Market Insights: Third Quarter Wrap-up

Milestone Wealth Management Ltd. - Oct 08, 2021

Market Update Global equity markets started the third quarter brightly where the second ended, confidently charting a course forward. By the end of August, equities had notched a seventh straight month of gains, with the S&P 500 Index finishing near

Market Update

Global equity markets started the third quarter brightly where the second ended, confidently charting a course forward. By the end of August, equities had notched a seventh straight month of gains, with the S&P 500 Index finishing near its all-time high and the TSX Composite Index on its longest monthly winning streak in four years.

After the summer slumber, market volatility once again reared its ugly head in September. While it caught some off guard, the past 20 years of historical returns show that September has typically resulted in the worst month-over-month showing for the S&P/TSX, with an average return of -1.3%. Markets dipped in September on heightened uncertainly and several risk-related events, primarily the prospect of quantitative easing (QE) tapering, elevated inflationary pressures, the fourth COVID wave, and slowing economic growth, before finishing Q3 almost exactly where it started.

The U.K.’s Freedom Day, celebrating the reopening of its economy, went ahead on July 19. Developments in the U.K. are seen as a potential leading marker for the reopening of other western economies. Shortly after, the Canadian federal government unveiled a roadmap to reopen its borders. On August 9, vaccinated Americans were allowed to visit again, and from September 7 vaccinated travelers from other countries. The third quarter also witnessed an historic monetary development as El Salvador became the first nation to adopt bitcoin, the most popular cryptocurrency, as legal tender.

The Fed left U.S. interest rates in the near zero range but indicated it would begin winding down its US$120 billion monthly government bond buying stimulus by year-end. U.S. inflation, although cooling, rose 5.3% over the same period last year, driven by COVID-19 infections impacting economic growth with related shortages of labor and supplies affecting prices. The Fed reiterated it saw no immediate need to raise rates as this recent inflation spike was temporary. However, it signaled rates might start increasing sooner than previously planned – possibly by late 2022.

The Bank of Canada also held interest rates at 0.25% saying it expects the economy to strengthen throughout the second half of the year. The bank warned supply chain bottlenecks and rising COVID-19 cases could slow the pace of the recovery though. The bank continued with its bond buying program but scaled back purchases to about C$2 billion per week. Canadian inflation went north as well. Inflation rose 4.1% in August compared to year ago, the highest since 2003. The Bank of Canada has regularly stated it would intervene should inflation come in persistently above its 2% target but noted the current bout of inflation was likely transitory.

For the year to date, the S&P/TSX Composite Index increased 17.5%, the S&P 500 Index rose 15.9% and the MSCI EAFE Index was up 8.2%, on a total return basis. The S&P/TSX Composite Index ended the quarter up 0.17%, led by the Financials (31.9% weight), Energy (13.1%) and Information Technology (11.5%) sectors. The S&P 500 Index posted a 0.58% quarterly return, while the MSCI Europe Asia & Far East (EAFE) Index was also in positive territory with an 1.95% return.

In Canada, our top six banks also posted strong quarterly earnings that easily beat analyst expectations. Overall, approximately a fifth of TSX-listed companies and a third of S&P 500-listed companies reported handsome corporate results during the quarter, including some of the biggest tech names.

Fixed income markets remained mostly calm and U.S. treasury yields steady on the Fed’s reassuring comments about its bond tapering plans, a potential rate hike next year and the current inflation spike being temporary. The treasury yield curve flattened in the first half of the third quarter; however, in the second half we have once again seen a spike in long-term interest rates on renewed inflation concerns.

Outside of cryptocurrencies, the biggest mover this year in risk assets has been the energy markets, with WTI Crude prices up 56% this year and Henry Hub natural gas prices up a whopping 114%. The latter recently reached a price of $6.47 (USD/million BTU), matching the February 2014 high within a couple cents, and the highest since 2008 when it peaked out at over $13. We have also seen a resurgence in the price of uranium, starting the year around $30/LB and moving up as high as $55 this year at one point. On the other hand, precious metals have been under pressure with gold and silver down 7% and 18% respectively this year. This is not a surprise to us as gold tends to underperform during reflationary periods.

In foreign exchange markets, the Canadian Loonie appreciated against the U.S. dollar and other G10 currencies due to rising oil prices and the Canadian federal election outcome. Oil prices surged following the threat of Hurricane Nicholas in the U.S. gulf and depleting U.S. crude inventories before declining on Russian plans to increase exports.

Milestone Strategy and Outlook

The outlook for the North American economy is robust and supportive of equity markets. We see firm evidence that our economy is in the early-/mid-phases of the business cycle, which has been historically beneficial for the performance of most risk assets. Uncertainties remain high but cause for concern remains low. We raised cash across our mandates prior to the September dip and added to some pockets of real assets where we see opportunities, both of which panned out well so far. We now look to leverage periods of weakness in equity markets to add to high-quality positions as our long-term positive fundamental thesis remains positive.

As the pandemic recedes from view, the accommodative monetary policies of major central banks are beginning to be pared back so it is natural that we might experience some near-term setbacks and volatility as market conditions shift. Last week Norway became the first developed country to hike interest rates, and here, the Bank of Canada has cut its asset purchases in half. In the U.S., it is anticipated that the Fed will announce their own tapering of asset purchases in November. This proposed reduction has stoked some worry of a 2013 Taper Tantrum replay; however, we do not believe that will be the case this time. Firstly, tapering is not parallel to the tightening that took place in 2013. The Fed will still be adding to its balance sheet, just at a reduced rate. In other words, a slower pace of easing as opposed to outright tightening, an important distinction.

In our view, it is unlikely that the Fed will start to raise interest rates until late 2022 or early 2023. And then another year or two after that for interest rates to become restrictive. It will then potentially be even longer for the lagged effects of the unprecedented amount of stimulus to fully work its way through our economies. The pace of growth will likely be slower, but this is understandable as we are now coming off a record breaking post-COVID economic growth. Overall, the outlook remains positive, driven by strong economic fundamentals and corporate earnings.

Last quarter we discussed the extremely high savings rate in North America and the incredible amount of cash still on the sidelines. A good portion of the unprecedented amount of stimulus has yet to make its way through the economy. This pent-up demand is shown by the fact that U.S. households are currently sitting on $2.4 trillion of excess savings (above pre-pandemic levels), equivalent to 14% of annual consumption. We continue to believe this to be a tailwind for economic and earnings growth. Due to its strong correlation, we believe the main reason for this cash not being spent yet is a lack of consumer confidence which remains below pre-pandemic levels. However, as households continue to recover, spending should hold up well.

We expect inflation to remain elevated as we head into 2022. However, we expect a large portion of the pressures that are causing inflation to run above trend will moderate as several transitory elements (e.g., supply chain issues, commodity pressures, elevated demand, etc.) should gradually reduce over the next year. This relaxation could keep inflation within the Bank of Canada and U.S. Federal Reserve’s long-term target range and result in a continuation of accommodative conditions, albeit somewhat less than the last few quarters. However, we recognize the risk to inflation staying higher for longer and have geared our portfolios with a tilt toward this probability, at least in the near-term.

Global growth has very likely peaked, as we referenced in our last quarterly commentary, but from very high levels. According to Bloomberg consensus estimates (see table below), real GDP in the G7 rose by 6.0% in Q3, down from 6.8% in Q2. G7 growth is expected to soften to 4.9% in Q4. However, not all countries have reached peak growth. Japan is projected to see faster growth in Q4. Canadian growth should pick up from 4.5% in Q3 to 5.8% in Q4. Across almost all the major economies, growth should remain at an above-trend pace in 2022. G7 growth is expected to hit 4.1%, well above the trend rate of 1.4%. Usually when growth peaks, investors start to worry that a recession is around the corner. Given that growth is coming down from exceptionally high levels, this sharp decline is not, in our opinion, a major risk at the moment.

Source: BCA Research

Most countries are easing lockdown measures. There are now 3.5 Billon people worldwide, or 45% of the world’s population, have received at least one vaccine. While vaccinations in emerging markets have been problematic, primarily due to lack of availability, this access too is improving as can be seen in India for example, now vaccinating 7.5 million people per day. In addition, recent breakthroughs such as Merck’s pill that studies have shown reduces the risk of hospitalization from COVID by 50% is adding to the more promising outlook. Globally, the number of daily cases has now gone from 750,000 per day in August to 450,000 today.

For Canada, given that 75% of the population have received at least one dose of an approved COVID-19 vaccine, the economic impact from new restrictions/lockdowns has so far been minimal. The evidence points to an increase in infections with no commensurate effect on hospitalizations and fatalities, which reduces the odds of renewed measures that would restrict economic activity.

With long-term interest rates, as represented by the U.S. 10-year Treasury yield, rising this year from under 1% to over 1.5% today, our firm’s 2021 fixed income strategic positioning of lower duration, higher yielding corporate credit, with added components of preferred shares and private debt has proven to be our strongest source of relative outperformance this year. We expect the trend of higher long-term interest rates to be with us for a while longer; however, as the transitory inflationary effects subside, long-term rates will likely also stop rising.

Lastly, it is important to note that our positive core fundamental thesis is centered on the direction of earnings, because equity markets correlate mostly to the direction of earnings per share (over 0.90 correlation factor), not the rate-of-change. This principle means that absent a credit-based recession which we view as extremely low at this point, any market correction/consolidation caused by slowing in the second derivative of stimulus measures and economic growth rate should prove temporary.

Regardless of where we are in the market cycle, it is important to take a disciplined approach to investing and stay focused on one’s long-term financial goals. This strategy helps us keep our emotions out of investing. We recommend maintaining a diversified mix of asset classes, including allocations to real assets and alternative strategies, to maximize potential returns and minimize risk. Regularly reviewing and rebalancing your portfolio back to the target asset mix also ensures it remains aligned with your goals.

Thank you for your continued trust in Milestone as we navigate the tides ahead, and for the opportunity to assist you in working toward your financial goals. We are with you every step of your investment journey, identifying strategies and opportunities, reviewing performance, and rebalancing your portfolio to help you remain on track. Should you have any questions regarding your portfolio, please do not hesitate to contact us.

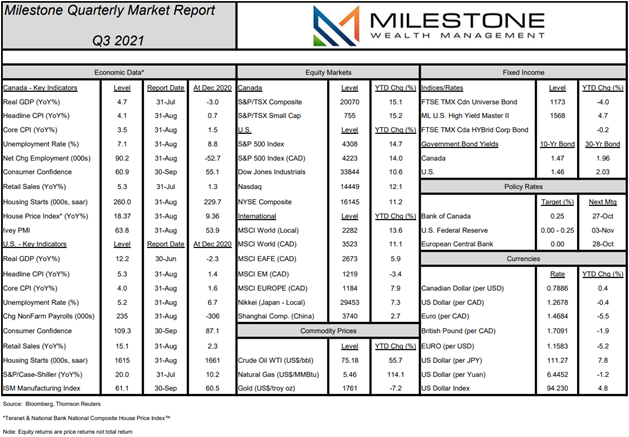

Here is our Milestone Market Report on economic data, capital markets, commodities, and currencies through September 30th: (click image for PDF version)

Sources: BNN Bloomberg, Thomson Reuters, Refinitv, CI Global Asset Management, Teranet & National Bank of Canada, CNBC, Globe & Mail, National Post, Bank of Canada and Statistics Canada, Wall Street Journal, BCA Research.