Market Insights: Is Peak Inflation Behind Us?

Milestone Wealth Management Ltd. - May 27, 2022

Macroeconomic and Market Developments:

- North American markets staged a huge comeback this week. In Canada, the S&P/TSX Composite Index was up 2.84%. In the U.S., the Dow Jones Industrial Average increased 6.25% and the S&P 500 Index jumped 6.58% this week.

- The Canadian dollar was positive this week, closing at 78.62 cents vs 77.90 cents last Friday.

- Oil prices were also positive this week. U.S. West Texas crude closed at $115.07 vs $113.23 USD last Friday, and the Western Canadian Select price closed at $97.09 vs $95.75 last Friday.

- The gold price was up slightly this week, closing at $1,854 vs $1,846 USD last Friday.

- The markets had a better week this week. Notably, on Wednesday the U.S. Federal Reserve released the minutes of their May meeting. The market interpreted their comments to suggest that the central bank won’t be quite so aggressive in interest rate hikes over the next few months. This allowed the markets some relief from the downtrend of the past several weeks.

- After the U.S. markets closed on Monday, Snap Inc (SNAP), parent company of Snapchat, sent a shock across the social media industry. Snap CEO Evan Spiegel warned employees and investors that “the macro environment has deteriorated further and faster than we anticipated when we issued our quarterly guidance last month”. This news sent the stock price down 43.08% on Tuesday. The stock price recovered some of that decline as the week progressed, but remains down 66.90% so far in 2022 and 81.25% from its all time closing high on September 24, 2021.

- Canadian banks released earnings this week.

- Beginning on Wednesday, Bank of Montreal (BMO) reported earnings of $3.23/share, slightly better than the expected $3.22/share and announced that it will increase its quarterly dividend by 4.5% to $1.39 from $1.33.

- Bank of Nova Scotia (BNS) reported better than expected earnings of $2.18/share vs $1.97/share, and better than expected revenue of $7.94 billion vs $7.88 billion expected. The bank also increased its quarterly dividend by 3.0% to $1.03 from $1.00/share.

- Then on Thursday, CIBC (CM) reported lower than expected earnings of $1.77/share vs $1.79/share expected, despite above expected revenue of $5.38 billion vs $5.30 billion expected. CIBC raised its quarterly dividend to $0.83 from $0.805/share.

- Royal Bank of Canada (RY) beat expectations, coming in at $2.96/share vs $2.67/share expected. The bank also announced that it is increasing its quarterly dividend by 6.7% to $1.28 from $1.20/share.

- Toronto-Dominion Bank (TD) reported better than expected earnings of $2.02/share vs $1.94/share expected, however chose to keep its dividend the same.

- And finally on Friday, National Bank of Canada (NA) beat earnings expectations with $2.55/share vs $2.25/share expected, and beat revenue expectations with $2.44 billion vs $2.36 billion expected. The bank is increasing its quarterly dividend by 5.7% to $0.92 from $0.87/share.

- The price of natural gas on the NYMEX exchange surged again this week, briefly breaking through the US$9.00 level, but pulled back to close out the week at US$8.72. The commodity is now up 145% so far in 2022, from a price of $3.56 on December 31, 2021, and is up 193% from the $2.98 price one year ago.

- Chip maker Broadcom (AVGO) announced a plan to buy VMware (VMW) in a deal valued at $61 billion in a combination of cash and stock, based on the closing price of Broadcom common stock on May 25. Broadcom’s purchase of VMware will help the company diversify away from its core business of designing and selling semiconductors into enterprise software. The transaction will still have to be approved by regulators.

- U.S. Real (after inflation) GDP growth in the first quarter of 2022 was revised slightly lower to a -1.5% annualized rate, down from a prior estimate of -1.4%, missing expectations for a revision to -1.3%. Downward revisions to inventories and home building more than offset an upward revision to consumer spending. The largest positive contributions to the real GDP growth rate in Q1 were consumer spending and business investment. The weakest components were net exports and inventories.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled A Special Thank You and Thought on Bounce: DWYER VLOG

Weekly Diversion:

Check out this video detailing some of the strangest and most amazing planets scientists have discovered.

Charts of the Week:

We have discussed inflation and interest rates numerous times in the last couple months and its impact on the equity and bond markets this year. What we have stated more recently is that although we believe inflation will stay elevated for a significant period of time and will have negative impacts to growth, we likely have already seen the peak of the rate of change in inflation. The level of inflation versus the rate of change of inflation, is an important delineation to make when putting probabilities towards how it will impact markets going forward. Market prices and changes of those prices are a reflection of the collective mindset of all investors and what they are willing to pay for an expected level of growth and/or a future cash flow in the context of the current inflation and interest rate environment we are in. The market already knows that inflation is high and will be high for a while, but on a go forward basis, markets move more on the rate of change of that expectation, not the actual level itself.

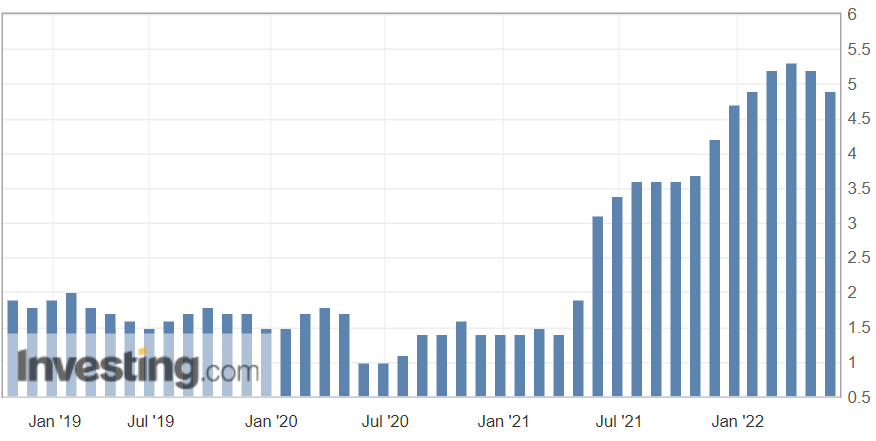

The chart below shows the year-over-year change of the monthly core Personal Consumption Expenditures (PCE) price index. The core price index excludes food and energy and is less volatile. The PCE and core PCE are the preferred inflation measures used by the Federal Reserve in its monetary policy decisions. As you can see, the core PCE peaked in February at 5.3% and has since declined to 4.9%. The most recent measure for April was just released today and was in line with expectations. Importantly, this was the first back-to-back monthly decrease in year-over-year core inflation in two years, going back to April 2020. In addition, the PCE price index (which includes food and energy), also declined in April from a level of 6.6% to 6.3% for its first year-over-year monthly decline since November 2020. This is just one month, but we would venture to say it is important to note since it had not declined a single time for a year and a half.

Source: Investing.com, Fusion Media Ltd.

While politicians and consumers continue to fret about high inflation, and rightfully so in many cases, the data itself is starting to show that inflation may have peaked already. In other words, the bond markets themselves are starting to price downright modest long-term price increases and that a good portion of the current bout of high inflation is transitory. We can see how markets are pricing this in from something called inflation breakevens. This is the spread between real yields on the Treasury Inflation Protected Securities (TIPS) and nominal Treasury Bonds. The spread is an implied market price for inflation on a forward-looking basis as it measures the inflation compensation between the two markets. The chart below shows the 2-year, 5-year and 10-year inflation breakevens over the past five years. You will note that these rates have been coming down significantly the last two to three months. The difference between the nominal 2-year yield and the TIPS yield is currently 3.91%. What that means is that it is implying a market price of 3.91% inflation over the next two years (much lower than the current 4.9% rate we mentioned above). This yield approached 5% at its March 25th peak, so this rate has moved firmly lower since then, backing up our thought process that peak inflation is potentially behind us. Long-term breakevens have also come down a lot lately, with the 5-year inflation rate priced at 2.92% after peaking at 3.75%. This represents the average pricing of inflation over the next five years so it includes the 2-year rate. Lastly, the 10-year inflation is priced around 2.6% and has also been falling persistently. With inflation being closer to 2% pre-COVID, this means that we should get used to inflation consistently being about 0.5 - 0.75% higher going forward on a longer-term basis. We believe markets have mostly priced this impact into current prices, so if these breakevens do not consistently move back up again, there could be a good opportunity to put cash to work into certain risk assets with an intermediate to long-term time horizon. We will say it is important to note that TIPS breakevens at any maturity are not a general expectation, they are a money-weighted expectation combined with a liquidity premium. Therefore, both nominal and TIPS yields can go haywire during periods of stress, sometimes providing irrational numbers due to changes in liquidity (an issue back in 2008). So while these breakevens are important to watch, they still do require a grain of salt at times.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke Investment Group, Investing.com