Market Insights: Energy Commodity Futures Out of Line with Industry Shares

Milestone Wealth Management Ltd. - Feb 11, 2023

Macroeconomic and Market Developments:

- North American markets declined this week. In Canada, the S&P/TSX Composite Index was down 0.70%. In the U.S., the Dow Jones Industrial Average declined 0.17% and the S&P 500 Index was lower by 1.11%.

- The Canadian dollar was positive this week, closing at 74.94 cents vs 74.65 cents last Friday.

- Oil prices were strong this week. U.S. West Texas crude closed at US$79.79 vs US$73.39 last Friday, and the Western Canadian Select price closed at US$61.13 vs US$50.77 last Friday.

- The gold price was flat this week, closing at US$1,865 vs US$1,864 last Friday.

- Canadian mining company Newmont Corp (NGT) announced that it has provided a takeover proposal to Australia’s Newcrest Mining with aims to build a gold mining giant. The proposed deal equates to a US$16.9 billion offer, with each Newcrest share receiving 0.380 Newmont shares. If the takeover is completed, it would be one of the biggest in Australian history.

- Shares of Oak Street Health (OSH) jumped on Tuesday following reports that CVS Health (CVS) would acquire the company for $10.6 billion including debt. The offer price of $39.00/share represents about a 73% premium to Oak Street’s last closing price before talks of the deal were first reported in January. If the deal goes through, it will give CVS access to a bigger footprint of primary care doctors, with a large network of clinics focused on seniors.

- Canadian cryptocurrency miner Hut 8 Mining (HUT) and U.S. Data Mining Group announced an agreement to combine companies. Shareholders of Hut 8 will receive 0.2 shares of New Hut shares for each current share owned, which will effectively result in a consolidation of the Hut 8 shares on a 5 for 1 basis.

- According to data from ATB Financial, Alberta set an annual record for oil production last year with an output of approximately 3.73 million barrels/day, beating the previous record set in 2021. Year over year, conventional oil production rose by 12% while oil sands production rose 2%.

- Disney (DIS) reported earnings after the close on Wednesday, coming in with earnings of $0.99/share vs $0.78/share expected, on revenue of $23.51 billion vs $23.37 billion expected. Also, Disney said it will be reorganizing into three divisions: Entertainment, ESPN and Parks & Experiences and plans to cut 7,000 jobs from its workforce with an aim to cut $5.5 billion in costs.

- French oil giant TotalEnergies announced a spinout of its Alberta oil sands business. The IPO is expected to have an equity valuation of between $2 billion and $3 billion making it the largest IPO on TSX since 2021.

- On Friday, Canada’s jobs numbers were released, showing another strong month. The Canadian economy added 150,000 jobs, well above the 15,000 expected, with the unemployment rate holding steady at 5.0%. The report showed broad-based employment gains during what was a fifth consecutive month of job increases, bringing total employment gains since September to 326,000.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer titled New Data Reinforces Using a Slow Cooker in Microwave Market: Dwyer VLOG

Weekly Diversion:

Check out this video: Who says hockey is a violent sport?

Charts of the Week:

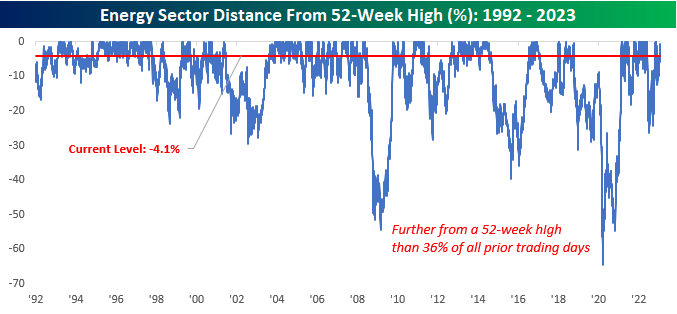

This week we take a look at the oil and gas industry. Crude oil and natural gas prices have declined significantly from their peak values achieved during 2020. As can be seen in the charts below, as of last Monday, crude oil futures have declined by over 36% from their 52-week high, representing a deeper drawdown than 88% of all trading days since 1992. Perhaps more significant is the decline in natural gas futures, decreasing by more than 71% from its 52-week high, representing a deeper drawdown than 98% of all previous trading days since 1992.

Source: Bespoke Investment Group

This instance of crude and natural gas future price declines is interesting as we have not seen nearly the same impact on Oil and Gas stock prices. As can be seen in the chart below, as of this past Monday, the S&P 500 Energy sector was only down 4.1% from its 52-week high, trailing only 36% of all trading days since 1992. This type of occurrence is extremely rare, with only two such prior cases since 1992 of natural gas futures being down by 50%+, Crude oil futures being down by 30%+, and the energy sector trading within 10% of a 52-week high. These two prior examples also resulted in very different outcomes, with the first occurrence in 1997 resulting in a year after return of 6.49% for the S&P 500 Energy Sector, and the second occurrence in 2001 resulting in a year after return of -7.49% for the S&P 500 Energy Sector. Time will tell how the industry will be impacted and if the windfall gains for the oil and gas sector will continue into 2023.

Source: Bespoke Investment Group

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha