Market Insights: Second Quarter Wrap-up

Milestone Wealth Management Ltd. - Jul 12, 2022

Market Update

Global equity markets continued to decline in the second quarter with MSCI World Total Return Index down 18.8% YTD, hitting the lowest level since December 2020 as still-high inflation, sharp increases in interest rates, rising recession risks, and ongoing geopolitical unrest pressured stocks and other risk assets. International developed markets were down a similar number to the U.S. In Canada, with a large energy weighting, the S&P/TSX Total Return Composite held up relatively well down 9.9% YTD. In addition, the sharp increase in interest rates on all portions of the yield curve has wreaked havoc on fixed income markets, with the global aggregate bond market down over 10% YTD and the Canadian bond market down over 12% YTD, after already suffering losses in 2021. The rare sharp decline in bond markets has made it exceedingly difficult this year for a traditional diversified portfolio of fixed income and equity.

After a rebound in March, equity markets dropped sharply in April to start the second quarter. While some of the reasons for the declines were similar to the first quarter (rising rates, high inflation, geopolitical concerns) the primary catalyst for the April sell-off was something new: a massive COVID-related lockdown in China. Unlike the rest of the world, China continues to enforce a “Zero-COVID” policy, whereby small outbreaks are met with extremely intense city- and province-wide lockdowns. At the peak of the recent COVID outbreak and subsequent lockdowns throughout China, it was estimated that 46 separate cities and provinces, impacting 300 million people and representing nearly 80% of China’s economic output were shut in and shut down, essentially halting the world’s second-largest economy. This sharp drop-in economic activity not only increased the chances of a global recession but also compounded global supply chain problems (Shanghai, the world’s busiest port, operated far below capacity during the lockdowns). The severe decline in economic activity in China combined with lingering concerns about rising interest rates and high inflation hit stocks hard in April, and the S&P 500 Total Return Index and S&P/TSX Total Return Composite fell 8.7% and 5%.

The selling continued in early May, as the Federal Reserve raised interest rates by 50 basis points at the May 4th meeting, the single-biggest rate hike in 22 years. Canada has been mirroring rates with the U.S. Additionally, at the press conference, U.S. Fed Chair Jerome Powell clearly signaled that the Fed would continue to hike rates aggressively to tame inflation and that weighed on stocks, pressuring the S&P 500 to fall to new 2022 lows in mid-May. Towards the end of the month, however, markets staged a modest rebound thanks to potential improvement in multiple market headwinds. First, as COVID cases declined, the Chinese economy started to reopen, and by the end of May, the port of Shanghai was operating at 80% capacity, a material improvement from earlier in the month. In addition, some inflation metrics implied price pressures may be peaking. Those potential positives, combined with deep, short-term oversold conditions in equity markets, prompted a solid rally in late May and equity markets finished the month with a fractional gain.

Unfortunately, the relief did not last long. On June 10th, the May U.S. CPI report showed inflation had not yet peaked as CPI rose 8.6% year-over-year, the highest reading since 1982. That prompted a violent reversal of the late-May gains, and the selling and market volatility was exacerbated when the Federal Reserve (and Bank of Canada) increased interest rates by 75 basis points on June 15th, the biggest rate hike since 1994. Additionally, U.S. Fed Chair Powell again warned that similar rate hikes are possible in the coming months. The high CPI reading combined with the greater-than-expected rate hike hit stocks hard, with a mid-month drop of about 12% over seven trading days. During the last two weeks of the quarter, markets stabilized as commodity prices declined (WTI oil prices still up 46% YTD) while U.S. economic readings showed a clear moderation in activity which rekindled hope that a peak in inflation and an end to the rate hike cycle might come sooner than feared. Those factors, combined with the fact that markets had become near-term historically oversold again (some negative sentiment indicators hit all-time highs), resulted in a modest bounce late in the month, but the S&P 500 Total Return Index and S&P/TSX Total Return Composite still finished with a solidly negative returns of -8.3% and -8.7% for June.

In sum, the factors that pressured stocks in the first quarter, including high inflation, the prospect of sharply higher interest rates, geopolitical unrest, and rising recession fears, weighed even more heavily on stocks in the second quarter and until investors get some relief from these headwinds, markets may remain volatile.

Milestone Strategy and Outlook

The S&P 500 just realized its worst first-half performance since 1970 as initial market headwinds of high inflation and sharply rising interest rates combined with growing recession risks and extreme geopolitical uncertainty pushed stocks and bonds sharply lower through the first six months of the year. Although aided by high energy prices, the S&P/TSX Composite also struggled in the first half, while what most consider one of the most conservative asset classes (government and investment-grade corporate bonds) sustained heavy price declines.

The traditional asset mix was a difficult environment to navigate. With the addition of non-traditional asset classes, as well as raising some cash earlier in the year through tactical risk management, our core mandates at Milestone were able to shelter from some of this storm.

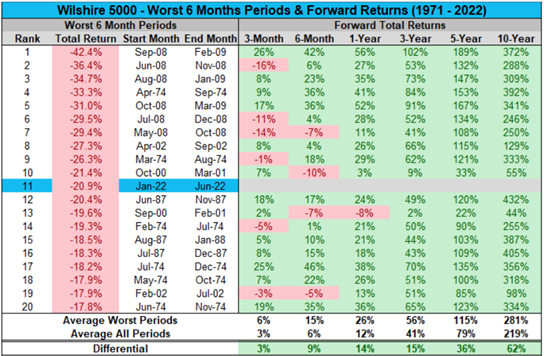

For those not focusing on a long-term investment strategy and process, however, it may feel like the time to capitulate and step aside but history would generally not concur with that strategy. The table below shows the worst twenty six-month periods for the U.S. Wilshire 5000 Index (more encompassing index than S&P 500). As illustrated, and perhaps not surprisingly, forward returns have been extremely high after that point relative to all periods.

Source: Charlie Bilello, Compound Capital Advisors, LLC

Many believe that the declines this year are understandable considering inflation reached a 40-year high, the U.S. Federal Reserve raised interest rates at the fastest pace in decades, the world’s second-largest economy effectively shut down and the Russia-Ukraine war raged on. Yet while the volatility and market declines of the first six months of 2022 have been unsettling, North American equity markets now sit at much more historically attractive valuation levels. In fact, we are now at or slightly below the long-term average. At current prices, many negatives have been priced into the market, opening the possibility of positive surprises as we move forward in 2022.

Source: Connected Wealth, Purpose Investments, Bloomberg

What we do know for sure is that the last two and a half years have been nothing but normal and squarely a result of the COVID pandemic, subsequent complete global economic shutdowns that in hindsight probably should not have occurred, followed by massive government stimulus that would not have happened otherwise, and then monetary policy mistakes by not acting quicker and tightening conditions sooner potentially avoiding as the inflation we are enduring today. Multiply all of that with resulting serious global supply-chain issues, geopolitical risks with the Russia-Ukraine war, and ongoing zero-COVID policy lockdowns in China, and you have a recipe for uncertainties and thus volatility.

The elevated level of inflation and aggressive tightening of financial conditions by central banks are now well known and telegraphed, but the media generally only focuses on the negatives. There certainly are some positives as well, namely historically low unemployment, sitting at 3.6% in the U.S. and 4.9% in Canada, its lowest rate on record since comparable data became available in 1976. Usually, one prerequisite for a recession is a struggling labour market. This status could certainly change quickly in the future (unemployment is a lagging indicator), but at least at present it is not signaling we are in or near a recession.

In addition, the U.S. consumer, which makes up 20% of the world’s economy, seems to be in a strong position and perhaps that is why the service sector (largest component of U.S. economy) has held up relatively well so far as the U.S. economy tries to shift back from a goods (due to COVID) to a service economy. In fact, cash reserves in the banking system are up $2.5 Trillion (10% of GDP) primarily due to COVID stimulus packages, and U.S. households have been strong savers over this period. It is not a stretch to project that this certainly will help the U.S. endure if it does fall into a mild recession in the next year.

Regarding inflation and Fed rate hikes, markets have aggressively priced in stubbornly high inflation and numerous additional rate hikes from the Federal Reserve between now and early 2023. However, if we see a definitive peak in inflationary pressures in the coming months, which we are currently witnessing now in the latest data and our forward-looking indicators showing Q2 will be the peak in inflation, then it is likely the Federal Reserve will hike rates less than currently feared, and that could be a materially positive catalyst for markets.

As shown in the next two charts, longer-term inflation break-evens are trending lower quickly, and the implied U.S. Fed Funds rate is set to steadily decline next year. The break-even inflation rate is a market-based measure of expected inflation. Since market participant’s money is on the line, it is viewed as a more reliable measure of inflation expectations than those done by surveys. Although we are not displaying the 10-year rate break-even rate below, it has just recently fallen to its lowest level (2.29%) since September 2021, which is potentially signaling that equity markets may have overshot the mark to the downside, at least on a longer-term perspective.

Source: Connected Wealth, Purpose Investments, Bloomberg

Source: Connected Wealth, Purpose Investments, Bloomberg

On economic growth, the Chinese economic shutdown has increased global recession concerns, but recently officials in Shanghai declared “victory” against the latest COVID outbreak and if Chinese economic activity can return to normal, that will be a positive development for global economic growth. This possibility is not something to be overlooked and another potential upside surprise. If the Chinese economy (world’s second largest) re-opens in the back half of this year, it would add a meaningful boost to global economic growth. Meanwhile, recession fears are rising, but stocks are no longer richly valued, and as such, are not as susceptible to an economic slowdown as they were at the start of the year.

Finally, regarding geopolitics, the human tragedy in Ukraine continues with no end in sight, but the conflict has not expanded beyond Ukraine’s borders, and many analysts believe that some sort of conflict resolution can be reached in the coming months. Any sort of a truce between Russia and Ukraine will likely reduce commodity prices and global recession fears should decline as a result.

Bottom line, the markets have experienced numerous macro-and micro-economic headwinds through the first six months of 2022, and they have legitimately pressured asset prices. The sentiment is extremely negative now, and a lot of potential “bad news” has been priced into stocks and bonds at these levels, again creating the opportunity for potential positive surprises.

To that point, the S&P 500 has declined more than 15% through the first half of the year five previous times since 1932. And in all those instances, the S&P 500 registered a solidly positive return for the final six months of those years.

Obviously, past performance is not necessarily indicative of future results, and we will continue to be vigilant to additional risks to portfolios, but market history provides a clear example that positive upturns can and have occurred even in difficult markets such as this. More importantly, through each of those declines, markets eventually recouped the losses and moved to considerable new highs. We continue to believe that markets remain in a secular bull market that started in 2009 and should still have years to go with the average lasting 21.2 years, according to data from Fidelity.

“The stock market is a device to transfer money from the impatient to the patient” – Warren Buffett.

At Milestone, we understand the risks facing both the markets and the economy, and we are committed to helping our clients effectively navigate this challenging investment environment. Successful investing is a marathon, not a sprint, and even extended bouts of volatility like we have experienced over the past six months are unlikely to alter our diversified and endowment-style approach set up to meet each individual’s long-term investment goals.

Regardless of where we are in the market cycle, it is important to take a disciplined approach and follow a rigorous process to investing and stay focused on one’s long-term financial goals. Therefore, it is critical for one to stay invested, remain patient, and stick to the process and plan, as we have worked with you to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline. Rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.

Thank you for your continued trust in Milestone as we navigate the tides ahead, and for the opportunity to assist you in working toward your financial goals. We are with you every step of your investment journey, identifying strategies and opportunities, reviewing performance, and rebalancing your portfolio to help you remain on track. Should you have any questions regarding your portfolio, please do not hesitate to contact us.

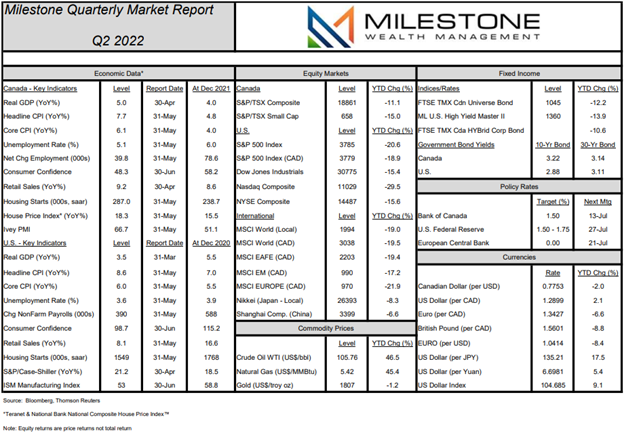

Here is our Milestone Market Report on economic data, capital markets, commodities, and currencies through June 30th, 2022: (click image for PDF version)

Sources: BNN Bloomberg, Thomson Reuters, Refinitv, CI Global Asset Management, Teranet & National Bank of Canada, CNBC, Globe & Mail, National Post, MarketWatch, Bank of Canada, Statistics Canada, The Economist, Wall Street Journal, Canaccord Genuity, BCA Research, Bespoke Investment Group, Fidelity Investments, Compound Capital Advisors, Connected Wealth, Purpose Investments