Market Insights: April Seasonality

Milestone Wealth Management Ltd. - Mar 31, 2023

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index soared 3.67%. In the U.S., the Dow Jones Industrial Average rose 4.43% and the S&P 500 Index climbed 4.92%.

- The Canadian dollar increased this week, closing at 73.97 USD cents vs. 72.76 USD cents last Friday.

- Oil prices improved this week. U.S. West Texas crude closed at US$75.55 vs US$69.28 last Friday, and the Western Canadian Select price closed at $US53.12vs US$48.01 last Friday.

- The price of gold dropped this week, closing at US$1,968 vs US$$1,996 last Friday.

- First Citizens Bank (FCNCA) has agreed to buy Silicon Valley Bank’s (SIVB) deposits and loans valued at $72B at a 23% discount. $90B in securities and other assets will remain in receivership for disposition by the FDIC. The lender will assume $56 billion in deposits and 17 legacy branches, and will begin operating Silicon Valley Bank, a division of First Citizens after the acquisition.

- On Tuesday, Deputy Prime Minister and Finance Minister Chrystia Freeland announced the 2023 Federal Budget to mixed reviews. The budget includes $43 billion in new spending over the next 6 years with a heavy focus on a clean energy transition. More information on the budget can be found in our recent blog post (link above).

- Walt Disney Co. (DIS) announced its intention to cut 7,000 jobs in an attempt to lower costs and achieve returning CEO Bob Iger’s savings objective of $5.5 billion that was announced in February.

- Crescent Point Energy (CPG) announced the acquisition of Spartan Delta Corp.’s (SDE) Montney formation in Alberta’s shale for C$1.7 billion. The purchase will add 600 drilling locations and 38,000 barrels of oil production.

- Alibaba Group Holdings LTD. (NYSE:BABA) is planning a six unit split of the $220 billion valued company. The split will result in 6 separate groups including: Cloud Intelligence, Taobao Tmall Commerce, Local Services, Cainiao Smart Logistics, Global Digital Commerce, and Digital Media and Entertainment, each with their won CEOs. The company has said that this will allow the organizations to become more agile.

- A Brookfield Asset Management-led consortium announced the agreement to purchase Australian utility Origin Energy Ltd. (ORG) for A$18.7 billion, including debt. The acquisition allows Brookfield to add further exposure to the shift away from fossil fuels in Australia, where utilities are accelerating plans to shutter coal plants and expand in renewables.

- The Federal Government has approved the purchase of Shaw Communications Inc. (SRJ) by Rogers Communications Inc. (RCI) after 2 years of delays for $20 billion. Industry Minister Champagne outlined a number of conditions, including a requirement for Rogers to create 3,000 new jobs in Western Canada and invest $5.5 billion to expand 5G coverage and services. Rogers faces fines of as much as $1 billion if it breaks those commitments.

Weekly Diversion:

Check out this video: French bulldog and cat

Charts of the Week:

The first quarter of 2023 has come to an end and although there has been plenty of volatility and negative media surrounding U.S. regional banking failures and recession risk, the S&P 500 Index closed up 7.02% YTD. However, we will note that on an equal-weighted basis, the S&P 500 Index is only up 2.41% YTD, as referenced in our recent post called Big Tech Rally, which indicates that most stock investors are experiencing the latter returns.

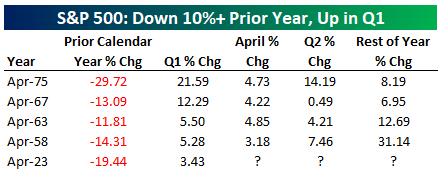

Today, we wish to highlight that a positive first quarter has historically brought favourable returns for the remainder of the year for the S&P 500 Index. As shown in the following chart, since WW2 there have been four other instances like today when the S&P 500 Index was down 10% or more in the prior year and then posted gains in the current year’s first quarter. In each of these prior occurrences, the index was up at last 3% in April, as well as very strong results on average in the second quarter and remainder of the year.

Source: Bespoke Investment Group

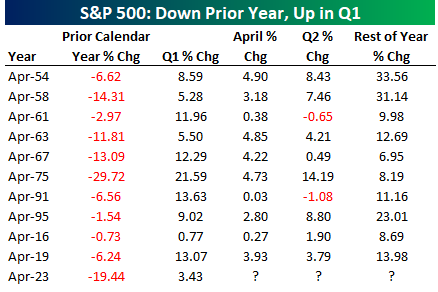

Only four prior instances may seem fairly limited to use as a reliable indicator; however, when we observe occurrences where the S&P 500 was down by any amount in the prior year and then posted positive gains in the current year’s first quarter, we can expand the data points to 10 prior instances. In every case, April posted positive returns. Only two times have resulted in negative returns for the second quarter (and those were small), but even more impressive is that 100% of the prior instances resulted in strong positive returns for the rest of the year (April to December). Time will tell if 2023 can maintain this trend.

Source: Bespoke Investment Group

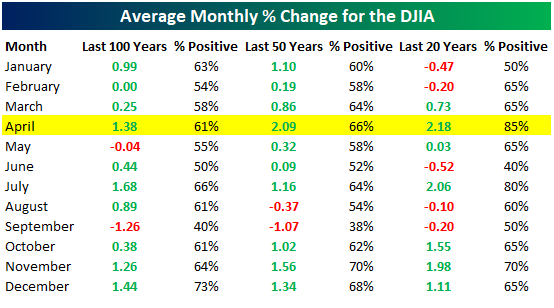

Looking specifically at the month of April, it’s not only the S&P 500 Index that has benefited, as we can observe historical April returns for the Dow Jones Industrial Average (DJIA) in the tables below. Over the last 20 and 50 years, April has been the strongest month for stocks, with 20-year average returns of 2.18% and 50-year average returns of 2.09%. When observing the past 100 years, only December and July have been stronger than April returns. These are impressive numbers, especially when considering that April returns for the DJIA over the last 20, 50 and 100 years were positive 85%, 66% and 61% of the time, respectively.

Source: Bespoke Investment Group

The last item we wanted to share this week is the December Low Indicator. This was created in the 1970s by Lucien Hooper, former Forbes columnist and Wall Street analyst. Simply put, it says that if the S&P 500 closes beneath the December low during the first quarter, it’s a warning sign for potential weakness over the balance of the year. Well, good news: this year that didn’t occur, with the S&P 500 not breaching the December low of 3,783. The following table shows the previous 36 times since at least 1950 where the S&P 500 didn't close beneath the December low during Q1. When there is a large sample size like this, and only one negative instance out of 36 times, we would rate this is a strong and reliable indicator. Nothing is for certain, but this usually means good things for the year.

Source: Ryan Detrick, Carson Investment Research

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha, Carson Investment Research, FactSet