Market Insights: "Max Q"

Milestone Wealth Management Ltd. - Jul 29, 2022

Macroeconomic and Market Developments:

- North American markets were very strong this week. In Canada, the S&P/TSX Composite Index advanced 3.92%. In the U.S., the Dow Jones Industrial Average was up 2.96% and the S&P 500 Index increased 4.26% this week.

- The Canadian dollar was positive this week, closing at 78.13 cents vs 77.45 USD cents last Friday.

- Oil prices recovered somewhat this week. U.S. West Texas crude closed at $98.06 vs $94.66 USD last Friday, and the Western Canadian Select price closed at $77.21 vs $74.16 last Friday.

- The gold price was strong this week, closing at $1,763 vs $1,724 USD last Friday.

- The closely watched U.S. Federal Reserve announced its rate decision on Wednesday. The central bank raised its key interest rate by 0.75% for the second consecutive time, moving the rate to a range of 2.25% - 2.50%. The move was well telegraphed ahead of time and the decision was unanimous, with all Fed members voting in favour.

- After the close of the market on Monday, Walmart (WMT) surprised investors by cutting its quarterly and full-year profit estimates because of rising food inflation. As a result, Walmart’s stock price declined on Tuesday, taking other retail stocks along with it.

- Canadian tech company Shopify (SHOP) announced that it plans to lay off approximately 10% of its global workforce, or roughly 1,000 workers. The cuts will affect all of Shopify’s divisions, though most will occur in recruiting, support, and sales.

- Canadian mining company Teck Resources (TECK.B) reported earnings of $3.25/share, slightly below the $3.29/share expected, although revenue came in above expectations at $5.79 billion vs the $5.60 billion forecast. The company also announced an additional $500M stock buyback and announced that president and CEO Don Lindsay is retiring on September 30th.

- Canadian National Railway (CNR) reported strong earnings, as the company was able to increase prices and fuel surcharges to offset rising costs. Earnings were $1.93/share vs $1.76/share expected, with revenue at $4.34 billion vs $4.08 billion expected, roughly 21% higher than last year.

- It was a big week for large tech company earnings this week:

- After the market closed on Tuesday, Alphabet (GOOGL) disappointed with earnings of $1.21/share vs $1.28/share expected, on revenue of $69.69 billion vs $69.90 billion expected.

- Also on Tuesday, Microsoft (MSFT) also disappointed the market with earnings of $2.23/share vs $2.29/share expected, with revenue coming in at $51.87 billion vs $52.44 billion expected.

- After the close on Wednesday, Facebook and Instagram parent company Meta Platforms (META) released earnings that were below expectations of $2.46/share vs $2.59/share anticipated, with revenue of $28.82 billion vs $28.94 billion expected.

- After the market close on Thursday, Amazon (AMZN) beat expectations with a loss of $0.20/share due to a $3.7 billion write down on its investment in EV maker Rivian, on revenue of $121.23 billion vs $119.09 billion expected.

- Also on Thursday, Apple (AAPL) beat with earnings of $1.20/share vs $1.16 estimated, on revenue of $83.0 billion vs $82.8 billion estimated. Importantly, iPhone revenue came in at $40.67 billion vs $38.33 billion estimated, up 3% year-over-year, as more Android users switches to iPhone.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled Our Signal Suggests That's About It: DWYER VLOG

Weekly Diversion:

Check out this video of an incredible America’s Got Talent audition.

Charts of the Week:

As expected, on Wednesday the U.S. Federal Reserve raised their overnight rate by 0.75% to a range of 2.25% - 2.50%. It may surprise many that stock and bond markets actually responded very positively to this announcement. In the bond market, interest rates actually dropped across most maturity terms, thereby increasing the prices of those bonds. The stock market also bounced, especially growth markets like the tech-heavy NASDAQ Composite which rose over 4% on the day. As an aside, a large one-day gain of over 4% for the NASDAQ, especially when it hasn’t occurred in over three months like now (17 occurrences now since 1971), has historically been a good indicator of well-above average forward returns over the next year. Markets have continued to move higher the last couple of days as well. Why? Well, the key in our view is that in reaction to the report, we have seen what is called a yield curve steepening. This means that the interest rate on long-term bonds have dropped less than the interest rate on short-term bonds. They refer to this as a yield curve bull-steepening and is normally associated with a market perception that the Fed will be less aggressive in hiking interest rates than is currently priced in the bond market, leading to a need for higher longer-term inflation risk premiums or a steeper yield curve. This is one of the items we mentioned in our quarterly comments that could be a potential upside surprise for markets in the back half of this year, and especially the summer, where since June we have been referencing that we believe there was a strong setup for at least a short- to intermediate-term rally for equity markets from extremely oversold levels. This has come to fruition with the S&P 500 Index now up about ~12% since its June 16th closing low, while the NASDAQ is up 16% since then. This surely does not mean the cyclical bear market we are in is over, but it has provided at least some short-term relief.

As the following chart shows, the U.S. 5-to-30-year treasury yield curve (difference between the 5-year and 30-year treasury yield) has steepened dramatically over the last couple of days through July 28th by 0.16%, among some of the largest 2-day moves we have ever seen over the last 20 years. There is something in aerospace engineering referred to as “max Q” which is the point of a rocket’s flight where pressure is the greatest. We could potentially apply this analogy to where we are with the current U.S. rate tightening cycle, that perhaps its own “max Q” has passed, and the market has already priced it in. In general, this would be a positive for growth equities.

Source: Bespoke Investment Group

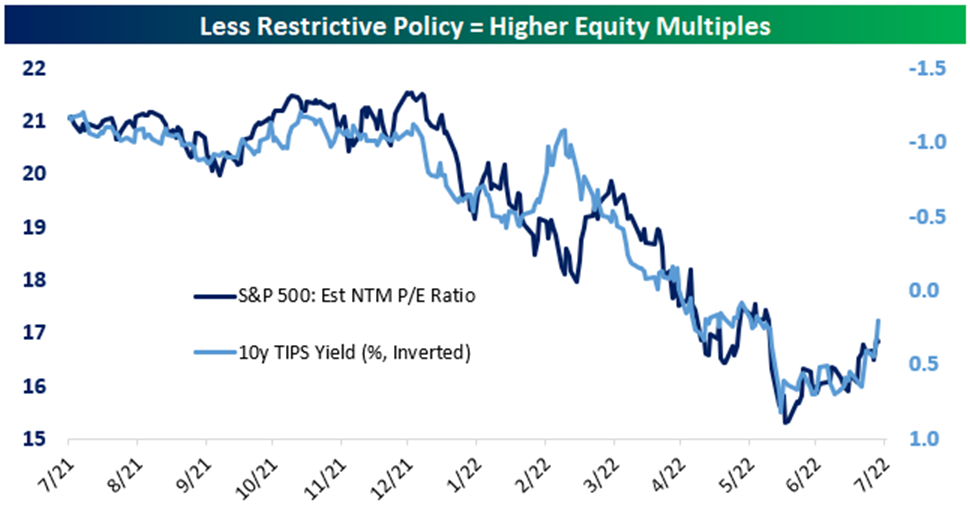

As a result of this, the market’s perception of a less restrictive Fed also implies that real yields (yields after inflation) are falling and that is certainly what we have been seeing recently. You can see in the chart below that U.S. 10-year Treasury Inflation Protected Securities (TIPS) have come down. 10-year TIPS are treasury yields that are indexed to inflation; in other words, they offset the effect of rising prices by adjusting its principal value as inflation rises. This is represented by the light blue line, which is inverted on the chart so that we can show you its correlation with equity markets. When real yields are dropping, which coincides with a less restrictive monetary policy, equity valuations normally increase. The dark blue line is the forward 12-month price-to-earnings multiple of the S&P 500 Index, and you can see it has come up from a level below 16X in June to close to 17X today. We also mentioned this in our quarterly comments, that after the recent correction, equity valuations at the end of June had come right back down to historical average (if not slightly below), which we felt would provide some strong support for equity markets going forward. We are certainly not out of the woods yet, however; inflation may have recently peaked but will remain high through the balance of this year and likely 2023 as well. In addition, the Fed could react to this with a more restrictive policy tone at its next meeting in late September, potentially knocking the wind out of this current momentum. Therefore, a continued active approach to asset management complemented with risk management strategies should continue to be the favored strategy.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke Investment Group