Market Insights: January Rally

Milestone Wealth Management Ltd. - Jan 28, 2023

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index was up 1.03%. In the U.S., the Dow Jones Industrial Average increased by 1.81% and the S&P 500 Index rose 2.47%.

- The Canadian dollar rallied this week, closing at 75.13 cents vs 74.77 cents last Friday.

- Oil prices declined this week. U.S. West Texas crude closed at US$79.41 vs US$81.31 last Friday, and the Western Canadian Select price closed at US$55.71 vs US$58.08 last Friday.

- The gold price improved slightly this week, closing at US$1,928 vs US$1,926 last Friday.

- The big story in Canada this week was the announcement by the Bank of Canada. The Canadian central bank raised its bank rate by 0.25% to 4.50%, continuing its tightening policy. The BoC wrote that recent economic growth has been stronger than expected and highlighted that there is growing evidence that restrictive monetary policy is slowing activity, especially household spending.

- The U.S. economy beat expectations in the last quarter of 2022, with Gross Domestic Product (GDP) rising at a 2.9% annualized pace, beating estimates of 2.6%. This GDP reading shows the U.S. economy slowing from the 3.2% annualized pace in the third quarter.

- The U.S. also saw the overall PCE (Personal Consumption Expenditures) Index increase 0.1% in December, up 5.0% year over year. Core PCE (excluding food and energy) rose 0.3% in December and is up 4.4% year over year. The PCE Index is the Fed’s preferred measure for inflation and both results are expected to be welcomed by the Fed as they show evidence of slowing inflation.

- Calgary-based Saturn Oil & Gas (SOIL) has entered into an agreement to acquire Ridgeback Resources Inc., a privately held oil and gas producer focused on light oil in Saskatchewan and Alberta, for a transaction value of $525 million.

- Microsoft (MSFT) beat earnings estimates after the market closed on Tuesday. The company reported earnings of $2.32/share vs $2.29/share expected on revenue of $52.75 billion vs $52.94 billion expected. However, the company also warned that revenue growth in its cloud-computing business will decelerate in the coming months and corporate software sales will slow.

- Tesla (TSLA) also beat earnings expectations this week, with earnings of $1.19/share vs $1.13/share expected, with revenue coming in at $24.32 billion vs $24.16 billion expected. In the year-ago quarter, Tesla reported revenue of $17.72 billion and adjusted earnings of $2.52/share.

- The Rogers/Shaw deal took another step forward this week, with a federal court dismissing the competition bureau's case for blocking Rogers’ $20 billion bid for Shaw. The decision marks the second victory in less than a month for the two cable and wireless firms, who agreed to the deal nearly two years ago.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer titled Our Plan For If or When Bad News Becomes Bad News: Dwyer VLOG

Weekly Diversion:

Check out this video: Reverse psychology at its best.

Charts of the Week:

The S&P 500 is currently up 6.46% YTD, which is a positive sign when you take a look at historical returns following a year of declines, such as the one observed in 2022. Since WW2, after experiencing a decline in the prior year, a positive January has often compounded on those gains throughout the remainder of the year. As shown in the graph below, a positive January has averaged a gain of 0.37% in February, 4.78% in the rest of the first half of the year, and 10.91% for the remainder of the year.

Source: Bespoke Investment Group

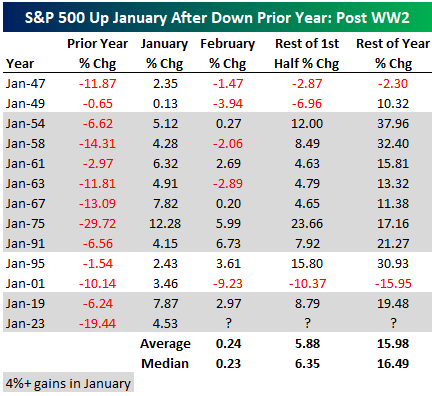

Things get more positive when we observe the table below which singles out all years where January finished positive after a prior down year. In those 12 occurrences, the average rest of the first half of the year, and the rest of the year was even higher, at 5.88% and 15.98% respectively. Even better than this is when we focus on Januaries that returned over 4% (like this year) after a prior negative year. All but two occurrences resulted in a positive February, but more impressively, the rest of the first half of the year was positive in each instance with an average return of 9.4%, and the rest of the year was also always positive with an average return of over 21%. This is approximately twice the average return for all years. There is an old investment axiom that states, “as goes January, so goes the year”. This is also known as the January Barometer. As of the market close, there are only two trading days remaining in January, so time will tell if this positive trend continues.

Source: Bespoke Investment Group, as of Jan. 24th

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group, First Trust, Seeking Alpha