Market Insights: Big Tech Rally

Milestone Wealth Management Ltd. - Mar 24, 2023

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index was up 0.59%. In the U.S., the Dow Jones Industrial Average increased 1.18% and the S&P 500 Index advanced 1.39%.

- The Canadian dollar declined slightly this week, closing at 72.76 cents vs. 72.82 USD last Friday.

- Oil prices increased this week as U.S. West Texas Crude closed at US$69.28 vs US$66.93 last week.

- The price of gold marched higher again this week, closing at US$1996 vs US$$1,990 last Friday.

- UBS agreed to buy Credit Suisse for US$3.25B in a government-brokered deal, which included a CHF 100B liquidity line backed by federal default guarantee and write-off of AT1 (Contingent Convertible) bonds as part of deal.

- The Federal Deposit Insurance Corporation announced that a subsidiary of New York Community Bancorp (NYCB), Flagstar Bank, will acquire all deposits, certain loan portfolios, as well as 40 former branches of Signature Bank from the FDIC.

- Canadian inflation came in lower than expected for the month of February. Consumer inflation, as measured by the Consumer Price Index (CPI), measured at 5.2% year-over-year vs. the estimate of 5.4% and down from the year-over-year growth of 5.9% in January. This was the largest deceleration in headline inflation in approx. 3 years. Despite this good news, food inflation for grocery store items was up 10.6% year-over-year for the month of February, the seventh consecutive month of double-digit increases.

- On Wednesday, the U.S. Federal Reserve raised interest rates by 25 bps, marking the 9th straight increase since March 2022. The most recent increase to a range of 4.75% to 5.00% raises interest rates to the highest level since September 2007. Comments by Fed. Chair Jerome Powell caused markets to drop on Wednesday, stating that the rate increases may not be done and that the central bank does not currently plan on any rate cuts this year.

- BlackBerry Ltd. (BB) announced that it intends to sell 32,000 mobile and wireless related patents for up to US$900M to Malikie which is a subsidiary of Key Patent Innovations Ltd.

- Amazon (AMZN) announced this week that it intends to lay_off another 9,000 workers after cutting more than 18,000 jobs in January. This adds to the long list of tech companies that have laid off a significant number of employees in an attempt to lower costs.

- Ford Motor Co (F) is forecasting losses in its EV business will grow to US$3 billion as it continues to spend heavily on new models and factories to meet demand. The company does not expect a change in profit guidance for the year even as costs mount for the EV unit.

- Google (GOOGL) has opened testing for Bard, the company’s direct competition to Microsoft’s AI Technology ChatGPT, to users in the U.S. and the U.K. The success of Microsoft’s ChatGPT has pushed other tech companies to rush their AI products to market as evident by Google’s CEO stating that “things will go wrong” when the public starts using Bard.

Weekly Diversion:

Check out this video: Baby Beaver Cuteness

Charts of the Week:

Big Tech significantly underperformed the S&P 500 last year, leading headlines with heavy layoffs in an attempt to control costs, however, the past three months have been different. In a refreshing change of pace, Big Tech has seen a substantial rally as can be seen in the table below with extremely strong YTD returns and most in overbought territory. To provide some context, the overall S&P Technology Select Sector Total Return Index is up 17.3% YTD as of yesterday, whereas the S&P 500 Total Return Index is only up 3.3%, after the S&P Tech sector underperformed the S&P 500 last year by about 10%. However, many tech names performed much worse than that as the NASDAQ underperformed the S&P 500 by 15% last year.

It has been such a stark contrast this year that the tech sector has single-handedly put the S&P 500 Index into positive territory. While the S&P 500 Total Return Index, which is market capitalization-weighted, is up 3.3% YTD, the S&P 500 Equal-Weight Total Return Index is actually down 2.4% YTD as of yesterday. One of the key reasons for this is that Microsoft and Apple now make up a combined weight of 13.3% of the S&P 500, the highest level on record, according to Strategas Securities data back to 1990. In other words, while the U.S. large cap index remains up this year, many investors are not as the average stock is in negative territory.

Source: Bespoke Investment Group

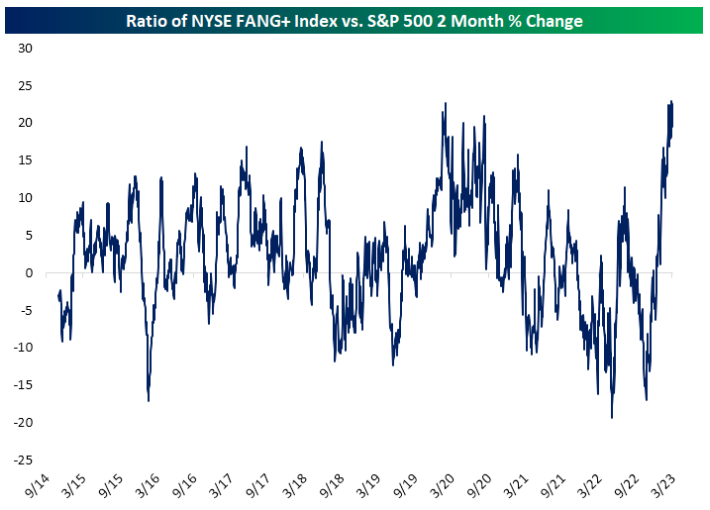

Things turn more positive for Big Tech when we observe the charts below, one showing a comparison between the NYSE FANG+ Index and the S&P 500 Index over the last two years and one showing the ratio of their 2-month rates of change. The NYSE FANG+ index tracks ten of the largest and most highly traded Tech and Tech-related companies. Currently, the NYSE FANG+ is trading its highest level since April 2022, while the S&P 500, as of Wednesday, was still trading 4% below its most recent February 2023 high and still well below its August 2022 high. As the second chart illustrates, the 2-month rate of change for the S&P Tech sector relative to the S&P 500 is at its highest rate since 2014.

Although there are numerous possible reasons for the Big Tech rally including the recent cost-cutting measures described earlier, one important reason could be the change in recent market sentiment towards interest rates. Before the volatility in U.S. regional banks that started to creep into the global banking system last week, the U.S. Federal Reserve (Fed) appeared to be prepared to continue raising rates in an attempt to battle the persistently sticky inflation. However, the current weakness in the banking sector appears to be changing that outlook for the Central Bank, and although the Fed did increase its key rate by 25 bps this week, the tone towards future hikes by the Fed and by markets may provide an opportunity for a further rally in the Tech sector that relies more on borrowing for daily operations and could benefit from interest rates holding or lowering in the future.

Source: Bespoke Investment Group

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha, Strategas Securities