Market Insights: Sentiment Collapse Continues

Milestone Wealth Management Ltd. - Feb 11, 2022

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index was up 1.32%. In the U.S., the Dow Jones Industrial Average declined 1.00% and the S&P 500 Index was down 1.82%.

- The Canadian dollar was slightly positive this week, closing at 78.48 cents vs 78.33 cents last Friday.

- Oil prices were up again this week. U.S. West Texas crude closed at $93.94 vs $92.11 USD last Friday, and the Western Canadian Select price closed at $79.81 vs $78.37 last Friday.

- The price of gold was also higher this week, closing at $1,863 vs $1,808 USD last Friday.

- U.S. inflation data came in hot again last month. The U.S. Consumer Price Index (CPI) rose 0.6% in January, with the annual inflation rate at 7.5% which is the highest since February 1982, with core inflation rising by 6.0% over the past year. As a result, the U.S. 10-year government bond yield reached 2.0% for the first time since August 2019 this week, however pulled back to finish the week at 1.92%. In fact, even the German 10-year government bond yield has now crossed into positive territory, after having a negative interest rate since May of 2019.

- The market continued to be nervous about a possible invasion of the Ukraine by Russia. On Friday, Secretary of State Blinken said that a Russian invasion of Ukraine could begin at any time. This led to a sell off in equity markets, except for oil and gold which spiked on the news.

- The U.S. airline Frontier Group (ULCC) has agreed to buy Spirit Airlines (SAVE) for $2.9 billion in cash and stock. If the deal is completed, Frontier Airlines shareholders will control 51.5% of the merged airline while Spirit shareholders will hold the remaining 48.5%. By uniting the low-cost airlines, the new entity will be the fifth largest airline in the United States.

- Peloton (PTON) shares recovered somewhat this week, although still down dramatically from its high. Reports emerged that companies such as Amazon and Nike are potentially interested in a takeover offer for the company. Also, the company announced a restructuring plan including a new CEO and a round of layoffs.

- Calgary-based Cenovus Energy (CVE) reported lower than expected Q4 cash flow of $0.97/share vs $1.08/share estimated, however production beat expectations at 825.3 Mboe/d vs 809.5 Mboe/d estimated. Also, net debt was below C$9.6 billion at year end, which is a reduction of more than C$1.4 billion from the end of Q3.

- Enbridge (ENB) reported lower than expected Q4 earnings of $0.68/share vs $0.76/share expected, however distributable cash flow came in at $2.49 billion vs $2.45 billion expected. The company also provided guidance for its fiscal year 2022 that reaffirmed adjusted EBITDA of between C$15.0 billion and C$15.6 billion.

- Disney (DIS) reported blowout earnings this week, with earnings of $1.06/share vs $0.63/share expected on revenue of $21.82 billion vs $20.91 billion expected. Importantly, Disney+ total subscriptions increased to 129.8 million vs 125.75 million expected and attendance at its parks has markedly improved.

- Brookfield Asset Management (BAM.A) announced that it may soon spin off its division that invests on behalf of institutions, betting that the move will give the business division a better valuation based on the stock performance of other pure-play investment firms. The newly independent company would be positioned to capitalize on investor hunger for exposure to sectors such as real estate and private credit.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled This Is the Definition of Tumultuous: DWYER VLOG

Weekly Diversion:

Check out this video of a four-year-old snowboarder narrating their own ride.

Charts of the Week:

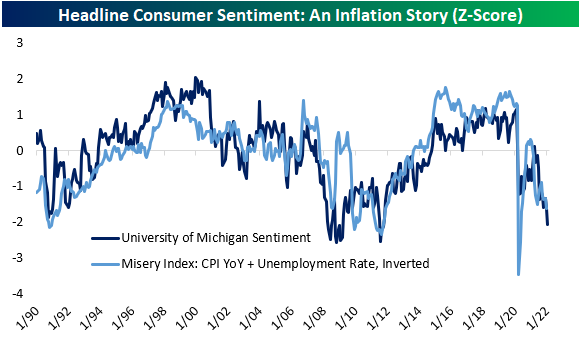

Today we saw the release of the University of Michigan Consumer Sentiment survey for February and preliminary results were not pretty. This is one of a few widely followed sentiment indicators for the United States. The reading came in at the weakest level since the last quarter of 2011 and not that far off the levels we saw that year or in late 2008 during the Great Recession. Before that, the only previous time lower than today was the Volcker-induced early 80s recession. This is a relatively extreme reading considering the fact that U.S. economic growth is actually currently strong, as opposed to 2008 and 2011 which were recessionary or near recessionary times.

Source: Bespoke Investment Group

However, it is straightforward to understand why this reading is so low at the moment, and it solely has to do with inflation and inflation expectations. In the past, this headline consumer sentiment indicator has correlated strongly with the inverted combination of the unemployment level and the year-over-year inflation rate, often referred to as the Misery Index. Right now, the unemployment rate is very low at 4% and already at the Federal Reserve’s long-term target. The year-over-year inflation rate, on the other hand, is around 7% and at 40-year highs. So, although the unemployment rate is low which is a positive, it is the extreme current level of inflation that is pulling the light blue line down in the chart below, and thus likely this sentiment index as well.

Source: Bespoke Investment Group

On a forward-looking basis (a sub-index of the above sentiment survey), consumers aren’t any happier. Again, what is interesting about this is the fact that normally this level of sentiment in the past has only been seen in recessionary or very poor economic periods, as opposed to the growth environment in which the U.S. is currently.

It is worth noting that most of the negative sentiment revolves around short-term inflation expectations, not long-term expectations. Although the latter has certainly picked up as of late, it is much more muted than the short-term, and just getting back to the levels they were for 20 years prior to the post-financial crisis expansion. We do not expect the light blue line below to stay at this level, it will likely gradually drop back down towards the 3% level as the year progresses. One positive from this is that we have yet to see a surge in long-term inflation expectations.

Source: Bespoke Investment Group

We continue to expect above trend economic and earnings growth this year. This in combination with low levels of credit stress and still relatively accommodative central banks, albeit with much higher levels of volatility than last year, should provide good entry points this year within the long-term secular bull market.

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke Investment Group