Market Insights - Jobless Claims at Pandemic Low

Milestone Wealth Management Ltd. - May 28, 2021

Macroeconomic and Market Developments: Equity markets in North America were positive this week. In the US, the Dow Jones Industrial Average was up 0.94% and the S&P 500 Index increased 1.16%. In Canada, the S&P/TSX Composite Index was up a strong 1.7

Macroeconomic and Market Developments:

- Equity markets in North America were positive this week. In the US, the Dow Jones Industrial Average was up 0.94% and the S&P 500 Index increased 1.16%. In Canada, the S&P/TSX Composite Index was up a strong 1.72%.

- The Canadian dollar was almost flat this week, closing at 82.82 cents compared with 82.88 cents last Friday.

- Oil prices were strong this week, with US WTI crude finishing at US$66.65 vs US$63.85 last week, and the Western Canadian Select price at ~$52.25 vs ~$49.20 last week.

- Gold prices increased again this week, closing at ~$1,904 compared with ~$1,881 last Friday.

- On Wednesday, Amazon (AMZN) announced that it is purchasing MGM Studios (a privately owned company) for US$8.45 billion, as the competition for streaming content heats up. MGM Studios owns the James Bond catalog, as well as the series The Handmaid’s Tale and reality shows Shark Tank and Survivor. This deal marks the second-largest acquisition in Amazon’s history, behind its $13.7 billion purchase of Whole Foods in 2017.

- This week was Canadian bank earnings week, and the big story was stronger earnings due to lower loan-loss provisions as the COVID pandemic eases up and concerns of bad loans reduces. Bank of Montreal (BMO) beat estimates with adjusted earnings of C$3.13 vs estimates of C$2.75, followed by CIBC (CM) beating with $3.59 in earnings vs $3.01 estimates. Then Royal Bank (RY) also beat with $2.76 in earnings vs $2.51 estimates and TD Bank (TD) beat with earnings of $2.04 vs $1.75 estimates. And on Friday, National Bank (NB) beat estimates with earnings of $2.25 vs $1.99 estimates.

- On Friday, Canadian cannabis company HEXO Corp (HEXO) announced that it has entered into a definitive share purchase agreement to acquire all the outstanding shares of the entities that carry on the business of Redecan for a purchase price of $925 million. The terms of the deal include $400 million in cash and $525 million in HEXO shares.

- The U.S. overall PCE deflator (consumer prices), which is the primary inflation gauge of the Federal Reserve in terms of policy decisions, rose 0.6% in April and is up 3.6% versus a year ago. The "core" PCE deflator, which excludes food and energy, rose 0.7% in April and is up 3.1% in the past year. If you look at just the past six months, removing the large drop from last April, the annualized rate now sits at 4.3%.

- This week saw Jeff Bezos, founder of Amazon, lose his title as world’s richest person. Bernard Arnault, the 72-year-old majority stakeholder and CEO of LVMH (owner of luxury brands like Moët, Tiffany, Sephora, and Louis Vuitton) eclipsed Bezos’ net worth. By the week’s end, Arnault had an estimated net worth of $192.4 billion, Bezos with $186.9 billion, and Elon Musk of Tesla now a distant third with a net worth of $157.0 billion.

- For those interested in disruptive technology, here is the 9th annual 2021 CNBC Disruptor 50 companies list.

-

Here is a link to a short video from Canaccord’s chief U.S. Strategist Tony Dwyer entitled Updated View on Rate Stall: DWYER VLOG

- For a deeper dive, the US investment company First Trust has put out a US COVID-19 Tracker. Click here: COVID TRACKER

- In addition, First Trust has created a COVID Recovery Tracker. Click here: RECOVERY TRACKER

Charts of the Week:

We will start this week looking at US Jobless Claims, a closely followed indicator of the overall employment health in the US. New claims for the week of May 22nd came in lower than expected at 406,000 vs. 450,000 consensus, and continuing claims dropped 38,000 (beating consensus by 4,000) from 3,680,000 to 3,642,000. The 4-week moving average of claims now stands at 458,750. As you can see from the chart below, it has been an incredible period of time, where jobless claims exploded in March 2020 from a stable level in the range of 200,000 to 300,000 claims/week to unprecedented levels peaking at 6.87 million claims during the week of April 2, 2020. The encouraging sign of late is that the weekly claims have been dropping at a rapid rate since the end of March, providing some hope that we are not too far off claims returning to pre-pandemic levels hopefully sometime in the third quarter.

Source: Connected Wealth, Bloomberg

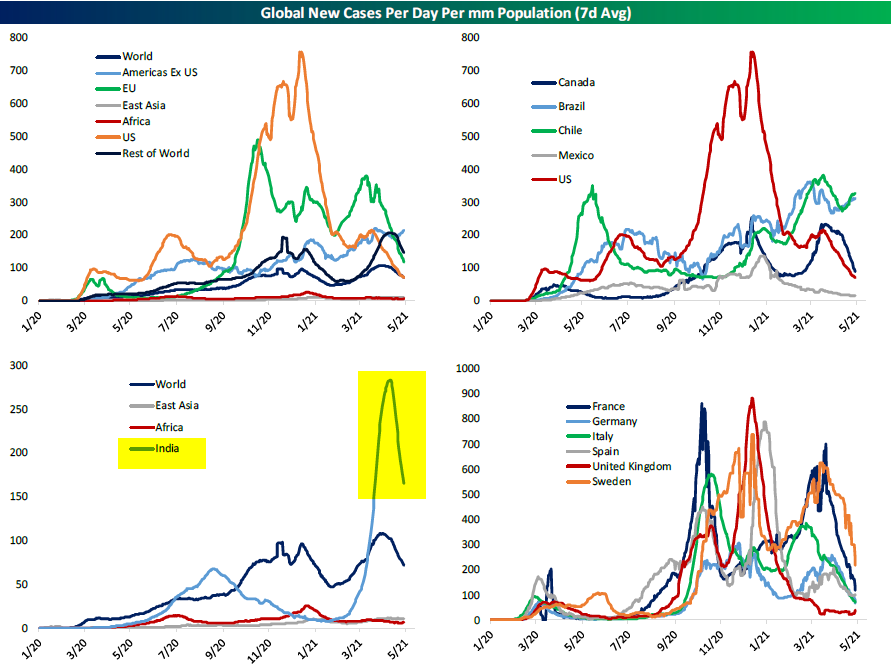

The reason for this rapid decline in jobless claims likely has to do with the decline in global new COVID cases. The charts below show the daily COVID case trends for various regions around the world. Clearly, the country that really stands out more than any others has been India, but the positive sign is that the daily number of new cases has nearly been cut in half as the surge part of the recent wave burns itself out. Looking at other major countries/regions, most have been on a rapid decline, apart from a slight increase in both Brazil and Chile, although neither country is close to its highs. Also, of note in the top right chart, Canada has recently started to catch up with the US with our 7-day moving average approaching 100 new case per day per million population. Meanwhile, the numbers for our neighbors to the south continue to shrink and is now below 100 new daily cases per million.

Source: Bespoke Investment Group

We would like to end our comments this week by saying Happy 125th Birthday to the Dow Jones Industrials Average (DJIA)! The widely followed US stock index debuted over a century ago with just 12 members (now 30). Its best year occurred in 1915 when the benchmark rallied 81.7%, while 1931 marked its worst year with a 52.7% loss. "The interesting thing about the Dow is that despite its odd construction and price weighting, which is really unusual and odd, it basically beat the S&P 500 over the last 30 years," said Wharton School professor Jeremy Siegel. Over that period, the DJIA returned a 11.17% annualized total return (including reinvested dividends) compared to 10.59% for the S&P 500 Index. Due to the tech sector, the S&P500 has surely beat the DJIA over the last 10 years, but this shows how important a growing dividend and high-quality matters over the long-term.

Sources: CNBC.com, Globe and Mail, Financial Post, Government of Canada, Johns Hopkins University, BNN Bloomberg, Tony Dwyer, Canaccord Genuity, Connected Wealth, Bespoke Investment Group LLC, S&P Dow Jones