Market Insights: S&P/TSX Composite Hits New All-Time High

Milestone Wealth Management Ltd. - Oct 15, 2021

Macroeconomic and Market Developments: North American markets were strong this week. In Canada, the S&P/TSX Composite Index was up 2.51%, closing at a new all-time high. In the U.S., the Dow Jones Industrial Average was increased 1.58% and the S&P

Macroeconomic and Market Developments:

- North American markets were strong this week. In Canada, the S&P/TSX Composite Index was up 2.51%, closing at a new all-time high. In the U.S., the Dow Jones Industrial Average was increased 1.58% and the S&P 500 Index was up 1.82%.

- The Canadian dollar continued its uptrend this week, closing at 80.82 cents vs 80.18 cents last Friday.

- Oil prices were strong again this week. US West Texas crude closed above $80 for the first time since 2014 at $82.29 vs $79.35 last week. The Western Canadian Select price closed at $67.41 vs $66.50 last week.

- Gold prices were up slightly this week, closing at $1,767 vs $1,757 last Friday.

- Canada’s Dorel Industries has reached an agreement to sell Dorel Sports, which is its bicycle segment including popular brands like Schwinn, Mongoose and Cannondale, to Netherlands-based Pon Holdings B.V. for US$810 million in cash. This transaction lifted Dorel’s stock price by 102.4% on Tuesday.

- Canadian company Neo Lithium (NLC) is being purchased by Zijin Mining Group Co for a price of $6.50/share in cash. The total cash consideration for all of the outstanding equity of Neo Lithium is approximately $960 million. The buyout price is 18.4% above the previous day’s closing price.

- U.S. banks kicked off earnings season this week. On Wednesday, JP Morgan (JPM) beat estimated earnings with $3.74/share vs. $3.00/share expected, and revenue of $30.44 billion vs $29.8 billion estimated. On Thursday, Bank of America (BAC) released earnings of $0.85/share vs the $0.71 estimates and revenue of $22.87 billion vs the $21.8 billion estimate, Citigroup (C) beat estimates with $2.15/share vs $1.65 expected on $17.15 of revenue vs $16.97 expected, and Morgan Stanley (MS) also beat estimates with earnings of $1.98 vs $1.68 expectations on $15.75 billion revenue vs $14.0 billion expected. Goldman Sachs (GS) crushed estimates on Friday, with earnings of $14.93/share vs. $10.18 estimated and revenue of $13.61 billion vs. $11.68 billion estimated.

- Inflation proved to still be running hot with the U.S. Consumer Price Index (CPI) data released this week showing a 0.4% increase for the month of September compared with estimates of 0.3%. Year over year, the CPI is up 5.4% vs the 5.3% expected. However, the core CPI, which excludes volatile food and energy prices, came in slightly below expectations with an increase of 0.2% for the month and 4.0% for the past year.

- U.S. retail sales (large portion of GDP) for September rose 0.7%, easily beating consensus expected decline of 0.2%. Retail sales are now up 13.9% versus a year ago. In addition, August’s gain of 0.7% was upwardly revised to 0.9%. Retail sales are now up 18.9% versus February 2020 (pre-COVID). In other words, due to temporary government support, retail sales are running much hotter than they would have in the absence of COVID, even as the level of output (real GDP) is still running lower than it would have been in the absence of COVID.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled The Issues are Real - so is the Discounting: DWYER VLOG

Weekly Diversion:

Check out this video of a house designed specifically for cats.

Charts of the Week:

We have seen some positive signs with equity markets this week, with the S&P 500 breaking its downtrend of lower highs since early September and the S&P/TSX Composite making a new all-time high today thanks to strength from the energy, financial and industrial sectors which combined make up 57% of the index. Underlying breadth metrics for the TSX, like the cumulative advance/decline line, have been a bit underwhelming. This important breadth metric has yet to confirm this new high for the TSX, but we will continue to monitor for any other divergences.

This week we thought we would compare current patterns in the market to prior periods to see if there are any similar patterns.

"It is not worthwhile to try to keep history from repeating itself, for man's character will always make the preventing of the repetitions impossible." -Mark Twain

This logic has also been similarly quoted by Winston Churchill, George Santayana and many others. As we have said many times in past comments, while history rarely repeats itself, it very often rhymes. We often show the history of certain indicators or patterns in these weekly commentaries, and analyze what happened after those occurrences with the objective to potentially provide a framework for what may occur next this time around, or at least somewhat improve the probability of that forecast.

Last week, we crossed the 200th trading day of the year so let us examine past years for the S&P 500 Index to see which years were most closely correlated to 2021. In our industry, correlation is a statistic that measures the degree to which two securities (but for our purpose today, the same index but different years) move in relation to each other, with a value that falls in between -1 and +1 with 0 being no correlation, -1 being perfectly uncorrelated and +1 being perfectly correlated.

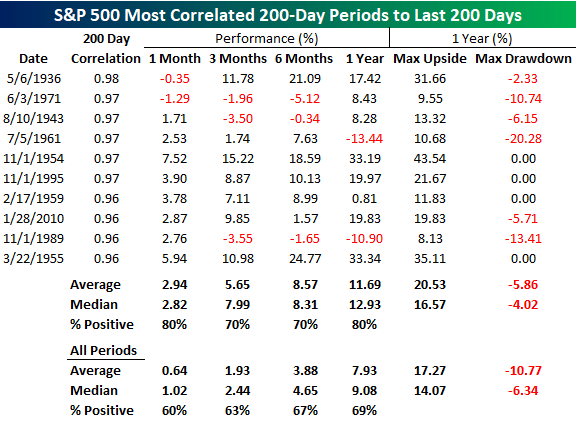

The table below shows a list of the 10 highest correlated years when compared to 2021. All of these have had a correlation coefficient of 0.95. When we look at these instances in isolation, the forward-looking returns have been well above average for all periods which is very positive. In addition, the average maximum upside and drawdown were markedly better than average for all periods. However, we should definitely take these examples with a grain of salt as many of the years in this analysis are from a very long time ago, in fact, eight of them being 50 or more years ago. Only 1989 and 2010 are even remotely recent. If we look at 1989, its forward-looking returns were very week. The most recent highly correlated year to 2021 was 2010. Its forward-looking returns were very strong over the next three months, but quite week from month three to month six, but then the one-year forward return was very strong, more than double the average for all periods.

Source: Bespoke Investment Group

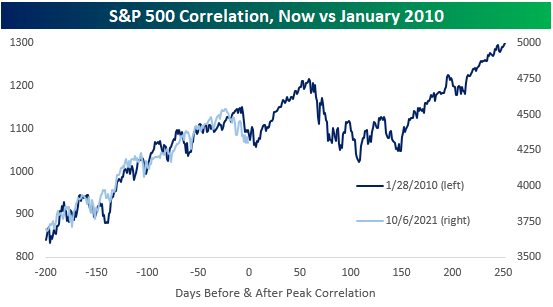

To isolate the most recent highly correlated year, here is a chart showing how the S&P 500 Index has performed the last 200 days (light blue line), with a superimposed chart of 2010 (dark blue line) showing the same previous 200 days from the point of maximum correlation, plus the following one-year period. So far, it is tracking it quite nicely:

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust, Bespoke Investment Group