Market Insights: U.S. Still Enjoying Strong Earnings Outlook

Milestone Wealth Management Ltd. - Apr 09, 2022

Macroeconomic and Market Developments:

- North American markets were mostly down this week. In Canada, the S&P/TSX Composite Index fell 0.36%. In the U.S., the Dow Jones Industrial Average was up 0.28% and the S&P 500 Index was down 1.27%.

- The Canadian dollar declined this week, closing at 79.54 cents vs 79.86 cents last Friday.

- Oil prices were down slightly this week. U.S. West Texas crude closed at $98.02 vs $99.46 USD last Friday, and the Western Canadian Select price closed at $85.18 vs $85.78 last Friday.

- The price of gold was up this week, closing at $1,946 vs $1,928 USD last Friday.

- The Canadian federal budget was released on Thursday. Some of the highlights include:

- A forecasted $52.8 billion budget deficit.

- A 1.5% surtax on major banks and insurance companies’ profits.

- A new ‘home savings account’ allowing first time home buyers to save for a down payment in a tax efficient way.

- A carbon capture tax credit to help companies move more quickly on reducing emissions.

- Suncor Energy (SU) announced this week that it is changing its ESG strategy and eliminating its wind and solar assets. In an effort to be net-zero by 2050 and also increase shareholder returns, Suncor has decided to switch its focus to hydrogen and renewable fuels.

- The U.S. ISM Non-Manufacturing (Services) index increased to 58.3 in March, slightly below the consensus expected 58.5 (levels above 50 signal expansion; levels below signal contraction). The major measures of activity moved mostly higher in March, and all stand comfortably above 50, signaling growth.

- Twitter (TWTR) got a huge boost on Monday after it was disclosed that Elon Musk has taken a 9.2% stake in the company. The stock price was up 28.38% on Monday as a result. The company also announced that the billionaire will be joining the Twitter board of directors.

- On Wednesday, the U.S. Federal Reserve released the minutes from its March meeting, which showed that officials plan to reduce their trillions in bond holdings and indicated that one or more 0.5% interest rate hikes could be warranted to battle surging inflation.

- The federal government gave the green light to a $12 billion offshore oil project proposed by Norway’s Equinor ASA. The Bay du Nord project, about 500 kilometers off the coast of Newfoundland, can move ahead as long as the company follows strict environmental protection measures. Equinor will need to comply with 137 legally-binding conditions, including requirements to reduce greenhouse gas emissions.

- The Canadian March employment report showed Canada added 73,000 jobs last month, better than the expected 50,000 job gain. The unemployment rate edged down to 5.3% from 5.5%, the lowest level on record going back to 1976.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled ‘Rate Bite and Tactical Update’: DWYER VLOG

Weekly Diversion:

Check out this video of a heartwarming daddy/daughter gymnastics routine.

Charts of the Week:

There certainly hasn’t been a shortage of so-called prognosticators in the media over the last few weeks looking through negative lenses, but the fact is the trend for economic growth and corporate earnings for the U.S. remains positive and strong. Despite some of the headwinds in developed Europe, Asia & Far East (EAFE) and Emerging Markets (EM) of late, you must be impressed to see that U.S. earnings are holding up very well in the face of everything we’ve seen this year. Here are the current 12-month consensus earnings per share estimates for the S&P 500 (blue line), as well as for EAFE and EM.

Sources: Ryan Detrick & LPL Research

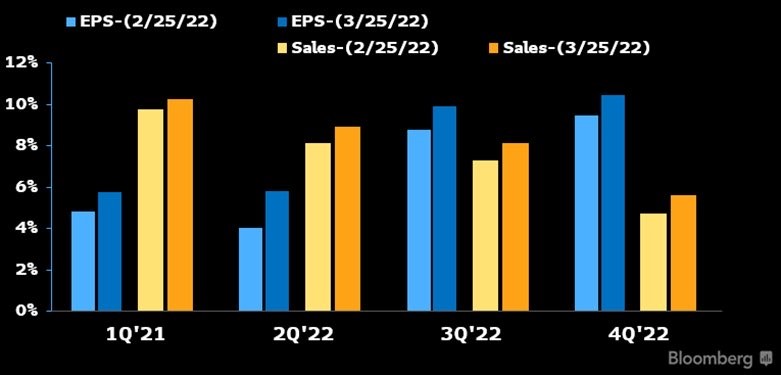

The chart above is as of March 31, 2022. However, over the past month analysts have revised earnings and revenue forecasts for the S&P 500 higher for the next four quarters of 2022, so the trend has not just been positive but accelerating. Please note one typo in the chart below, the first bars should say 1Q’22.

Sources: Gina Martin Adams & Bloomberg

We continue to witness some incredible moves in long-term government bond yields in North America. In the last five weeks, we have witnessed the 10-year U.S. Treasury yield rise by almost 1% from 1.7% to 2.7% today. Bond markets are taking it on the chin as a result, with the FTSE Canada Bond Universe Index down more than 5% over that period and down well over 8% YTD. As you can see in the chart below, this is rare move in such a short period of time. In fact, this is only the 11th time we have seen this occur since 1990. We will note that the chart below was from a couple days ago when the increase was closer to 0.8% so the little red dot in the most recent instance is even higher right now.

Source: Bespoke Investment Group

The table below shows what has occurred in these prior 10 instances. While the prior five-week periods during these rate rises have been volatile, the following one-, three-, six- and twelve-month periods have been much more stable for equity markets. Median returns for the S&P 500 have actually been above average for all these forward-looking periods over these past occurrences, with positive returns in the 80-90% range.

Source: Bespoke Investment Group

We wanted to end our comments this week on a lighter note. With golf season just around the corner, this weekend is the most prestigious golf tournament in the world, The Masters. It has sure been impressive to see Tiger Woods back in action looking for his sixth green jacket, after shocking the world this week with his incredible comeback from a very serious injury. The following chart shows how the S&P 500 Index has fared over a calendar year basis when various nationalities have won the Masters. This is clearly a random stat, and no investment should be based on this, but interesting nonetheless. Let’s all root for players from either Australia, Japan or Canada!

Source: Ryan Detrick & LPL Research

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke Investment Group, LPL Research