Market Insights: Looking Ahead to 2023

Milestone Wealth Management Ltd. - Jan 07, 2023

Macroeconomic and Market Developments:

- North American markets rose this week. In Canada, the S&P/TSX Composite Index increased by 2.22%. In the U.S., the Dow Jones Industrial Average rallied 1.46% and the S&P 500 Index climbed 1.45%.

- The Canadian dollar improved this week, closing at 74.38 cents vs 73.78 cents last Friday.

- Oil prices declined this week. U.S. West Texas crude closed at US$73.76 vs US$80.51 last Friday, and the Western Canadian Select price closed at US$47.03 vs US$52.64 last Friday.

- The gold price strengthened this week, closing at US$1,866 vs US$1,824 last Friday.

- The Canadian Manufacturing Purchasing Managers Index (PMI) fell to 49.2 in December from 49.6 in November (levels below 50 signal contraction), the weakest level since June 2020. This marks the fifth straight month that the index has been below the 50-point threshold.

- Tesla’s stock price slide continued this week, hitting its lowest point since August 2020 after the company announced fourth-quarter vehicle deliveries that fell short of Wall Street’s expectations. The electric vehicle maker delivered 405,278 cars in the fourth quarter, compared with the average analyst estimate of roughly 427,000, according to FactSet. The stock price recovered somewhat by the end of the week, but as of Friday’s close, the stock is down approximately 72% from its all-time high in November 2021.

- In another sign of a slowing tech sector, Salesforce (CRM) said on Wednesday it would lay off about 10% of its employees and close some offices. The company expects this change to result in $1.4 billion to $2.1 billion in charges. Also this week, Amazon (AMZN) announced that they will cut more than 18,000 jobs, with most job cuts concentrated in the retail and HR areas of the company.

- General Motors (GM) reclaimed its U.S. sales leader crown from Toyota. GM said it sold 2.27 million vehicles in the U.S. in 2022, a 2.5% increase over 2021, whereas Toyota said it sold 2.1 million vehicles in the U.S. last year, down 9.6% from 2021. As a whole, the auto industry slowed last year with only 13.7 million vehicles sold in 2022, marking an 8% decrease from the previous year and the lowest overall figure since 2011.

- On Friday, North American employment numbers for December were released. In Canada, the economy added 104,000 jobs in December, well above the 5,000 jobs gain that had been forecast. The unemployment rate fell to a near record low of 5.0%, below the 5.2% forecast rate. In the U.S., nonfarm payrolls increased by 223,000, slightly above the estimate of 200,000. The unemployment rate fell to 3.5%, matching the lowest rate in the last 50 years, compared to a forecast of 3.7%.

Weekly Diversion:

Check out this video: Unique AirBNB built into a cave

Charts of the Week:

Now that 2022 is behind us, we can look forward to 2023 and a new investing year. Clearly 2022 will go down in history as a terrible year for investments, both for bonds and stocks. The widely watched S&P 500 index in the U.S. was down almost 20% for the year, with the NASDAQ index down over 30%.

Does looking back historically give us any indication as to what might unfold for 2023? One comparison could be the year 1966, which saw the S&P 500 fall 22%, starting in January and bottoming out in October, quite similar to what occurred in 2022. Additional comparisons to 1966 include the Fed hiking interest rates continuously as inflation soared, and a midterm election - just like in 2022. In that instance, the S&P 500 gained 6% in Q4 1966 and went on to gain 24% in 1967. In 2022, the S&P 500 gained 7% in the fourth quarter and 2023 is yet to be seen, but if the comparison to 1966 continues to play out, that would certainly be a positive.

Source: Seth Golden, FactSet

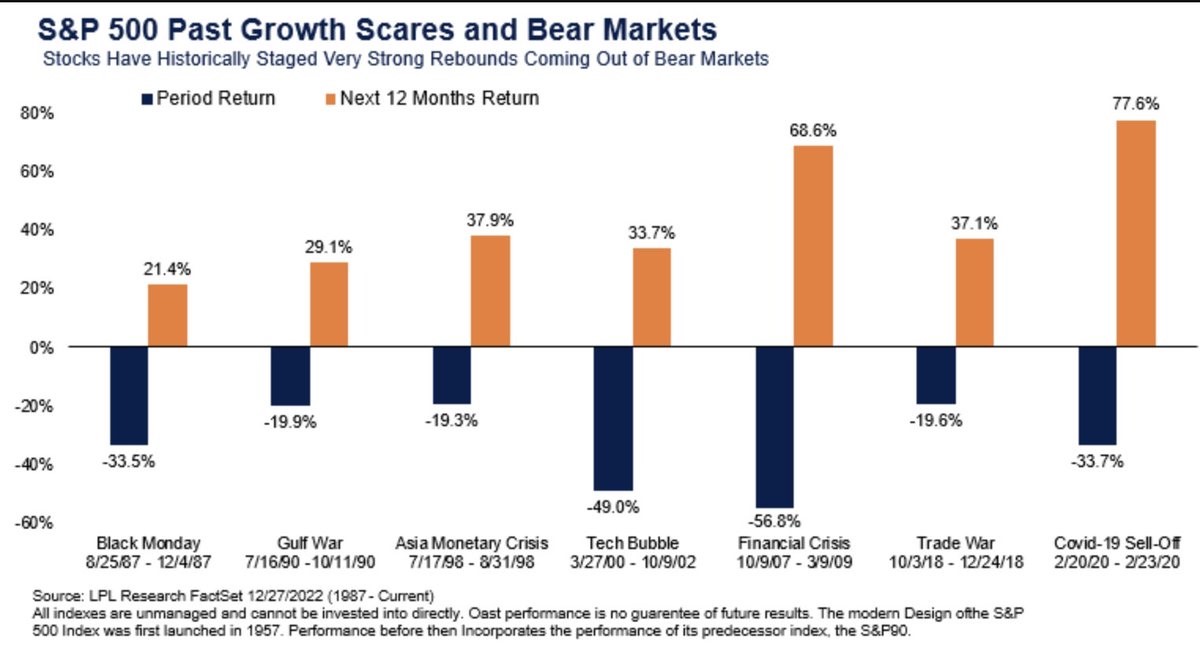

A bear market is typically defined as a drop of at least 20% in a market. At the lowest point in 2022, the S&P 500 was down approximately 25%, so this certainly qualifies as a bear market. With forecasts for a possible recession in 2023, a bear market isn’t an unexpected consequence and we may not have seen the true bottom just yet – time will tell. However, looking forward to when the bear market does end, let’s look at how the markets perform post-bear market by reviewing previous occurrences. In the last seven bear markets since the 1987 crash, the S&P 500 has bounced back by an average of 43.6% over the following 12 months. So, although no one is able to accurately predict WHEN the bear market will bottom out, one will almost certainly want to be invested for the subsequent recovery.

Source: Seth Golden, LPL Research, FactSet

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group. First Trust, Seeking Alpha, Seth Golden, LPL Research, FactSet