Market Insights: Performance in Mid-Term Years

Milestone Wealth Management Ltd. - Jan 21, 2022

Macroeconomic and Market Developments:

- North American markets sold off this week. In Canada, the S&P/TSX Composite Index was down 3.48%. In the U.S., the Dow Jones Industrial Average declined 4.58% and the S&P 500 Index fell 5.68%.

- The Canadian dollar was down slightly this week, closing at 79.47 cents vs 79.66 cents last Friday.

- Oil prices were mostly flat this week. U.S. West Texas crude closed at $84.77 vs $84.28 last Friday and the Western Canadian Select price closed at $70.75 vs $71.25 last Friday.

- The gold price was positive this week, closing at $1,831 vs $1,817 last Friday.

- The markets were down hard this week, continuing the theme that’s been in place since the start of 2022. Interest rates have spiked higher on government bonds in anticipation of central banks in Canada and the U.S. beginning to tighten monetary policy, with the Bank of Canada expected to increase interest rates as early as next week. Couple that together with a couple of big-name earnings disappointments, and the market is off to a rough start to the year.

- Calgary-based Tourmaline Oil (TOU) announced both an increase of 11% to its base quarterly dividend, going from $0.18/share to $0.20/share beginning in Q1 of 2022, as well as a special one-time cash dividend of $1.25/share. This is a reflection of the continued strong financial performance and outlook for the company.

- Another big U.S. bank reported earnings this week, with Goldman Sachs (GS) missing earnings expectations similar to JP Morgan last week. The bank reported earnings of $10.81/share vs $11.76/share estimated, although revenue came in higher than expected at $12.64 billion vs $12.08 billion estimated. This led to a sell off, with the stock ending Tuesday down 6.97%.

- Microsoft (MSFT) has reached an agreement to buy video game giant Activision Blizzard (ATVI) for $95.00/share, which works out to a $68.7 billion all-cash deal. If completed, this deal would be the biggest takeover in history in the tech industry. Activision Blizzard is the creator of popular games such as Call of Duty, Candy Crush and World of Warcraft. Activision was up 25.88% and Microsoft was down 2.43% the day of the announcement.

- Netflix (NFLX) shocked the markets after the close on Thursday. Although earnings came in above expectations at $1.33/share vs $0.82/share expected, they divulged that increased competition from other streaming services is beginning to eat into the company’s growth. This led to a series of analysts decreasing their price targets and saw the stock price down a startling 21.79% on Friday.

- The Canadian inflation rate was 4.8% in December from a year ago, which was in line with estimates and slightly higher than the 4.7% annual rate in November. The average core inflation rate rose to 2.93%, the highest since 1991.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled Adjusting Yield Curve View: DWYER VLOG

Weekly Diversion:

Check out this video of a Canadian Olympic gold medalist hitting the streets.

Charts of the Week:

Equity markets are off to a rocky start, however perhaps it isn’t completely unexpected that markets are taking a breather after such a strong year in 2021. Adding to that, bond markets haven’t fared any better, with the Canadian aggregate bond index down more year-to-date than it was down all last year. In other words, what is normally considered a safe haven during corrections has not been this time.

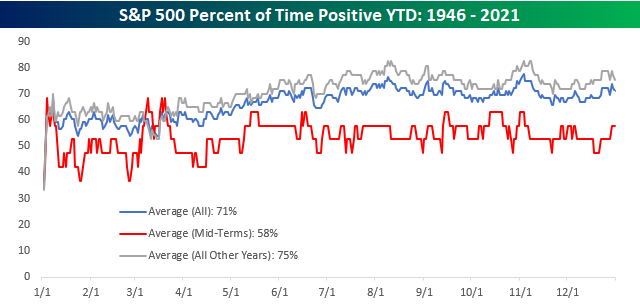

Mid-term election years are known for being a bit more volatile than others, and this year is living up to that reputation so far. In the post-WWII period, the S&P 500’s average return during mid-term election years has been about half of what it typically is for non-mid-term years, approximately 5% vs 10%. Perhaps expectations should be tempered a bit this year. That being said, overall economic growth and earnings growth is still shaping up to be strong this year, so perhaps a higher base level of growth could prove to make this mid-election year better than average. Here is a chart of the U.S. market’s average mid-term year performance compared to all years and all other years. In looking at the red line in the chart, typically the year starts off weak and then strengthens into the spring, before pausing again in the summer and leading to a big rally in the third quarter. There is certainly no way to know if this pattern will play out again this year, but it is always good to know past patterns for at least a rough guide.

Source: Bespoke Investment Group

In addition to the above weakness compared to other years, mid-term election years tend to have a lower rate of positive returns as well. The biggest strength in these years tends to be in March compared to all other years, so we will see if that plays out this year. It certainly could prove to be true, especially with the bar being fairly low right now after a weak start to the year. Although mid-term years have been weaker on average, the percent of time positive is still close to 60%. This year, we would likely lean towards that positive rate being higher than that, given the still strong economic backdrop and earnings growth, relatively low stressed credit markets, and very low real rates of interest.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke Investment Group