Market Insights: Gold Back at 52-Week Highs

Milestone Wealth Management Ltd. - Apr 06, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index was up 0.48%. In the U.S., the Dow Jones Industrial Average increased 0.63% and the S&P 500 Index declined 0.10%.

- The Canadian dollar rallied this week, closing at 74.12 cents vs. 73.97 cents last Friday.

- Oil prices rose this week on a surprise OPEC+ oil production cut. U.S. West Texas crude closed at US$ 80.44 vs US$75.55 last Friday, and the Western Canadian Select price closed at US$65.78 vs US$53.12 last Friday.

- The price of gold surged this week, closing at US$2,022 vs US$1,968 last Friday.

- Tesla (TSLA) first quarter vehicle sales rose 36% after the company cut prices twice. The company delivered 422,875 vehicles worldwide, up from 310,000 year over year. Although the increase in sales still fell short of analyst expectations of 432,000 vehicles, the quarterly sales mark a record for the company.

- Endeavor Group Holdings (EDR) and World Wrestling Entertainment (WWE) announced that they have signed a definitive agreement to form a new, publicly listed company combining global sports and entertainment brands: UFC and WWE. Endeavor will hold a 51% controlling interest in the new company and existing WWE shareholders will hold a 49% interest in the new company.

- Glencore Plc (GLNCY) is still pursuing its $23 billion proposal to buy Teck Resources (TECK), despite firm rejections from both Teck’s board and controlling shareholder. Glencore has proposed an ambitious multi-stage deal to acquire Teck for shares and then spin off both firms’ coal businesses into a new company.

- Three Canadian crypto companies, WonderFi, Coinsquare, and CoinSmart, are combining to create the country’s largest regulated crypto asset trading platform, with hopes that the merger will give them a new edge for business success. This will likely be welcomed news for crypto investors after crypto currencies were rocked by the FTX Trading Ltd. collapse.

- General Motors (GM) has pulled ahead of Ford Motor (F) to become the second-best U.S. seller of EVs during the first quarter, trailing only industry leader Tesla. GM sold 20,670 EVs during the first three months of the year while Ford reported EV sales of 10,866 over the same time frame. These numbers still pale in comparison to Tesla’s quarterly numbers as discussed earlier.

- FedEx (FDX) announced plans to combine its two main delivery networks into one to boost efficiency and reduce costs by $4 billion in a bold move to increase profit margins. Markets have reacted positively to the company’s turnaround effort closing at $232.10, up from the 52-week low of $141.92 in September 2022.

- Canadian employment numbers were released on Thursday and for the fourth straight month, Canada beat its jobs forecast. In March, Canada added 34,700 jobs, holding the unemployment rate at 5%. The continuing strength of the Canadian jobs market has put the Bank of Canada in a difficult position, as the aggressive rate increases seem to be having a minimal impact on the labour sector.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer titled In Need of Breadth Mints and Antacid: DWYER VLOG

Weekly Diversion:

Check out this video: Baby pandas having fun

Charts of the Week:

Gold has been steadily increasing in value since last autumn, and after a limited correction at the end of January, the past month has seen the value surge 12% to reach a new 52-week high this week. The following candlestick chart shows the price of gold over the past year, along with the 50- and 200-day moving averages in dark and light blue. In addition, we have included a longer-term chart going back the past five years.

As of market close, gold was trading at US$2022.20, not far off the all-time high of US$2069.40 achieved in 2020. Gold has typically been seen as a hedge against inflation, and although we are starting to see inflation numbers fall, the uncertainty around food prices and hot job numbers could be the part of the reason for the recent rally. In addition, recession fears and geopolitical risk still linger, with gold still considered to be a safe haven.

Source: Bespoke Investment Group

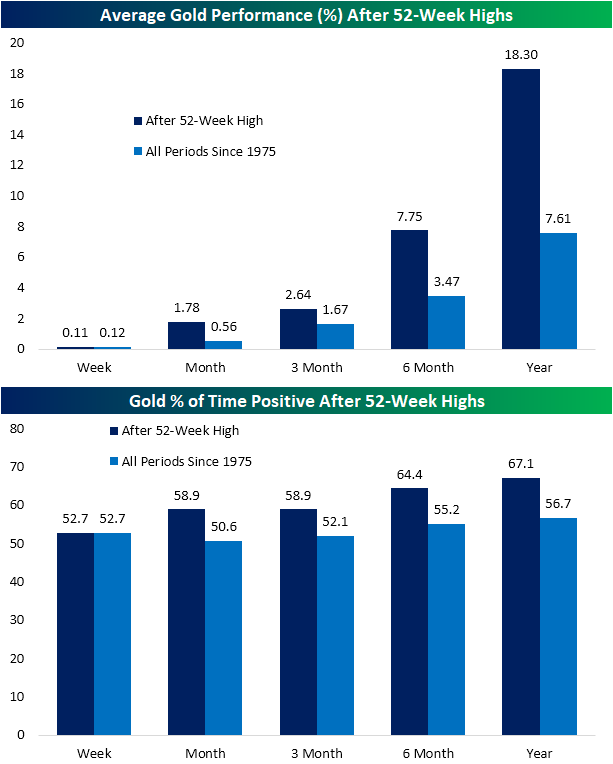

Although we have not yet seen gold hit the all-time high set during the Covid-19 Pandemic, this new 52-week high is promising for the yellow metal when we observe prior occurrences. In the charts below, we show the average performance of the front-month gold price after the first 52-week highs (on an intraday basis) for different time horizons. As illustrated, short-term performance offers little excitement with one-week returns that are basically right in line with the average for all performance since 1975. However, returns tend to get much stronger with a higher consistency of gains when we start to look at longer time horizons. Six months and one year after achieving a new 52-week high, the price of gold has averaged a return of 7.75% and 18.30% respectively, both more than double the average return of all periods.

Perhaps more impressive is the consistency of these returns as can be observed in the “Gold % of Time Positive After 52-Week Highs” chart with positive six-month returns occurring 64.4% of the time and positive one-year returns occurring 67.1% of the time after a new 52-week high. As always, past performance does not guarantee future performance, and only time will tell if we see a new all-time high for the price of gold in the near future.

Source: Bespoke Investment Group

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust