Market Insights: Peak Inflation?

Milestone Wealth Management Ltd. - Jul 16, 2021

Macroeconomic and Market Developments: North America markets were down this week. In Canada, the S&P/TSX Composite Index declined 1.19%. In the US, the Dow Jones Industrial Average was down 0.52% and the S&P 500 Index dropped 0.97%. The Canadian

Macroeconomic and Market Developments:

- North America markets were down this week. In Canada, the S&P/TSX Composite Index declined 1.19%. In the US, the Dow Jones Industrial Average was down 0.52% and the S&P 500 Index dropped 0.97%.

- The Canadian dollar fell again this week, closing at 79.27 cents vs 80.35 cents last Friday. It is now down 1.7% in June and down 4.3% since the end of May.

- Oil prices were lower again this week, with US West Texas crude finishing at $71.51 vs $74.56 last week for a 4.1% decline, and the Western Canadian Select price at $58.15 vs $61.84 last week.

- Gold prices were up slightly this week, closing at $1,815 vs $1,811 last Friday.

- On Monday, the Alberta Securities Commission ruled that Brookfield Infrastructure’s bid for Inter Pipeline (IPL) must get at least 55% of the shareholders to accept their offer, not including the shares they already own. This provision will make it more difficult for Brookfield to emerge as the successful buyer in its bidding war with Pembina Pipeline. Subsequently, on Thursday Brookfield announced its intent to revise its offer to C$21.23/share in cash and stock. Under the new terms, IPL shareholders may elect up to 100% cash totalling C$20.00/share of IPL without being subject to proration or 0.250 of a class A exchangeable subordinated voting share. This compares to their previous offering of $19.50 in cash or 0.225 of a BIPC share.

- On Tuesday, US inflation data was released for June, showing the Consumer Price Index increased 5.4% from a year ago; the biggest monthly gain since July 2008. Excluding the volatile components of food and energy, core inflation increased 4.5%, the largest move since September 1991. Used car and truck prices comprised about one-third of the total CPI increase.

- OPEC+ reached a deal on output quotes on Wednesday. The United Arab Emirates and Saudi have agreed to a higher output cap for the UAE. The remainder of OPEC+ will need to vote on the deal at a future meeting. This led to the price of oil easing back from its highest levels reached last week.

- On Wednesday, the Bank of Canada announced its latest decision on interest rates and Quantitative Easing. The central bank held its benchmark rate unchanged at 0.25% as expected and also reduced the QE program to $2 billion in weekly bond purchases, which was in line with estimates. The BoC expects GDP growth of 6% in 2021, lower than April's estimate due to the third wave of COVID-19, but revised its 2022 forecast to 4.5% and 3.25% in 2023.

- U.S. retail sales unexpectedly increased in June, posting an increase of 0.6% last month compared with expectations for a drop of 0.4%. Core Sales, which excludes volatile categories of autos, building materials and gas stations, rose 1.3%, also well above consensus expectations. On the flipside, data for May was revised downwards with retail sales falling 1.7% instead of 1.3% as previously reported. Impressively, retail sales are now up 18.2% (core sales up 16.5%) versus February of 2020, which was pre-COVID.

- Here is a good summary in charts of the first half of this year.

- US Investment company First Trust has created a COVID Recovery Tracker. Click here: RECOVERY TRACKER

Weekly Diversion:

Check out this video summarizing Richard Branson’s space flight last weekend.

Charts of the Week:

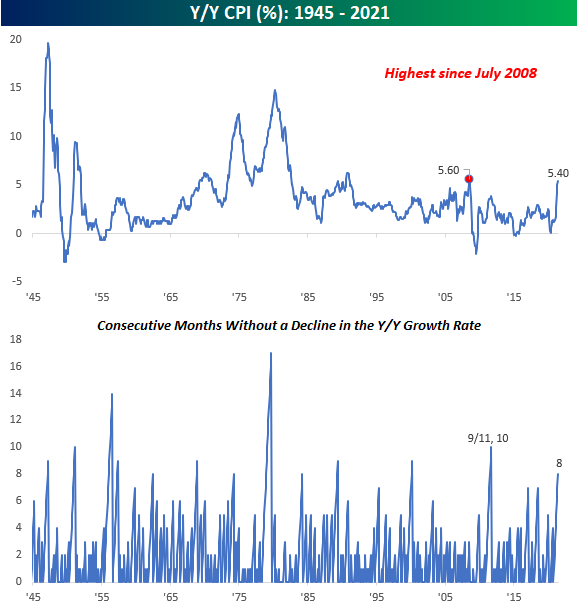

As noted above, year-over-year headline inflation for June (+5.4%) rose at its fastest rate since July 2008 and - before that - 1991. The term “peak inflation” seems to be the topic du jour right now with economists and strategists. Some view the recent rise in inflation and interest rates as merely transitory, while others view some longer-term effects. We highlight some of our views on this in our Second Quarter Wrap-Up posted to our Milestone Wealth Newswire blog earlier this week; please visit for more details.

This week’s charts show just how high the current level is, near the peak rate in 2008, but outside of that the highest in 30 years. What is also notable is that the yearly pace has not declined in eight straight months, which is the longest such streak in 10 years, so the uptick in CPI has been persistent as the base effect from last year’s decline in CPI were in favor of larger increases. Other than 2011, you have to go back to one period in the late 90s and one in the late 80s for a streak as long as the current one. If you look back to 2020, the low point for inflation was May and then in June it increased 0.5%, so this month’s report was actually the first year-over-year reading that wasn’t looking back at a period of declining CPI. Therefore, this report is now becoming more important, as the comparable numbers from a year ago are no longer in decline as they have in prior months, so the inflation reports in the coming months will certainly be closely watched by the marketplace. Any continuation of these historically high readings against more difficult comps would likely raise investor concerns.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, First Trust Advisors, Bespoke Investment Group