Market Insights: Benefits of Time and Staying Invested

Milestone Wealth Management Ltd. - Mar 10, 2023

Macroeconomic and Market Developments:

- North American markets declined this week. In Canada, the S&P/TSX Composite Index dropped 3.92%. In the U.S., the Dow Jones Industrial Average decreased 4.44% and the S&P 500 Index contracted by 4.55%.

- The Canadian dollar weakened this week, closing at 72.30 cents vs 73.54 last Friday.

- Oil prices pulled back this week. U.S. West Texas crude closed at US$76.63 vs US$79.87 last Friday, and the Western Canadian Select price closed at US$60.20 vs US$64.65 last Friday.

- The gold price rallied this week, closing at US$1,868 vs US$1,856 last Friday.

- Market News has been dominated by national economic updates from Canada and the US this week:

- Canada

- The Bank of Canada elected to leave the bank overnight rate unchanged, matching the majority consensus of economists. The decision comes with the announcement that the central bank expects CPI inflation to come down to around 3 per cent by the middle of this year; however, the bank has left the door open for future rate hikes, stating that it will continue to monitor inflation, the hot jobs market, and exchange rates for the Canadian dollar moving forward.

- Canadian employment grew more than expected with the economy posting higher than expected job numbers for the third straight month. Canada added 21,800 jobs in February vs. the consensus 10,000 expected. These numbers continue to demonstrate the strength of the Canadian jobs market with unemployment currently sitting at 5.1%.

- Canada announced a higher-than-expected merchandise trade surplus in January of $1.9B, increasing from December’s $1.2B.

- US

- US Fed Chair Jarome Powell testified before the US Senate Banking Committee this week stating that the US Fed will likely need to continue increasing interest rates based on the economy’s strong jobs numbers, wage pressures, and persistent inflation.

- US nonfarm payrolls rose by 311,00 in February, significantly higher than he 225,000 estimates by economists. Similar to the Canadian jobs market, the US is also showing resiliency, lending to the need for further action by the Fed.

- Canada

- Bank of Montreal (BMO) announced a deal on Friday to purchase the Air Miles loyalty rewards program in Canada for US$160 million after its U.S parent company filed for bankruptcy. It was reported that the deal will have no impact on current Air Miles collectors’ balances or ability to redeem current Air Miles.

- Today, regulators in the US stepped in and seized Silicon Valley Bank (SIVB) after failed attempts to raise capital this week. Silicon Valley Bank became the largest US lender to fail in more than a decade. News of the collapse has been weighing heavily on markets including both US and Canadian Bank shares.

- In crypto news, Bitcoin was trading below $20,000, a near-two-month low on news that a major crypto-focused lender, Silvergate Capital, was winding down operations. The FTX collapse was stated as the major factor leading to the Silvergate Capital decline. At market close, Bitcoin was trading at approx. US$19,900.

Weekly Diversion:

Check out this video: Ultimate Once in a Lifetime Places you need to Visit | Top 21

Charts of the Week:

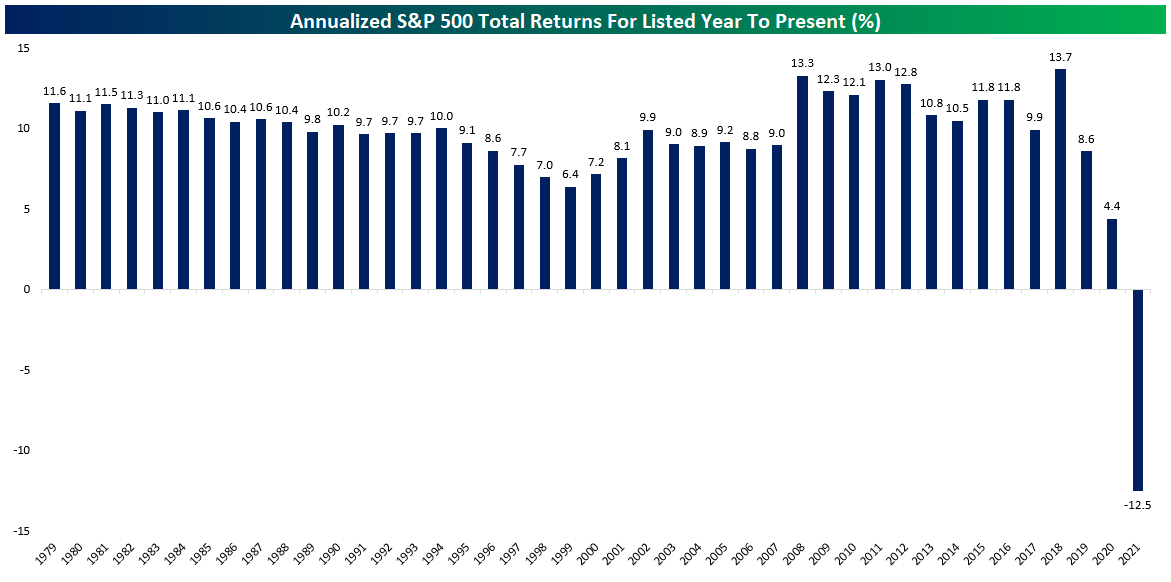

For this week’s Charts of the Week, we want to focus on the benefits of staying invested over the long-term. 2022 was a year that many investors would like to forget, and 2023 has started off with some ups and downs. The chart below illustrates these long-term benefits by showing the returns of the S&P 500 since 1979 stated as an annualized rate including dividends for the listed year to present. It shows that, had you invested at the end of 1979, the annualized total return would have been 11.6%. Next, if we observe the scenario of investing at the end of 1999, which includes the tech bubble, the 2008-09 global financial crisis, Covid downturn, and current inflation, the annualized total return would have been 6.4%. Moving forward, the returns for investing at the end of 2007 (prior to the financial crisis) would have resulted in annualized returns of 9.0%. Finally, we turn to the present and observe that the annualized return since the end of 2021 would have been -12.5%. The reason we bring attention to this is not that the current downtrend in the market is more severe than those in the past, but because with time, the past downturns that were experienced resulted in strong returns when averaged over a longer-period of time.

Source: Bespoke Investment Group

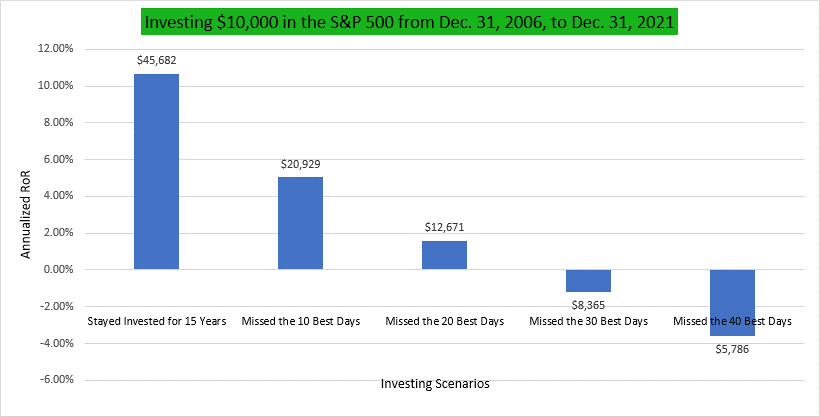

To reinforce the importance of time and staying invested, we observe the next chart which focuses on missing out on the best days for returns in the market. Best days in the markets will often come after a lengthy downturn resulting in a significant rally. The chart below observes different scenarios where an investor misses a certain amount of “best days” in the market when investing in the S&P 500 from Dec. 31, 2006, to Dec. 31, 2021. As we can observe, missing out on these “best days” results in significantly affected annualized returns compared to simply staying invested for the full 15 years, including all market cycles. This is a simplified example of how staying invested is so important. A trusted financial professional can help guide and navigate you through these periods by adhering to a disciplined investment process that is aligned with your objectives and risk profile.

Source: Seeking Alpha

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha