Market Insights: Tough First Half of the Year Comes to a Close

Milestone Wealth Management Ltd. - Jun 30, 2022

Macroeconomic and Market Developments:

- North American markets were lower this week. Markets are closed tomorrow for Canada Day, but U.S. markets remain open. In Canada, the S&P/TSX Composite Index was down 1.05%. In the U.S., the Dow Jones Industrial Average declined 2.30% and the S&P 500 Index fell 3.23% this week.

- The Canadian dollar was up slightly this week so far, closing at 77.67 cents vs 77.55 cents last Friday.

- Oil prices were down this week. U.S. West Texas crude closed at $105.76 vs $107.59 USD last Friday, and the Western Canadian Select price closed at $87.60 vs $89.70 last Friday.

- The gold price was also lower this week, closing at $1,807 vs $1,826 USD last Friday.

- A bidding war has heated up for U.S. discount airline Spirit Airlines (SAVE). Last Friday, Frontier Airlines (ULCC) sweetened its offer in response to JetBlue Airways’ (JBLU) increased all-cash offer. On Tuesday, JetBlue responded by yet again raising their bid price. The originally scheduled vote on Thursday was postponed in order to allow the board of directors time to assess the bids and make a recommendation to shareholders.

- The Bloomberg Nanos Canadian Confidence Index declined for a ninth straight week to the lowest reading ever outside of the last two economic crises. The gauge fell to 48.3 last week, the lowest since July 2020. Since polling began in 2008, the index has only fallen below 50 during the depths of the pandemic in 2020 and the Global Financial Crisis in 2008/2009.

- Nike (NKE) posted better-than-expected sales and profit for its fiscal fourth quarter. The company’s earnings came in at $0.90/share vs $0.81/share expected on revenue of $12.23 billion vs $12.06 billion expected. In the quarter, inventory rose 23% vs the year-ago period, driven by longer lead times from ongoing issues in the supply chain.

- Whitecap Resources (WCP) has entered into an agreement to acquire XTO Energy Canada from Imperial Oil and ExxonMobil Canada for a net purchase price of $1.7 billion. In addition, Whitecap's board has approved an increase to its monthly dividend to $0.0367/share from $0.03/share previously.

- Alberta recorded its first fiscal surplus in seven years after oil and gas prices surged in the first months of the year. The provincial government’s fiscal year ended on March 31st with a surplus of $3.9 billion after West Texas Intermediate crude traded at an average price of US$77/barrel, US$31 more than budgeted. Non-renewable resource revenue, which includes oil and gas royalties, ballooned to a total of $16.2 billion, or $13.3 billion more than originally budgeted.

- Canada’s economy grew by 0.3% for the month of April according to Statistics Canada, down from the 0.7% growth in March. However, the agency also reported an initial estimate that GDP declined by 0.2% in May, signaling a continued slowdown.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled Our View Is Same As We Exit Q2: DWYER VLOG

Weekly Diversion:

Check out this video of a girl standing up to the dark side.

Charts of the Week:

The first half of 2022 has been an extremely difficult environment with bonds in a correction and equities in a cyclical bear market. However, we continue to view this within a longer-term secular bull market that has years to go. According to Fidelity Investments & Bloomberg data, equity valuations, based on trailing and forward price/earnings (P/E) multiples, have now come back down to the long-term average. The average trailing 12-month P/E ratio for the S&P 500 since 1955 has been 17.1, and as of June 22nd it was also at 17.1 (and likely lower this week which would put it below the long-run average). With valuations now at reasonable levels, active management should provide solid investment opportunities over the coming weeks and months.

As we noted in a recent commentary, we still believe that markets are currently set up for a potential summer rally given the historically extreme oversold levels, record levels of investor pessimism, along with some early indications that year-over-year inflation is peaking (although a few months later than most anticipated). On the last point, importantly, in recent news this week the Federal Reserve reported that the M2 measure of the money supply (cash, chequing accounts, savings and time deposits, money market securities) grew only 0.1% in May and is up a relatively moderate 6.6% from a year ago. The economy still must absorb the massive increase in M2 from 2020-21, which means high inflation for a while longer yet. But at least for now, the Fed has reduced the pace of money growth so that, if it maintains this lower pace, inflation can eventually return to lower levels.

While we have been in drawdown periods like the current one before, they can understandably cause uncertainty, and unfortunately individual investors often panic and exit markets are the least opportune times as historical money flow data has shown. Larger, more patient institutional investors are often the ones on the buying end of those transactions, as we have referred to as money transferring from weaker to stronger hands. Let us reiterate the important quote from our comments two weeks ago, “The stock market is a device to transfer money from the impatient to the patient” – Warren Buffett.

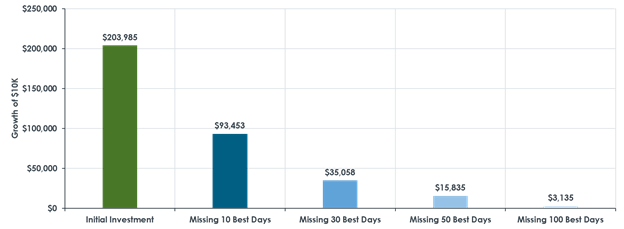

We encourage investors to focus on their long-term objectives and remember that time in the market has always proven to be a better approach than timing the market. This is because quite often the strongest and most powerful moves up occur after the highest points of volatility and after money has shifted as described above. The following chart shows just how costly it can be to sit on the sidelines in an attempt to try to time market upswings or recoveries. The data covers the time period from 1990 to June 16, 2022, which is a 31.5-year time period which is not dissimilar to the length of time individual investors are in the market growing their capital. The green bar is what $10,000 invested into the S&P 500 Index on January 1, 1990, has turned into today. The various blue bars illustrate how that $10,000 has performed by simply missing the best one-day periods in the market. Clearly, one must be in the market to earn the return of these best days. It may shock many to see that if you only miss the 10 best days (as we mentioned, these often occur after a big decline), the increase of $10,000 to $203,985 drops wildly to $93,453, and if you are out of the market on the 30 best days, it only increases to a meager $35,058 which is less than a fifth of the amount if one stayed invested.

Source: Fidelity Investments Canada ULC. (S&P 500 Index total returns from January 1, 1990, to June 16, 2022, in U.S. dollars. The best days were replaced with a 0% return to highlight the overall cost of missing them over the period analyed. Past performance is no guarantee of future results. It is not possible to invest directly in an index.)

To finish off this week, here is a chart potentially signalling capitulation. A period of capitulation refers to the dramatic surge of selling pressure in declining markets that marks a mass surrender by investors, with the resulting drop often marking the end of the decline. As of last week, there are a record percentage of companies that are now trading below the value of their cash and short-term investments, a level even greater than 2008.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke, Factset, JPMorgan, Fidelity Investments Canada