Market Insights: U.S. Dollar Index Hits Six-Month Low

Milestone Wealth Management Ltd. - Dec 17, 2022

*Please note this will be our last commentary before the Christmas season. Our next commentary will be Friday, January 6th. Happy Holidays!

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index fell 2.53%. In the U.S., the Dow Jones Industrial Average retreated by 1.66% and the S&P 500 Index decreased by 2.08%.

- The Canadian dollar declined this week, closing at 73.02 cents vs 73.26 cents last Friday.

- Oil prices rallied this week. U.S. West Texas crude closed at US$74.36 vs US$71.48 last Friday, and the Western Canadian Select price closed at US$46.31 vs US$43.60 last Friday.

- The gold price waned this week, closing at US$1,793 vs US$1,797 last Friday.

- The markets were anxiously anticipating the U.S. Federal Reserve’s final meeting of the year, which wrapped up with an announcement on Wednesday. The central bank raised its benchmark interest rate by 0.50%, taking it to a targeted range between 4.25% and 4.50%, the highest level in 15 years. The expected “terminal rate”, or the point where officials expect to end the rate hikes, was put at 5.1%, slightly higher than the market had been forecasting.

- The U.S. Consumer Price Index (CPI) came in slightly below expectations, rising just 0.1% from the previous month, and 7.1% year-over-year. Economists had been expecting a 0.3% monthly increase and a 7.3% 12-month rate. The core CPI (excluding volatile food and energy prices) rose 0.2% on the month and 6.0% on an annual basis, compared to respective estimates of 0.3% and 6.1%.

- U.S. pharmaceutical giant Amgen (AMGN) has agreed to acquire Horizon Therapeutics (HZNP) for $116.50/share in cash, valuing the company at nearly $28.3 billion, including debt. Horizon is a rare autoimmune and inflammatory disease-focused biotech, with medications such as Tepezza, Krystexxa, and Uplizna.

- Elon Musk is no longer the world’s richest person, mostly due to a falling Tesla stock price this year. Bernard Arnault, CEO and majority owner of luxury retailer Moet Hennessy Louis Vuitton (LVMH), now holds the top spot with an estimated net worth of US$182.4 billion.

- Popular barbeque maker Weber Inc. (WEBR) has entered into an agreement to be bought out by investment funds managed by BDT Capital Partners LLC for $8.05/share implying a total enterprise value of $3.7 billion. The purchase price represents a premium of 60% to the closing price of the shares on October 24, 2022, which was the last trading day before BDT submitted a proposal, although even at that level the stock is still down ~36% this year.

- Canadian satellite company Maxar Technologies (MAXR) announced that it is being acquired by Advent International (AVDWF) for $53.00/share in cash, giving the company an enterprise value of approximately $6.4 billion. The purchase price represents a 68% premium to where the stock closed the day prior to the announcement.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer titled Temporary Sweet Spot and Soft Landing vs. Recession: DWYER VLOG

Weekly Diversion:

Check out this video: Cheeky Sea Lion Stealing Fish From Boat

Charts of the Week:

There are always numerous reasons at any point in time why risk assets, namely equities, move up or down in the short to intermediate-term. Notwithstanding the pullback we have seen in equity markets the last couple weeks, we would like to point to one specific reason as to why we have seen a shift in sentiment towards risk assets since September. Enter the U.S. Dollar Index. This is an index that tracks the value of the U.S. dollar relative to a basket of six foreign currencies, often referred to as a basket of major U.S. trade partners’ currencies. The index moves up or down when the U.S. dollar gains or loses strength compared to the other currencies.

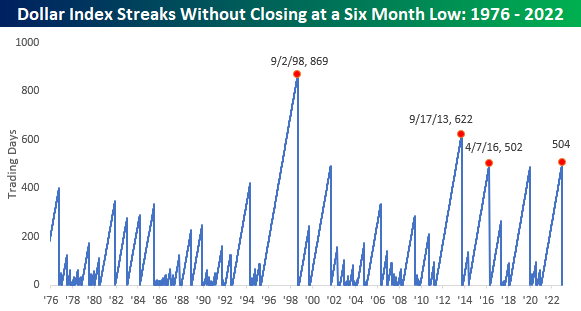

Why is it important? The U.S. Dollar Index is widely viewed as a risk sentiment gauge. Geopolitical risk or economic uncertainty around the world serves as a reminder of the importance of so-called ‘safe haven’ assets, such as the U.S. dollar. Since it is the reserve currency of the world, investors usually seek exposure to the dollar via short-term assets when market sentiment begins to shift negatively, and vice versa when sentiment becomes more positive. In other words, increases in risk aversion tend to be associated with appreciation of the U.S. dollar, and risk taking with the depreciation of the U.S. dollar. This is what we have been seeing since the end of the third quarter, with the U.S. Dollar Index hitting a 6-month low this past Tuesday for the first time in over 500 trading days.

Source: Bespoke Investment Group

A six-month low in anything may not seem like much, except when it hasn’t happened for over 500 days (504 days this time). Going all the way back to the early 1970s, this is now only the fourth time this has happened. You can see these points in time with the red dots on the charts below. The main point here would be that these red dots have not occurred near market tops.

Source: Bespoke Investment Group

Although this is clearly a small sample size of just three occurrences, it can still provide some telling information when we look at how the S&P 500 has fared after this signal. The table here shows the forward one-year performance, and although the results were mixed in the first month, the median return over the following 3-12 months was very favorable.

Source: Bespoke Investment Group

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges.

Sources: Game of Trades, SentimenTrader, Fidelity, CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Bespoke Investment Group. First Trust, Seeking Alpha