Market Insights: Over Six Months Without a Major Low

Milestone Wealth Management Ltd. - Apr 21, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite was up 0.55%. In the U.S., the Dow Jones Industrial Average declined 0.23% and the S&P 500 Index was down 0.10%.

- The Canadian dollar decreased this week, closing at $73.86 cents vs 74.82 cents USD last Friday.

- Oil prices fell 6% this week. U.S. West Texas crude closed at US$77.77 vs US$82.64 last Friday, and the Western Canadian Select price closed at US$62.92 vs US$66.86 last Friday.

- The price of gold dropped slightly this week, closing at US$1,982 vs US$2,004 last Friday.

- Canadian data released this week showed that inflation continues to moderate. The Consumer Price Index (CPI) rose 4.3% from March 2022 to March 2023, following a 5.2% annual increase posted in February. Excluding food and energy, the Core CPI was up 4.5% year over year, down from a 4.8% gain in February.

- Canadian Pacific (CP) and Kansas City Southern have finally combined to create Canadian Pacific Kansas City, creating the first single-line railway connecting Canada, the U.S., and Mexico. The new combined company has a much larger and more competitive network, operating approximately 20,000 miles of rail and employing close to 20,000 people.

- Prometheus Biosciences (RXDX), a clinical-stage biotech company focused on immunology, jumped this week after Merck (MRK) agreed to buy the company for $200/share in cash, indicating a total equity value of nearly $10.8 billion. Prometheus advances late-stage studies for ulcerative colitis and Crohn’s disease, as well as other autoimmune conditions.

- GSK Plc, maker of Advil and Centrum, has agreed to buy Canadian biotech company Bellus Health (BLU) for about $2 billion to bolster its pipeline of experimental medicines. The takeover will bring GSK a cough medicine that has shown promising results in clinical trials and has advanced through much of the research process.

- Netflix (NFLX) reported mixed results after the close on Tuesday, with earnings of $2.88/share vs $2.86/share expected on revenue of $8.16 billion vs $8.18 billion expected. The company also said it is pushing back the broad rollout of its password-sharing crackdown.

- WestJet (WJA) pilots have voted to strike as early as May 16, seeking better pay and working conditions. WestJet lost nearly 240 pilots last year and has lost another 100 so far this year to other airlines, including those offering better pay in the US.

- International Business Machines Corp. (IBM) reported first-quarter earnings of $1.36 per share vs. analyst expected $1.26 per share on revenue of $14.25 billion, just below analyst’s average estimate of $14.35 billion.

- Meta Platforms Inc. (META), the parent company of Facebook, announced additional layoffs of 10,000 employees in the coming months. This adds to the company’s efforts to cut costs, laying off approx. 11,000 employees this past fall.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer titled In Need of Breadth Mints and Antacid: DWYER VLOG

Weekly Diversion:

Check out this video of the craziest airport runway.

Charts of the Week:

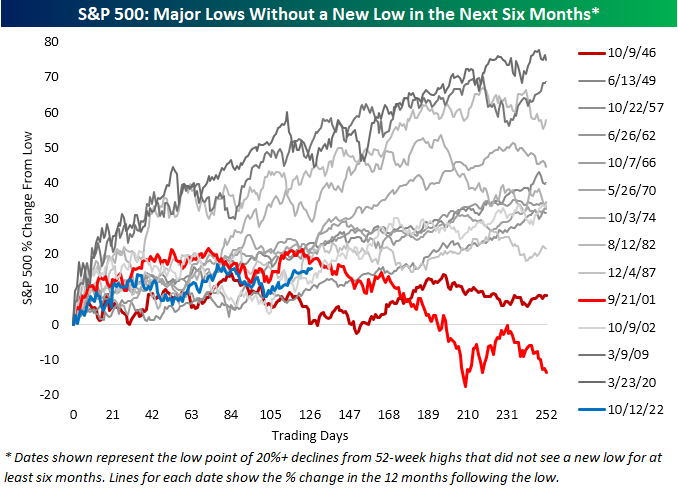

The S&P 500 Index has seen a significant rally from the 52-week low this past October, when the index hit a level of 25% below the 52-week high. With no new low being made since last October, the gap between the index's current level and its 52-week high is now down to approximately 3.2% on a weekly closing basis (although it's still 13.8% below its all-time daily closing high from January 3rd, 2022).

There have been 13 occurrences in which the S&P 500 went more than six months without making a new closing low after dropping over 20% from a 52-week high. These prior instances, as well as the current example, are highlighted in the chart and table below. The chart illustrates how the S&P 500 performed in the year following the major low. In each of these times, the S&P did not make a new low in the next six months; however, there were two instances where the S&P 500 made a new low in the six months after that. These two exceptions were the 1946/47 and 2001/2 periods. Following the low in October 1946, the S&P 500 only made a marginal new low shortly after the first six months, while in 2002, the lower lows were more significant. In all other cases, no new major lows were made.

Source: Bespoke Investment Group

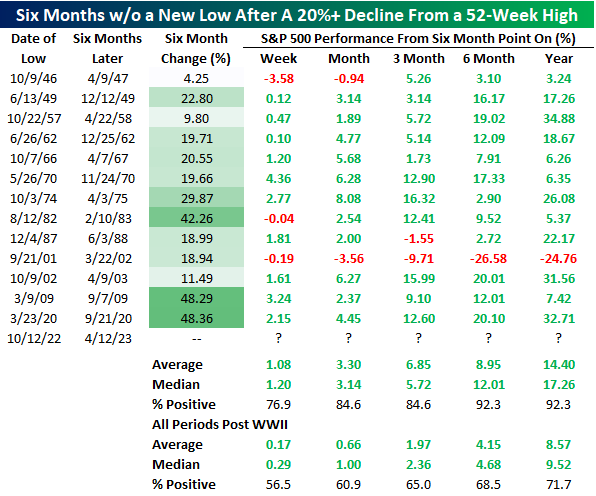

The following table illustrates the performance of the S&P 500 Index from the equivalent point across these past occurrences over the next year. As shown, aside from 2002, performance across the board was very positive six and 12 months later (with a positive rate of 92.3%). More impressively, the average return over these instances, as well as the positive rate, compared to all periods post WWII provide even more optimism. The average returns for six months out were 8.95% compared to all periods of 4.15% (median return of 12% vs. 4.75% all periods) and the average returns for 12 months out was 14.4% compared to all periods of 8.57% (median return of 17.3% vs. 9.5% all periods).

Source: Bespoke Investment Group

Rallies after major lows can be difficult to predict in real-time, but the current sentiment according to the latest Bank of America Global Fund Manager Survey showed investors are the most overweight bonds and underweight equities, on a relative basis, since the first quarter of 2009 which was very near the secular equity low of the Great Financial Crisis in 2008-9. From a contrarian perspective, this represents an opportunity for investors as equities in the past have tended to perform well when they become ‘unloved’. If the trend explored in the earlier chart and table hold, this could be an opportune time for a larger move higher in equities. The recent moderate rally has seen sentiment towards big tech and European equities turn positive (after a brutal 2022), with these areas becoming overbought. However, Milestone has avoided over-allocating to this in the near-term, instead continuing to focus on the longer-term market cycle and sticking to our investment and risk management process.

Source: Canaccord Genuity Corp, Bank of America

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha, Bank of America Global Research