Market Insights: Expect Continued Strength

Milestone Wealth Management Ltd. - Nov 05, 2021

Macroeconomic and Market Developments: North American markets were very strong this week. In Canada, the S&P/TSX Composite was up 1.92%. In the U.S., the Dow Jones Industrial Average increased 1.42% and the S&P 500 Index was up 2.0%. The Canadian

Macroeconomic and Market Developments:

- North American markets were very strong this week. In Canada, the S&P/TSX Composite was up 1.92%. In the U.S., the Dow Jones Industrial Average increased 1.42% and the S&P 500 Index was up 2.0%.

- The Canadian dollar was down this week, closing at 80.33 cents 80.73 cents last Friday.

- Oil prices were lower this week, especially the Canadian crude price. U.S. West Texas crude closed at $81.45 vs $83.57 last week. The Western Canadian Select price closed at $60.05 vs $67.86 last week.

- The price of gold price was higher this week, closing at $1,816 vs $1,783 last Friday.

- The U.S. Federal Reserve met this week and gave their post-meeting announcement after the market closed on Wednesday. The central bank announced a beginning to tapering of their Quantitative Easing program, decreasing QE by $15 billion in November to $105 billion, made up of a $10 billion cut to purchases of U.S. Government Treasury Bonds, and a $5 billion cut to agency Mortgage Backed Securities. The trajectory is to decrease QE by $15 billion/month which would indicate that the program would stop in mid-2022. The market reacted positively to this announcement, with the markets moving higher and the bond markets reasonably stable after the news.

- There has been somewhat of a changing of the guard in the past few weeks. First off, the title of world’s largest publicly traded company has been taken over by Microsoft (MSFT). Apple (AAPL) had been the largest company, but with Microsoft’s impressive 51.25% year-to date rate of return, it now has a market capitalization of US$2.523 trillion vs US$2.482 trillion for Apple. Secondly, Jeff Bezos is no longer the richest person in the world, with Elon Musk’s net worth exploding in the last month. Musk now has an estimated net worth of US$318.4 billion vs US$203.0 for Bezos.

- The U.S. ISM Manufacturing Index declined to 60.8 in October, but beat expectations of a 60.5 level (readings higher than 50 signal expansion; levels below 50 signal contraction). The major measures of activity were mixed in October, but all above 50, demonstrating continued manufacturing growth. The production index fell to 59.3 from 59.4 in September, while the new orders index declined to 59.8 from 66.7.

- The U.S. ISM Non-Manufacturing (Services) index increased to 66.7 in October, blowing past the expected 62.0 (as above, readings above 50 signal expansion; levels below signal contraction). As with the Manufacturing index, all major measures of activity stand above 50, signaling continued growth. The business activity index rose to 69.8 from 62.3, while the new orders index increased to 69.7 from 63.5. The national index has hit its highest level on record, the fourth time it has done that this year.

- In Canada, the IHS Markit Canada Manufacturing PMI (Purchasing Managers Index) came in at 57.7 for October, well above the 50.0 level to indicate growth. This gainis an increase from the 57.0 reading in September and marks 16 straight months of expansion.

- It was a busy week for earnings of Calgary-based oil and gas companies. Cenovus Energy (CVE) released earnings, beating estimates on both cash flow and production, with net income of $551 million or $0.27/share for Q3 2021. The company also announced that it is doubling its dividend, initiating a share buyback plan and continuing with its debt payback plan. Canadian Natural Resources (CNQ) reported Q3 cash flow of $3.07/shares vs expectations of $2.97 with revenue of $7.71 billion, up from $4.5 billion in the third quarter of 2020, and Daily average production of 1,237,503 barrels of oil equivalent per day, up from 1,111,286 a year ago. And Tourmaline Oil (TOU) reported Q3 cash flow of $2.32/share vs $2.21 expected, with revenue of $1.21 billion; more than double the year-ago revenue of $518.1 million.

- Friday was jobs day in North America. In Canada, the economy added 31,200 jobs in October, just missing estimates of a 41,600 job gain. The Canadian unemployment rate edged lower to 6.7% from 6.9% reported last month. In the U.S., Nonfarm payrolls increased by 531,000 in October, beating the estimate of 450,000. The unemployment rate fell to 4.6% from 4.8% the prior month, beating expectations of a 4.7% rate. In addition, payroll gains for August and September were revised up by a total of 235,000, bringing the net gain, including revisions, to 766,000. Average hourly earnings rose 0.4% and are now up 4.9% from a year ago.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled Strong Years Typically Get Stronger: DWYER VLOG

Weekly Diversion:

Check out this video of kangaroos invading a golf course.

Charts of the Week:

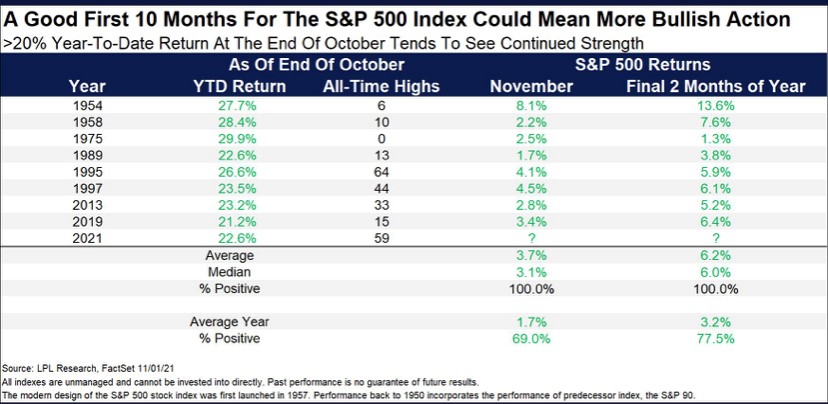

In the same theme as the video above titled Strong Years Typically Get Stronger, here are tables of both the Canadian and U.S. stock markets that show how they have performed in the past after a favorable first 10 months, specifically up over 20% for the year. Although past performance is not always indicative of future results, history does say to stay long after strength.

When the S&P/TSX Composite has been up greater than 20% for the year heading into November, it has only once declined in November, and it has never been lower over the final two months. That equates to seven out of eight in November, up an average of 4.9% vs 1.6% for all years. The final two months have been up 6.3% on average vs. just 3.6% for all years.

Source: Meng Gao, Canaccord Genuity

If we shift over to the S&P 500 Index, when it has been up greater than 20% for the year heading in November, it has never declined in November or the final two months. That is a perfect record in November, up an average of 3.7% vs. 1.7% for all years, and the final two months have been up 6.2% on average vs. only 3.2% for all years.

Source: Ryan Detrick, LPL Research

This is all pretty impressive, but it is also worth noting that November is actually historically the best month of the year for the S&P 500 since 1950 and also the past decade. For the past 20 years, and in post-election years like this year, it has been the second best month.

Source: Ryan Detrick, LPL Research

We will finish with a chart of the Value Line Geometric index breaking out to a new all-time high this week, the first time in five months. This is an important index because it shows that the current strength in markets is very broad, and not just isolated to large caps or certain sectors like technology. As opposed the S&P 500 Index or Dow Jones Industrial Average, which are market-weighted large-cap indices, this index contains about 1,700 stocks that are equally weighted. It uses a geometric average, so the daily change reflects the median stock price change. In other words, it provides a more accurate and broader representation of the overall stock market. This breakout to new highs for the broader market does not mean it will keep going higher, but this peak is certainly a very positive sign overall.

Source: Steven Strazza, All Star Charts

Sources: CNBC.com, Globe and Mail, Financial Post, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, LPL Research, All Star Charts