Market Insights: S&P 500 Earnings Bonanza

Milestone Wealth Management Ltd. - Aug 13, 2021

Macroeconomic and Market Developments: North American markets were positive this week. In Canada, the S&P/TSX Composite Index was up 0.21%. In the US, the Dow Jones Industrial Average was up 0.87% and the S&P 500 Index up 0.72%. The Canadian dollar

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index was up 0.21%. In the US, the Dow Jones Industrial Average was up 0.87% and the S&P 500 Index up 0.72%.

- The Canadian dollar finished up slightly, closing at 79.89 cents vs 79.62 cents last Friday.

- Oil prices were mixed this week. US West Texas crude was down slightly, closing at $67.94 from $68.12 last week, and the Western Canadian Select price was up, closing at $55.23 vs $54.49 last week.

- Gold prices shrugged off a ‘flash crash’ early this week, recovering to finish higher this week, closing at $1,778 vs $1,763 last Friday.

- This week kicked off with a flurry of blockbuster deals. Ritchie Brothers Auctioneers (RBA) agreed to acquire Euro Auctions for a total enterprise value of £775 million in cash (approx. $1.08 billion). Secondly, Brookfield Asset Management Reinsurance Partners is acquiring American National Group (ANAT) for $190.00/share in cash, a 10% premium to the Friday closing price of $172.80. And thirdly, Canada’s WPT Industrial Real Estate Investment Trust (WIR.un) is to be acquired by Blackstone REIT for US$22.00 per unit in an all-cash transaction.

- On Tuesday, CP Rail (CP) announced that it has submitted what it believes to be a superior proposal to acquire Kansas City Southern. The new offer is a stock and cash transaction representing an enterprise value of ~USD$31 billion, valuing the KCS shares at $300/share. Whereas the takeover price is actually lower than the current offer from CN Rail (CNR), the company believes that its bid is superior as it offers more regulatory certainty that the deal can get completed. The board of KCS responded by rejecting CPs lower offer as inadequate.

- The US Senate this week passed a $1 trillion bipartisan infrastructure bill as Democrats move ahead with their economic agenda. The chamber will next move to approve a budget resolution that would allow Democrats to approve their $3.5 trillion spending bill without Republican votes.

- US inflation data was released this week. On Wednesday, the Consumer Price Index (CPI) showed an increase of 0.5% in the month of July, matching expectations, and up 5.4% from a year ago. Energy prices increased 1.6% in July, while food prices increased 0.7%. The "core" CPI, which excludes food and energy, rose 0.3% in July, slightly below the expected 0.4%, and up 4.3% versus a year ago. And on Thursday, the Producer Price Index (PPI) numbers showed an increase of 1.0% for the month of July, well above the consensus expected 0.6%, and up 7.8% versus a year ago. Energy prices rose 2.6% in July, while food prices declined 2.1%. Producer prices excluding food and energy increased 1.0% in July and are up 6.2% in the past year.

- Disney (DIS) surprised the market with an earnings beat on Friday, helped by a rebound in its theme park business and stronger-than-expected growth for its Disney+ streaming service. The company reported earnings per share of 80 cents on $17.02 billion in revenue compared with estimates for 55 cents in earnings per share and $16.76 billion in revenue.

- Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled Updated Thoughts on Rates and Rotation: DWYER VLOG

Weekly Diversion:

Check out this video of the lesser-known Squirrel Olympics.

Charts of the Week:

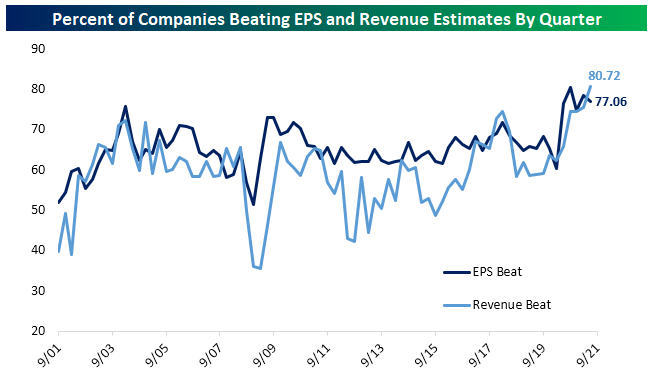

The US quarterly corporate earnings season is getting close to the finish line, with more than 80% of S&P500 companies having now reported. The next two charts show how remarkable this earnings season has been. A shocking 80.72% of companies so far have exceeded revenue estimates and 77.06% have beat earnings estimates. But if you thought that maybe the best is behind us, Corporate America seems to disagree. In the second chart you can see that future guidance from corporations has actually been very impressive, with 20.05% increasing forward guidance and only 3.66% warning of lower results going forward. So all in all, a very impressive earnings season so far.

Source: Bespoke Investment Group

However, it is interesting that the stock prices of those companies aren’t necessarily getting a big lift from such good results. This chart shows how muted the reaction is of stock investors to positive earnings surprises and even positive future guidance. Perhaps the market was overly optimistic coming into this round of quarterly earnings.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust Advisors, Bespoke Investment Group