Market Insights: Negative Market Expectations by Consumers

Milestone Wealth Management Ltd. - Mar 04, 2023

Macroeconomic and Market Developments:

- North American markets positive this week. In Canada, the S&P/TSX Composite Index was up 1.79%. In the U.S., the Dow Jones Industrial Average increased 1.75% and the S&P 500 Index rose 1.90%.

- The Canadian dollar inched higher this week, closing at 73.54 cents vs 73.50 last Friday.

- Oil prices improved this week. U.S. West Texas crude closed at US$79.87 vs US$76.55 last Friday, and the Western Canadian Select price closed at US$64.65 vs US$60.10 last Friday.

- The gold price rallied this week, closing at US$1,856 vs US$1,811 last Friday.

- Canada’s GDP data showed the Canadian economy stalled in the fourth quarter of 2022 with no growth vs expectations for a 1.5% gain. The slower GDP number could reinforce expectations for the Bank of Canada to hold interest rates steady at next Wednesday's meeting, with the bigger question still being what happens in April if inflation proves sticky.

- Chicago-based LKQ Corp (LKQ) announced that it will acquire Canadian company Uni-Select (UNS) for $48.00/share in cash, representing a total enterprise value of approximately $2.8 billion. Founded in Boucherville, Québec, Canada in 1968, Uni-Select is a leader in the distribution of automotive refinish and industrial coatings and related products in North America through its FinishMaster segment, in the automotive aftermarket parts business in Canada through its Canadian Automotive Group segment, and in the U.K. through its GSF Car Parts segment.

- Calgary-based Baytex Energy (BTE) announced that it will purchase Houston oil company Ranger Oil (ROCC) for cash and stock. Ranger shareholders will receive a fixed ratio of 7.49 shares of Baytex and $13.31/share in cash. Upon closing of the deal, Baytex shareholders will own approximately 63% of the combined company, and Ranger shareholders will own approximately 37%.

- Canadian Natural Resources (CNQ) reported lower than expected Q4 cash flow of $3.73/share vs $3.78/share expected. Earnings came in at $1.96/share vs $2.21/share expected, with production of 1,294.7 MBoe/d vs 1,316.6 MBoe/d expected. The company is increasing its quarterly dividend by 5.9% to $0.90/share from $0.85/share.

- Suncor Energy (SU) announced it has entered into an agreement with Equinor UK for the sale of Suncor Energy UK, which includes Suncor's non-operated stakes in the producing Buzzard field (29.9%) and the Rosebank development (40%). The deal is valued at approximately $1.2 billion.

- TD Bank (TD) announced that it has agreed to a settlement in principle relating to litigation involving the Stanford Financial Group. Upon final approval of the settlement by the Court, TD will pay US$1.205 billion to the court-appointed receiver for the Stanford Receivership Estate. TD expressly denies any liability or wrongdoing with respect to the multi-year Ponzi scheme operated by Stanford.

- Canadian banks reported earnings, starting last Friday and continuing throughout this week, showing the big banks set aside $2.5 billion for credit losses in Q1:

- First off, CIBC (CM) reported net income falling by 77% to $432 million, or $0.39/share as the provision for a lawsuit against the firm from Cerberus Capital Management LP impacted results. However, excluding some items, profit came in at $1.94/share vs analyst estimates of $1.72/share.

- On Tuesday, Bank of Montreal (BMO) reported better than expected Q1 earnings of $3.22/share excluding some items vs $3.16/share expected on adjusted revenue of $8.49 billion. Provisions set aside for credit losses were $217 million.

- Also on Tuesday, Bank of Nova Scotia (BNS) reported lower than expected Q1 adjusted earnings of $1.85/share vs $2.02/share, on revenue of $7.98 billion vs $8.28 billion expected. Provisions for credit losses was $638 million.

- On Wednesday, Royal Bank of Canada (RY) reported better than expected Q1 earnings of $3.05/share excluding some items vs $2.96/share expected, on revenue of $15.09 billion vs $13.17 billion. Credit loss provisions amounted to $532 million.

- On Thursday, Toronto-Dominion Bank (TD) reported better than expected Q1 earnings of $2.23/share vs $2.20/share expected, with provisions for credit losses of $690 million.

Weekly Diversion:

Check out this video: The cutest thing you’ll see today - polar bear cub gets surprised by a seal

Charts of the Week:

February was a month that many investors would like to forget as the rally that was enjoyed starting the year quickly fizzled. The volatility that has been experienced along with much of the market news over the past year has greatly impacted consumer sentiment, with February marking the 14th consecutive month where negative market sentiment outweighed positive market sentiment by consumers. Although the current difference (-0.4 of a percentage point) between positive and negative sentiment has declined significantly from the July 2022 high of (-19.2 percentage points), the negative sentiment remains, and the current 14-month streak is second only to the 18-month streak experienced from November 2007 to April 2009 during the Global Financial Crisis.

Now, this might sound like a negative outlook, but there is reason for optimism when we observe similar past trends. As we can see in the charts below, periods of long-lasting negative sentiment provide a lot of opportunity. In all past occurrences of negative sentiment lasting 9-months or longer, the S&P 500 posted positive gains of 11% to 36% in the following 12-month period. Clearly, a prolonged period of harboring negative sentiment towards equities creates pent-up demand for stocks once the period finally ends. Thus, not being in the market at this point in time could be very detrimental. Although we don’t know when the markets will turn positive, this chart helps illustrate the need to focus on long-term goals and the importance of staying invested.

Source: Bespoke Investment Group

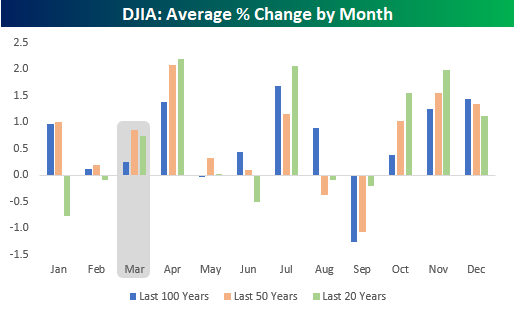

Our next chart looks to eliminate the market noise and just focus on the monthly performance of the Dow Jones Industrial Average (DJIA) over long time periods (20, 50, and 100 years). As illustrated below, February hasn’t typically been a strong performing month, especially when looking at the past 20 years resulting in negative returns on average. Things usually turn more positive moving into March and April considering their historical performance over these time periods. When observing this data, one may question why they should invest at all during months that tend to have unfavorable returns, but it is important to note that these are long-term averages and specific market conditions can impact these results on a year-to-year basis.

Source: Bespoke Investment Group

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha