Market Insights: How is Inflation Affecting Bond Yields?

Milestone Wealth Management Ltd. - Mar 11, 2022

Macroeconomic and Market Developments:

- North American markets went in opposite directions for the third week in a row. In Canada, the S&P/TSX Composite Index was up 0.28%. In the U.S., the Dow Jones Industrial Average declined 1.99% and the S&P 500 Index was down 2.88%.

- The Canadian dollar dropped slightly this week, closing at 78.43 cents vs 78.55 cents last Friday.

- Oil prices were very volatile this week, but ultimately finished lower. U.S. West Texas crude closed at $109.33 USD vs $115.00 USD last Friday, and the Western Canadian Select price closed at $96.36 vs $102.57 last Friday.

- The price of gold increased this week, closing at $1,987 USD vs $1,969 USD last Friday.

- Volatility continued this week as commodity prices bounced around fiercely as a result of the invasion of Ukraine by Russia. Early in the week, President Biden announced a U.S. ban on Russian oil imports, as well as natural gas and other energy sources. About 8% of American imports of oil and refined products, or about 672,000 barrels a day, came from Russia last year.

- Changes to Canadian indices were announced by Standard & Poor’s this week. Effective March 21st, Intact Financial (IFC) will be added to the S&P/TSX 60 index and Canopy Growth (WEED) will be removed. Also, Headwater Exploration (HWX) and Nuvista Energy (NVA) will be added to, and Silvercorp Metals (SVM) will be removed from the more broadly based S&P/TSX Composite index.

- Intertape Polymer Group (ITP) is being acquired by an affiliate of Clearlake Capital Group for C$40.50/share in an all-cash transaction valued at ~US$2.6 billion, including net debt. The buyout price represents a premium of ~82% to the closing price of Intertape’s share price the day before the acquisition announcement.

- Google’s parent Alphabet (GOOGL) announced Tuesday that it plans to buy cybersecurity firm Mandiant (MNDT) for ~$5.4 billion or $23.00/share, as part of an effort to better protect its cloud customers. If the deal gets approved by regulators, it will be Google’s second-largest acquisition ever behind its $12.5 billion Motorola Mobility deal in 2012 and ahead of its purchase of smart home product maker Nest, which it bought for $3.2 billion in 2014.

- TC Energy (TRP) has signed option agreements to sell a 10% equity interest in the Coastal GasLink Pipeline Limited Partnership to Indigenous communities across the project corridor. The equity option is exercisable after commercial in-service of the pipeline and is subject to approvals. Coastal Gaslink is a 670-kilometre project being built to deliver natural gas to the $40 billion LNG Canada facility that is being developed in Kitimat, BC.

- Amazon (AMZN) announced a 20 for 1 stock split after the market closed on Wednesday, as well as plans for a $10 billion share buyback plan. Amazon is following in the footsteps of Alphabet (GOOGL) which also announced a 20 for 1 split announcement in February.

- The U.S. Consumer Price Index (CPI) increased 0.8% in February, matching expectations, and is up 7.9% from a year ago. Energy prices increased 3.5% in February, while food prices increased 1.0%. The core CPI, which excludes food and energy, rose 0.5% in February, also matching expectations, and is up 6.4% from a year ago.

- Canada reported a big employment gain in January. The Canadian economy gained a net 336,600 jobs in February, well above the expected 160,000. The unemployment rate fell to 5.5% from 6.5% in January, much lower than the expected 6.2%.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled A Tactical Update On Opening Spike: DWYER VLOG

Weekly Diversion:

Check out this video of the Biggest Megaprojects in the World.

Charts of the Week:

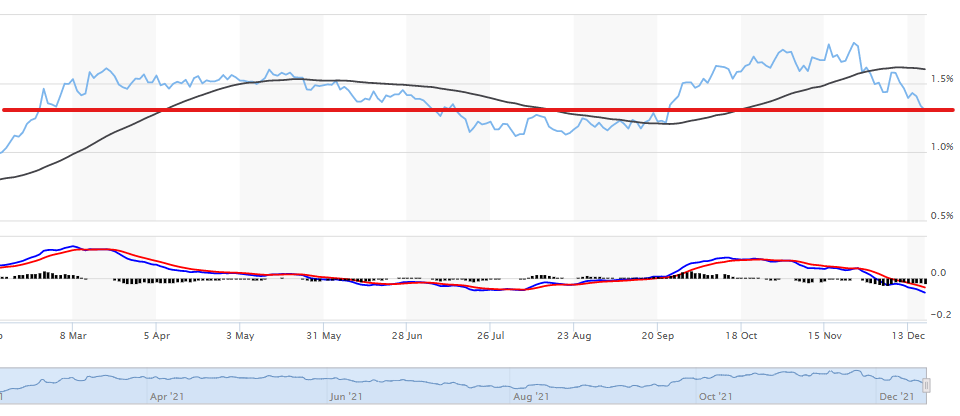

There has been much focus on inflation and rising interest rates in both the financial media and the mainstream media (as well as these weekly commentaries) for the past several months. The conflict in Ukraine and sanctions against Russia have only exacerbated that situation by pushing up commodity prices to levels not seen since 2008. Back in December, we discussed Canadian bond yields in our weekly commentary with this chart:

At that time, we had written, “The yield on the 10-year bond has been fairly flat since March 2021 despite the economy recovering, QE being discontinued, and inflation spiking. Evidently, this contradiction demonstrates that the bond market is not consistent with the central bank in terms of predicting high inflation in the future. If bond market participants believed that inflation would continue unabated into the future, the 10-year yield would be much higher to reflect this theory. What may have triggered such a massive drop in interest rates in the last few weeks? The most likely answer is Omicron: the uncertainty surrounding this new variant and its effect on the global economy. Stock markets have been volatile since Omicron was discovered. This perceived threat may have investors selling stocks to purchase the relative safety of government bonds (when the price of a bond goes up, its yield conversely goes down).”

So let’s take a look at what has occurred since then. First off, as we all now know, Omicron cooled off and the markets turned their focus back to the state of the economy and high inflation. As a result, interest rates started trending back upwards rather rapidly in the early part of 2022. In fact, as you can see by the chart below, the Canadian government 10-year bond interest rate bottomed out right around the time we printed the above chart.

In the past few weeks, interest rates have eased back a bit in light of the concern surrounding the ongoing Russia – Ukraine conflict, however, they have stayed quite elevated despite this. On one hand, the markets are feeling uncertain at the moment with respect to what potential negative impact this conflict will have on global economic growth, which partly explains why the stock market has sold off. However, on the other hand, that concern is being offset in the bond market (and therefore interest rates are not declining) by worries that escalating commodity prices will translate into even higher inflation, reinforcing the need for even higher interest rates.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust