Market Insights: Uranium Rally to Power Ahead

Milestone Wealth Management Ltd. - Jun 04, 2021

Macroeconomic and Market Developments: North American equity markets were positive this week. In the US, the Dow Jones was up 0.66% and the S&P 500 Index increased 0.62%. In Canada, the S&P/TSX Index was up 0.85%, finishing above the 20,000 mark for

Macroeconomic and Market Developments:

- North American equity markets were positive this week. In the US, the Dow Jones was up 0.66% and the S&P 500 Index increased 0.62%. In Canada, the S&P/TSX Index was up 0.85%, finishing above the 20,000 mark for the first time ever.

- The Canadian dollar was flat this week, closing at 82.79 cents vs 82.80 cents last Friday.

- Oil prices were strong again this week, with West Texas crude finishing at US$69.40 vs US$66.30 last week, and the Western Canadian Select price at ~$54.90 vs ~$52.25 last week.

- Gold prices dropped this week, closing at ~$1,892 compared with ~$1,904 last Friday.

- On Tuesday, Pembina Pipeline (PPL) and Inter Pipeline (IPL) announced that they have entered into an agreement for Pembina to acquire all of the outstanding shares of Inter Pipeline in a share-for-share transaction, which values Inter Pipeline shares at ~C$8.3B, or C$19.45 per share, based on the closing price of Pembina's common shares on the previous day’s close. This offer trumped the previous unsolicited takeover offer from Brookfield Infrastructure Partners (BIP.UN) earlier this year. In response, Brookfield announced that it intends to increase its offer to $19.75/share; however, the board of Inter Pipeline still unanimously recommends the offer from Pembina.

- Also, this week Chevron (CVX) said it would consider selling its 20% stake in Canadian Natural Resources' (CNQ) oil sands mine according to Bloomberg. Chevron’s CEO Michael Wirth notes the company's stake in the Athabasca oil sands project generates pretty good cash flow without needing much capital, but he would not deem it a strategic position.

- In Canadian economic news, Canadian Q1 GDP rose 5.6%, which was below consensus of 6.8%, with March's GDP coming in at 1.1%. The agency noted that April's GDP early estimate shows a 0.8% decline. Also, Statistics Canada noted Canada's current account balance posted a $1.2B surplus in Q1, lower than consensus estimates of $2.6B, after recording a $5.3B deficit in the fourth quarter.

- In May, an index of the growth rate in the US Service Sector hit the highest level on record going back to 1997, as the US economy continued to benefit from the end of lockdowns and other economic restrictions around the country. The ISM Non-Manufacturing index increased to 64.0 in May, beating the consensus expected level of 63.2 (levels above 50 signal expansions, levels below signal contraction). The major measures of activity were mixed in May, but all stand above 50, signaling growth.

- May jobs numbers were released in North America on Friday. The Canadian economy lost 68,000 jobs in May, much more than the average estimates of a 20,000 loss. The unemployment rate increased to 8.2%. In the US, their economy saw an increase of 559,000 jobs, lower than the 671,000 estimated, with the US unemployment rate falling to 5.8%.

-

Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled 'In Confused Market - Do No Harm': DWYER VLOG

- For a deeper dive, the US investment company First Trust has put out a US COVID-19 Tracker. Click here: COVID TRACKER

- In addition, First Trust has created a COVID Recovery Tracker. Click here: RECOVERY TRACKER

Weekly Diversion: Check out this amazing footage of a California girl pushing a bear off a fence to save her dogs.

Chart of the Week:

We are taking a bit of a detour this week from what you normally see or hear in the media. Uranium. We think for many, with oil & gas prices pushing higher, and with electric cars and solar, wind and hydro power taking front seat in recent memory, one would be forgiven about forgetting what may be the strongest and cleanest power source around, nuclear energy. All energy sources have their pros and cons, but one could argue that uranium and nuclear energy could have the best pro to con ratio. Although electric vehicles have a lower carbon footprint than gasoline-powered, the one argument against the electric car revolution is that it needs to be powered by electricity supplied by the electric grid, which in turn is still powered mostly by fossil fuels. According to the US Energy Information Administration (EIA), as of 2020 in the US, utility-scale electricity generation is 60% sourced from fossil fuels with only 18% from wind, hydro and solar. Coal, considered the ‘dirtiest’ energy source, still powers 20% of US electricity. This has been improving with more electricity being powered by solar panels and wind/hydro technologies, and we have also seen much improvement in battery storage. Another challenge is the material used in batteries and the bigger issue of how to recycle it. Again, these things are improving, but we a still a long way from this being anywhere near a con-free solution.

Uranium could potentially be a very important source of energy going forward as the technology has dramatically improved with regards to smaller scale nuclear plants and safety. Nuclear is a zero-emission clean energy source. It is also a very powerful source of energy. It generates power through fission, which is the process of splitting uranium atoms to produce energy. The heat released by fission is used to create steam that spins a turbine to generate electricity without the harmful by-products emitted by fossil fuels. According to the Nuclear Energy Institute (NEI), “the United States avoided more than 476 million metric tons of carbon dioxide emissions in 2019 through the nuclear industry. That is the equivalent of removing 100 million cars from the road and more than all other clean energy sources combined. It also keeps the air clean by removing thousands of tons of harmful air pollutants each year that contribute to acid rain, smog, lung cancer and cardiovascular disease.” Another benefit of nuclear power is a smaller land footprint. According to the NEI, solar photovoltaic plants and wind farms require 75 and 360 times, respectively, more land area to produce an equivalent amount of energy as a 1000-megawatt nuclear facility. The last main benefit of nuclear power is minimal waste; as it is an extremely dense energy source, you need very little to produce a lot of energy. The NEI says that all the nuclear fuel used by the US over the last 60 years could fit on a football field at a depth of less than 10 yards. The waste can also be reprocessed and recycled; however, the US does not currently do this. We are seeing new and improved technologies in this area advancing clean energy systems in this respect. Likely the only con for this source of energy is safety, and this has continually been the response of policymakers. However, the data shows that the risk of nuclear power plants is far smaller than generally perceived.

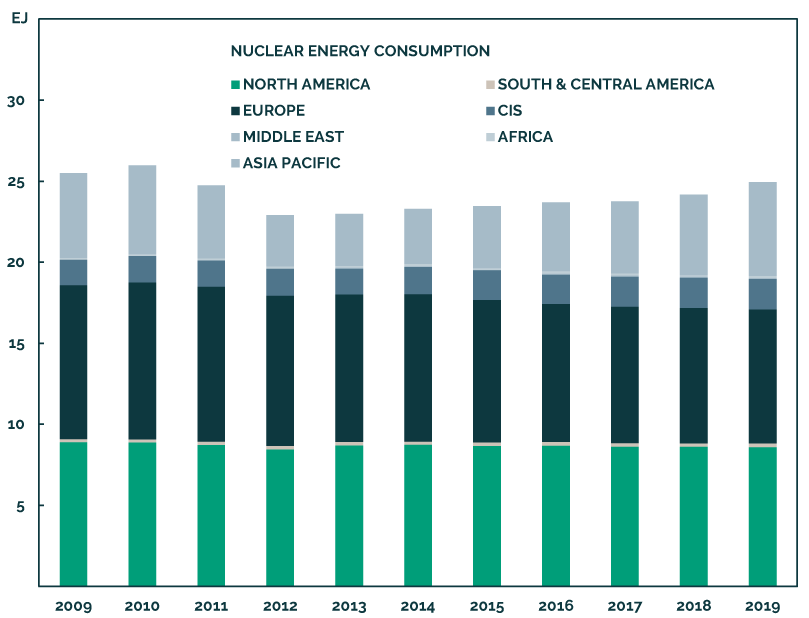

In terms of nuclear energy consumption, we saw a sharp decline following the 2011 Fukushima nuclear accident, but it is once again growing steadily. The BP Statistical Review’s latest data shows that global nuclear energy consumption was up 3.2% in 2019, above the -0.7% average in the past decade. This has mostly been driven by the Asia Pacific region, not by the US, with a 16.4% year over year increase. We believe this trend is likely to continue with the global push towards low-carbon economies. Data from the International Atomic Energy Agency (IAEA) shows that 52 reactors are currently under construction worldwide. Although there seems to be a bullish outlook for nuclear energy, the price of uranium, a critical ingredient in its power generation, remains relatively depressed. Even with a 30% increase since March of last year, the price of uranium futures traded on the NY Mercantile Exchange is $31.30/lb as of June, far below the $100/lb price back in 2007, prior to the Fukushima accident. However, market fundamentals are suggesting that upside price pressures should continue with rising demand, while supply has been declining since 2016 and unable to meet this demand. Our view is that higher uranium prices seem to be the likely path to rebalance the market and incentivize more production. Below is a chart from the latest BP Statistical Review showing the steady increase in global consumption since 2012.

Source: BCA Research 2021, BP Statistical Review of World Energy 2020

Sources: CNBC.com, Globe and Mail, Financial Post, Government of Canada, Johns Hopkins University, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, BCA Research, BP Statistical Review of World Energy 2020, US Energy Information Administration, Nuclear Energy Institute, International Atomic Energy Agency