Market Insights: Santa Claus Rally?

Milestone Wealth Management Ltd. - Dec 03, 2021

Macroeconomic and Market Developments:

- North American markets were down again this week. In Canada, the S&P/TSX Composite Index was down 2.33%. In the U.S., the Dow Jones Industrial Average was down 0.91% and the S&P 500 Index was down 1.22%.

- The Canadian dollar was lower as well this week, closing at 77.82 cents vs 78.18 cents last Friday.

- Oil prices were down this week. U.S. West Texas crude closed at $66.37 vs $68.15 and the Western Canadian Select price closed at $47.69 vs $58.54 last Friday.

- The gold price was also lower this week, closing at $1,784 vs $1,803 last Friday.

- The main news item driving markets this week was the new Omicron COVID variant. This week saw heightened volatility as the market digested each new piece of information. Compounding the negative sentiment, Fed Chair Jerome Powell gave a speech on Tuesday that suggested the U.S. Central Bank could accelerate its tapering of Quantitative Easing, setting the stage for higher interest rates sooner than expected, despite uncertainly due to the emergence of the new COVID variant.

- Canadian bank earnings were a focus this week, with the banks now able to increase dividends and share buybacks. On Tuesday, Scotiabank (BNS) reported better than expected earnings of $2.10 vs $1.91 expected, raised its dividend by 11.1% and announced a share buyback of up to 24M shares. On Wednesday, National Bank (NA) reported earnings of $2.21 vs $2.24 expected, a dividend increase of ~23% and a buyback of up to 7.0M shares. Additionally on Wednesday, Royal Bank of Canada (RY) reported earnings of $2.68 vs $2.81 expected, an increase to its dividend of 11.1% and a share buyback of up to 45M shares. On Thursday, CIBC (CM) reported earnings of $3.37 vs $3.54 expected, a dividend increase of 10.3% and a buyback of 10M shares. Also, on Thursday, Toronto-Dominion Bank (TD) reported earnings of $2.09 vs $1.96 expected, an increase to its dividend by 12.7% and a buyback of up to 50M shares. And finally on Friday, Bank of Montreal (BMO) reported earnings of $3.33 vs $3.21 expected, a dividend increase of 25.5% and a buyback of up to 22.5M shares.

- In Canadian economic news this week, Q3 GDP rose at an annualized pace of 5.4% beating estimates looking for a 3.0% gain. This upturn comes after the surprise 1.1% contraction in the economy in Q2. Monthly GDP edged up 0.1% in September with flash estimate for October showing a 0.8% GDP gain. As well, Canada's current account balance recorded a surplus of $1.4B for Q3. Statistics Canada noted that after continuous deficits from Q4 of 2008 through end of 2020, the current account balance has recorded a surplus for all quarters of 2021.

- Calgary-based PrairieSky Royalty (PSK) announced an agreement to acquire Western Canadian royalty assets from Heritage Royalty for total consideration of $728M. The company also announced a 14.93M share bought deal offering priced at $13.40/share through TD Securities and RBC Capital Markets.

- Cenovus Energy (CVE), which recently closed on its acquisition of Husky Energy, announced it has reached agreements to sell its Husky retail fuels network and the Wembley assets in its Conventional business for combined total cash proceeds of nearly $660M. Parkland (PKI) that owns a large portfolio of service stations including FasGas, announced that it has agreed to acquire ~156 retail locations from Cenovus Energy for total cash consideration of C$156M.

- In U.S. economic news, the ISM Manufacturing Index increased to 61.1 in November, slightly below expectations of a 61.2 reading (levels higher than 50 signal expansion; levels below 50 signal contraction). The major measures of activity were mixed in November, but all above 50, signaling growth. The production index rose to 61.5 from 59.3 in October, and the new orders index increased to 61.5 from 59.8. The employment index rose to 53.3 from 52.0, while the supplier deliveries index fell to 72.2 from 75.6 in October.

- Employment numbers in North America were released on Friday. In Canada, Statistics Canada reported the economy gained 154,000 Jobs in November, much higher than the 40,000 expected. Including the November gain, jobs stand 186K (1%) above pre-pandemic levels. The unemployment rate fell to 6.0% from 6.7% last month, also much better than 6.6% expected. On the flipside, in the U.S. nonfarm payrolls increased by 210,000 in November, following a gain of 546,000 the previous month, much lower than the expected 573,000 gain. Despite the disappointing numbers, the unemployment rate fell to 4.2%.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled Omicron and Powell Pivot: DWYER VLOG

Weekly Diversion:

Check out this video of a cute 11 month old girl snowboarding in China.

Charts of the Week:

Equity markets have displayed a little ping pong action lately, with some wild swings in either direction, at least relative to most of this year, outside of September’s correction, which has been relatively stable. The CBOE Market Volatility Index (also known as the VIX) has skyrocketed from a relatively calm reading in the 15-20 range to reach as high as 32.6 yesterday. Readings under 20 are generally considered periods of low volatility whereas periods over 20 are considered elevated volatility. Readings over 30 are periods of extreme volatility. The S&P/TSX Composite specifically has experienced a rough patch of late, down almost 5.3% as of the close of the markets today, from its all-time high in mid-November. In fact, it was down as much as 6.1% from that high at one point this week, taking it back to levels first achieved in early August. Although the TSX finished the month of November down 1.62%, accounting for its second worst month this year behind September, it is still up over 20% YTD including dividends, and thus, contextually speaking, still produces the longer-term positive trend.

With November behind us, perhaps we can look forward to a more positive set up coming into the New Year. A well-known market seasonal phenomenon called the Santa Claus Rally may generate an increase more than what is considered average/normal during the last week of December and first couple days of January. About two thirds of Decembers dating back to 1960 have led to positive results for investors. One potential explanation for this short-term positive seasonal trend is this Santa Rally. According to the Stock Trader’s Almanac, 39 of the last 50 holiday seasons, which consists of the last five trading days of the year and first two after New Year’s, have been positive, or 76% of the time. The average cumulative return over these days is 1.4%; certainly way above normal.

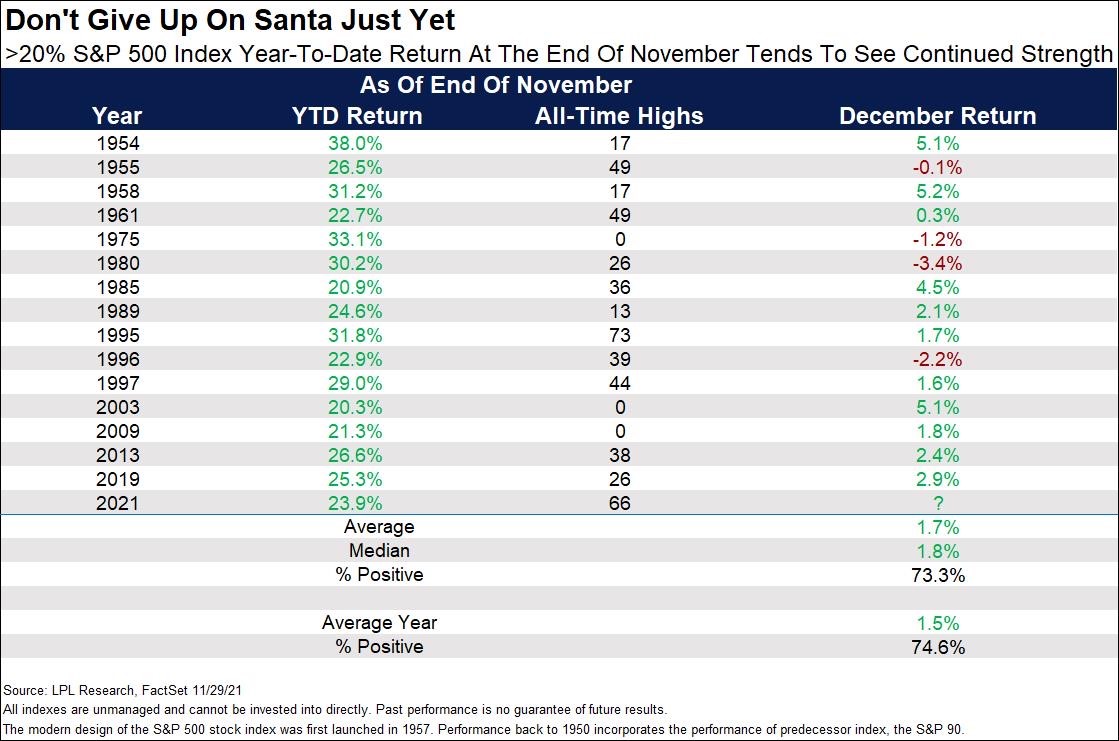

We sure started off December on the wrong foot with markets down significantly, most down more than 1%. However, let’s not give up on Santa just yet. Consider how the S&P 500 has performed in past Decembers when markets have been up over 20% through November, as is the case this year. As the following table illustrates, the final month of the year has been stronger than normal in those past 15 instances going back to 1950 for an average return of 1.7% versus 1.5% for all years. In fact, the S&P500 index has been higher in eight of the past nine times as well, for an average gain of 2.2%. Let’s hope Santa is good to us this year as well.

Source: Ryan Detrick, LPL Research

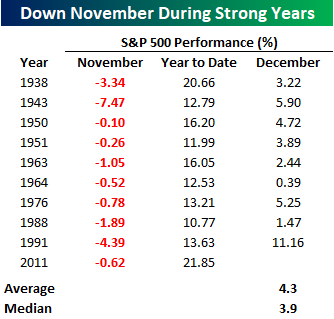

Lastly, examine how December has fared in the past after a poor November for the S&P 500 Index. It fell 0.62% last month. One may think that disappointing numbers - for what has historically been a strong month - is a negative indication for what is to come for December. However, the data simply doesn’t support that when considering how well markets have done on a year-to-date basis. For the S&P 500, this marks the 10th time in its history where the index was down in November after being up more than 10% on a year-to-date basis. The table pictured below lists those past 10 occurrences and how December has consequently performed. Please note, there is a typo on this table; it should be titled 2021 and not 2011 for the most recent year. Notice how December has exhibited growth in 100% of those times for an average gain of 4.3%. That result is drastically above the average return for December, in fact, a shockingly almost three times higher than normal. The last time this expansion happened, 30 years ago, December had a wild 11.2% gain. The last time this situation occurred, with the index up over 20% YTD as it is this year, was way back in 1938 and December still returned 3.2%.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Connected Wealth, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke Investment Group, Wealth Professional, Ryan Detrick, LPL Research