Market Insights: First Quarter Wrap-up

Milestone Wealth Management Ltd. - Apr 12, 2021

Market Update The first quarter can be characterized by accelerating economic growth, rising long-term interest rates, increasing inflation concerns, full throttle fiscal stimulus and the anniversary of COVID-19. This combination resulted in strong

Market Update

The first quarter can be characterized by accelerating economic growth, rising long-term interest rates, increasing inflation concerns, full throttle fiscal stimulus and the anniversary of COVID-19. This combination resulted in strong equity returns, however, with a large dispersion of returns across sectors favoring cyclical industries, value over growth, small over large capitalization and areas that benefit from rising inflation.

The Canadian stock market benefited from this environment, with the S&P/TSX Composite rising 7.3%, higher than the S&P 500’s 5.8% price increase and a full 3% higher in Canadian dollar terms. European and Japanese markets also performed well, with France and Germany both up over 9% and Japan up 6.3%. Emerging markets were more muted posting a 3.6% return, all in local currency. However, the strong Loonie has resulted in more muted international gains from a Canadian investment perspective. With the Euro down 5.2% to our dollar, the MSCI Europe Index was only up 2.3%. The MSCI Emerging Markets Index was the weakest, eking out a small 0.7% gain in Canadian dollars.

On the other hand, the strong rebound in long-term yields has resulted in a very difficult quarter for the bond markets, especially long-dated government bonds. Long-term treasuries, as measured by the BofA/Merrill Lynch 10+ Year Treasury Index, had their worst quarter in 41 years falling more than 13% in what was just the fourth instance since 1977 in which the index lost 10% in a quarter. If there is anything positive to take from this going forward, it is that in the quarter that followed each prior double-digit percentage decline, long-term US treasuries were higher all three times. Looking at the entire US bond market, the Bloomberg Barclays U.S. Aggregate Bond Index was down 3.6%. In Canada, the FTSE TMX Canadian Universe Bond Index was down 5.04% on a total return basis, really shaking up some of the largest core bond funds in Canada which posted numbers worse than -5%. We have seen prior pops in long-term yields over the last few years; however, they have remained just that - short-term. It remains to be seen if the secular downtrend in interest rates (and inversely secular bull market in bonds) that began in the 1980s is finally over. We have been hesitant in the past, but we think this time may be different.

In commodities markets, energy markets have been very strong partly thanks to oil prices increasing by over 20% YTD. On the other hand, the price of gold has dropped 10%. This is not a surprise to us as gold does not tend to perform when in an environment where both economic growth and inflation are accelerating.

Lastly, our Loonie has been strong so far this year, especially against the EURO at +5.2%. However, it also rose 1.4% and 0.6% against the Greenback and the Pound respectively and posted an extremely large 8.4% gain vs. the Yen.

Milestone Strategy and Outlook

On the final day of March 2021, the Canadian government announced a partnership with Sanofi Pasteur, the vaccines division of global pharmaceutical firm Sanofi, to build a vaccine manufacturing facility in Ontario. While the facility will take five years to build, and will not help curb the current pandemic, it will have the capacity to manufacture enough vaccine to inoculate the entire country within six months of any future pandemic. Welcome news indeed!

As expected, markets in the first quarter of 2021 have been marked by ongoing volatility as the world recovers from the negative effect of the first waves of the COVID-19 pandemic. In positive news the Canadian economy grew by 0.7% in January and the preliminary report for February indicates a better-than-expected 0.5% increase. Consumers and businesses continue to adapt to the containment measures, performance of the housing market has been stronger than expected, and higher commodity prices are a favorable sign for the economy going forward. However, Canada’s employment numbers remain below pre-pandemic levels, with the service sector particularly hard hit, while a possible third wave of COVID-19 looms, and further lockdowns and restrictions appear more likely as we move into the month of April.

The Bank of Canada held interest rates steady in an announcement on March 10, 2021. On March 23, citing positive economic news, Toni Gravelle, Deputy Governor of the Bank of Canada, indicated that as the economy strengthens the Bank will adjust the pace of its quantitative easing program by “slowly easing off the accelerator – but not hitting the brakes”.

In terms of our overall view and strategy, Milestone remains of the belief that we are in a reflationary environment that started in Q1 and will roll over into Q2. This environment is generally positive for equities overall, and as we stated from the outset of these comments, it should benefit the Canadian stock market which tends to perform well in this environment relative to the US. In bond markets, we think the bulk of the relative rise in long-term interest rates is likely behind us, but we do not discount the relatively high probability, in our view, that 10-year government yields in Canada and the US could push towards 2% by the end of this year and potentially higher in 2022, putting continued pressure on long-term bond prices. Milestone’s mandates remain heavily tilted towards maturities below benchmark, corporate credit ranging from investment grade to high yield, convertible debentures and rate reset preferred shares, which we believe will result in strong relative total returns in this environment.

As we have noted in past missives, our focus remains on what we deem to be the two most important factors when it comes to market direction and volatility and its effect on asset classes and sectors, namely year-over-year economic growth (real GDP) and inflation (headline CPI). Markets are now entering their fourth consecutive quarter where both factors are accelerating (market narrative: reflation), with some of the easiest economic comparisons we have seen in our lifetimes. These base effect dynamics are aided by ongoing Fed-Fiscal support and a promise of a continuation of historic reflationary environment that has already been on full display across cyclical, rate and inflation sensitive assets. Although we see year-over-year inflation growth starting to ease off the throttle heading into the third quarter, our primary concern currently is whether economic growth can maintain its positive trajectory into Q3. As we monitor incoming data, our mandates may shift asset mixes to take advantage of (or protect) this potential pause in equity markets.

Although the year-over-year economic growth looks more unclear next quarter, the continued rollout of vaccines, gradual reopening of economies and corporate profit growth could surprise to the upside. There is also the relative value component of equities vs. bonds. Although equities appear to be overvalued, in particular the US, from a historical perspective, when you factor in how low interest rates still are, it is less of a concern and one could argue that long-term bonds are more overvalued. In theory, as interest rates rise, growth stocks tend to feel more pressure. However, on the other hand, as yields increase, bond prices decline, potentially putting a floor under equities or even adding more fuel to its fire if more capital exits long-term bonds looking for income. In addition, there remains unprecedented stimulus with vast amounts of money in play (M2 money supply has skyrocketed to never seen levels), again a positive for risk assets in general, while healthy and robust credit markets should help corporate profits continue to surprise to the upside.

On balance, we remain positive on risk assets in general, with a watchful eye on year-over-year economic growth and inflation, as well as interest rates as we head into the third quarter. After an extremely difficult second quarter of 2020, we believe the event-driven recession of 2020 reset the economy into a new 3–4-year positive economic cycle, one which we believe is still within the secular bull market that began in 2009 and likely has years to go. The economic recovery fueled by excess liquidity and driven forward by increased vaccinations has begun to accelerate, judging from recent economic data with the vast amount, recently as high as 85% of data over the past twelve months, surprising to the upside. Some of the more recent data has been well above expectations, with manufacturing surveys and nonfarm payrolls crushing estimates. Within this framework, in a new environment of gradually rising rates and inflation, we believe it will benefit an active management style with a focus on credit markets, equity sector tilts and inclusion of non-correlating strategies (real assets and absolute returns) to help mitigate short-term volatility.

As the weather improves, we hope you will be able to get out and enjoy the outdoors. It may be difficult in our continued restricted environment, so we hope you stay safe in the months ahead as we try to overcome the pandemic and return to a more normal state.

Once again, we would like to assure you that a broadly diversified portfolio of investments offers protection from market volatility. It is important to stay focused on your long-term goals and stay invested during uncertain times and our team is here to help. Thank you for your continued trust in Milestone as we navigate the tides ahead.

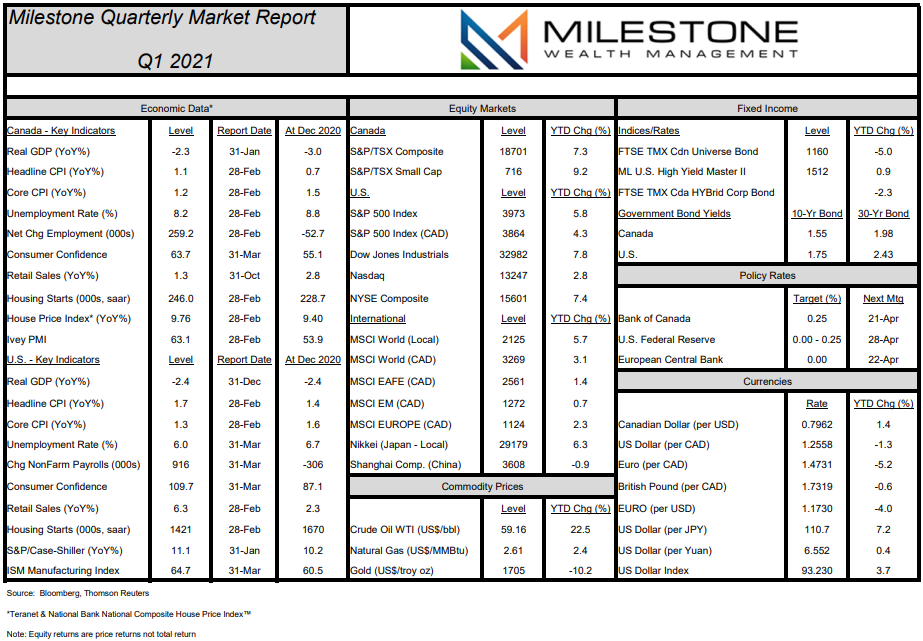

Here is our Milestone Market Report on economic data, capital markets, commodities, and currencies through March 31, 2021: (click image for PDF version)

Sources: BNN Bloomberg, Refinitv, Thomson Reuters, CNBC, CI Global Asset Management, Hedgeye Risk Management, Russell Investments, S&P Global, MSCI Inc., Statistics Canada, Bespoke Investment Group, Teranet & National Bank of Canada, Canaccord Genuity, Bank of America Securities