from its U.S. natural gas pipelines segment which achieved a company all-time record for deliveries to liquefied natural gas export facilities.

- Canada’s Real (after inflation) GDP rose 0.1% in February, below the 0.3% estimate. The early estimate for March points to a 0.1% decline, suggesting Real GDP rose at an annualized pace of 2.4% in Q1. U.S. Real GDP increased at a 1.1% annual rate in the first quarter, below the expected 1.9% annualized rate. The largest positive contribution to real GDP growth in Q1 came from personal consumption, with inventories being the largest drag on Q1 GDP growth.

- It was a big week for tech earnings, with positive results leading to some big gains in large cap tech stocks this week:

- After the close on Tuesday, Microsoft (MSFT) reported earnings of $2.45/share vs $2.23/share expected on revenue of $52.86 billion vs $51.02 billion expected.

- Also after the close on Tuesday, Alphabet (GOOGL) reported adjusted earnings of $1.17/share on revenue of $69.79 billion vs $68.9 billion and authorized a $70 billion share buyback plan.

- After the market closed on Wednesday, Facebook parent Meta Platforms (META) reported earnings of $2.20/share on revenue of $28.65 billion vs $27.65 billion expected. Important metrics Daily Active Users (DAUs) came in at 2.04 billion vs 2.01 billion expected and Monthly Active Users (MAUs) at 2.99 billion, exactly as expected.

- After the market closed on Thursday, Amazon (AMZN) posted earnings of $0.31/share on revenue of $127.4 billion vs $124.5 billion expected. Key segments of the business were Amazon Web Services generating $21.3 billion revenue vs $21.22 billion expected, and advertising generating $9.5 billion revenue vs $9.1 billion expected.

Weekly Diversion:

Check out this cute video: Honestly this happens to me all the time…

Charts of the Week:

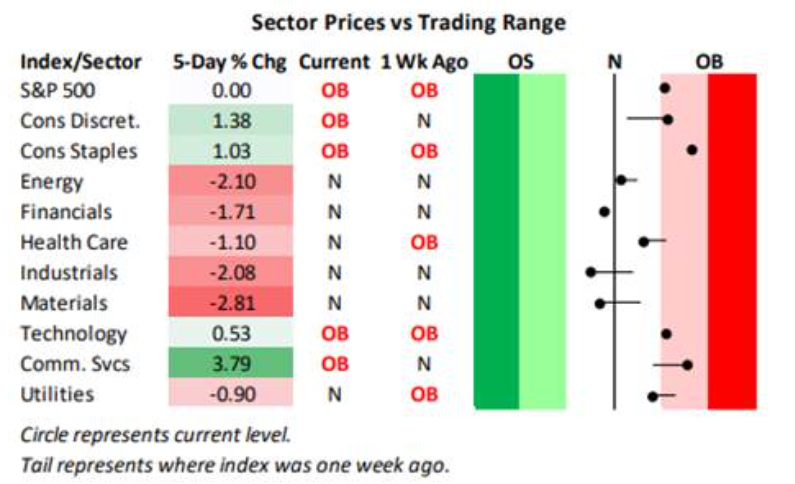

In last week’s charts of the week, we discussed the recent rally in the S&P 500 Index and that the underlying factors driving this rally have primarily been from one sector. Most of the recent success in the S&P 500 has been driven by “mega cap” technology stocks. This week we saw Alphabet (GOOGL) and Meta Platforms (META) post strong earnings on improved efficiency and cost-cutting measures. Impressively, year-to-date, Alphabet is up 20.44% and Meta is up 92.66%. As we can see from the chart below, the technology sector, and even more so, the communication services sector has become slightly overbought, however many other sectors continue to remain neutral.

Source: Bespoke Investment Group

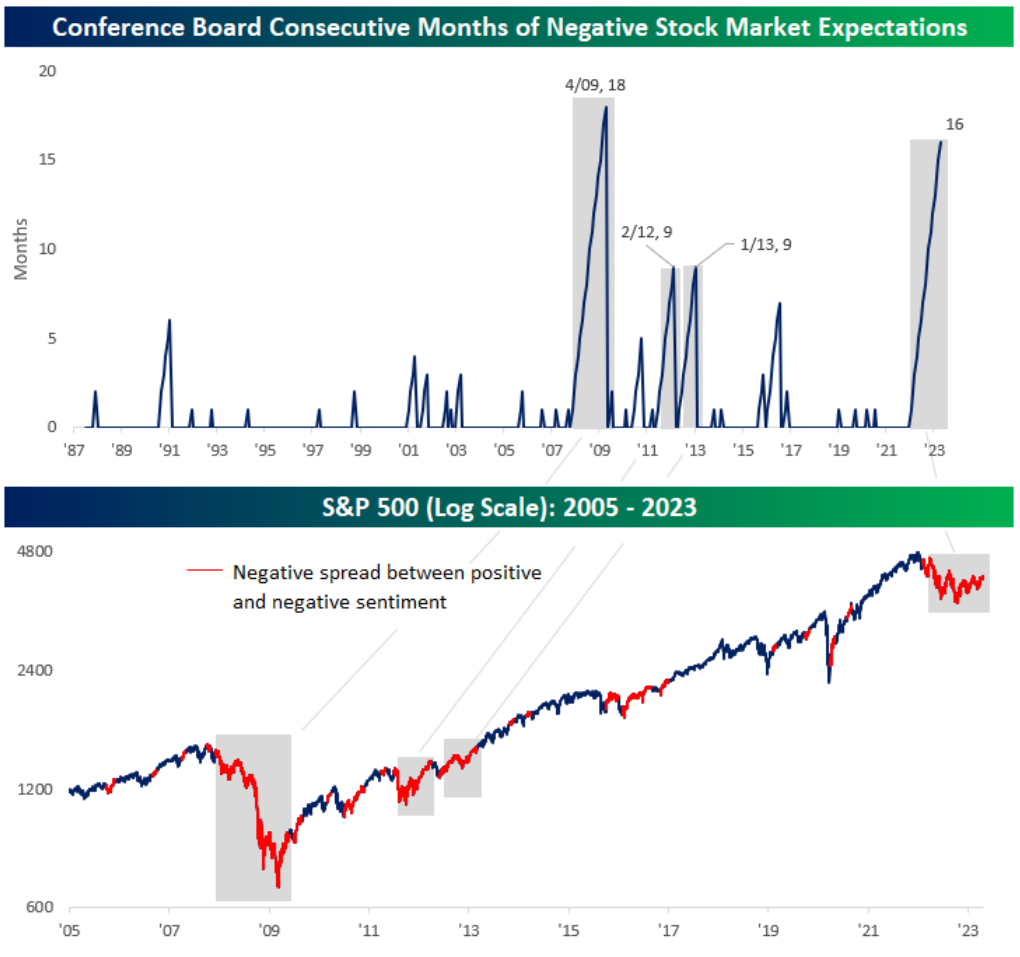

Investors continue to be relatively negative towards current stock market expectation. Now, this might appear to be a pessimistic statement, however, this could possibly represent a good opportunity from a contrarian perspective. We have stated that timing the markets is very difficult to do and will often result in lower long-term returns, but when market sentiment is very negative, prices have not been overinflated due to demand and may represent an opportunity for investors.

According to the U.S. Conference Board’s survey of Consumer Confidence, April data came in lower than expected and fell on a month-over-month basis for the eighth time is in the past twelve months. The survey also asks respondents for their views on stock prices, with 34.5% expecting stock prices to decline while just 29.3% expecting higher equity prices, extending the current negative reading streak to 16-months. As we can see in the chart below, going back to 1987, the current streak ranks as the second longest on record, trailing only the 18-month streak during the Financial Crisis that ended in April 2009.

Source: Bespoke Investment Group

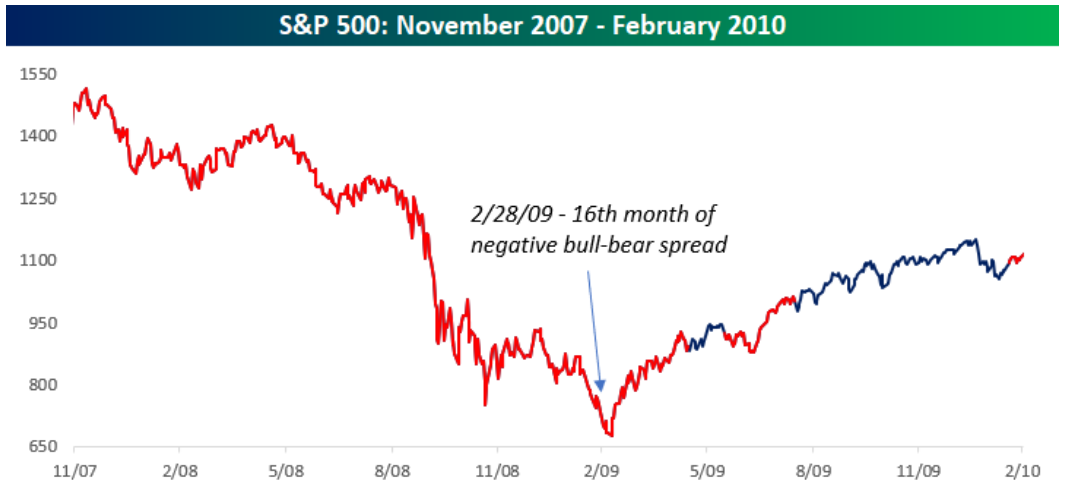

Looking more closely at the streak that spanned the Financial Crisis, when it reached the 16-month mark, the ultimate bear market low was just on the horizon but most of the damage had already been done. More importantly, over the next year, the S&P 500 was up over 30%. Additionally, in the year after each of the prior streaks lasting nine or more months (four times as noted above), the S&P 500’s performance in the year after the streak ended was positive each time with gains ranging from 11% to 36%. Based on these prior streaks, prolonged periods where consumers tend to have a more negative sentiment towards equities appear to create a pent-up demand for stocks once that period of pessimism finally ends. This point in time may be near.

Source: Bespoke Investment Group

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha