Market Insights: Early Year, Old Adage Market Signals

Milestone Wealth Management Ltd. - Jan 15, 2021

Macroeconomic and Market Developments: Markets in North America were lower this week. In the US, the Dow was down 0.91% and the S&P500 was down 1.49%. For Canada, the TSX Composite was down 0.74%. The Canadian dollar was slightly lower this week

Macroeconomic and Market Developments:

- Markets in North America were lower this week. In the US, the Dow was down 0.91% and the S&P500 was down 1.49%. For Canada, the TSX Composite was down 0.74%.

- The Canadian dollar was slightly lower this week, finishing at 78.5 cents vs 78.8 cents last Friday.

- Oil prices were mixed this week. US WTI crude finished at roughly $52.00 compared with $52.50 last Friday. However, in Canada the WCS price was up strongly this week, finishing at around $39 vs around $34 last Friday.

- Gold was down again this week, closing the week at $1,826 compared with last week’s $1,850.

- On Tuesday, Canadian-based Alimentation Couche-Tard (ATD.b), which owns Circle K convenience stores, confirmed that it has initiated discussions with France-based grocery store owner Carrefour (CA.FP) regarding a potential friendly transaction. Bloomberg has indicated that Couche-Tard is considering a €20/sh offer to buy Carrefour.

- Johnson & Johnson (JNJ) announced results of their forthcoming vaccine this week, stating that the vaccine generated a long-lasting immunity response, though the crucial late-stage data may still be a few weeks away. According to the report, more than 90% of participants made immune proteins, called neutralizing antibodies, within 29 days after receiving the shot, and all participants formed the antibodies within 57 days.

- Toronto-Dominion Bank (TD) has agreed to buy Wells Fargo’s Canadian Direct Equipment Finance business. The business has about $1.5 billion in assets and provides loans and leases for commercial equipment bought by businesses across Canada. The deal will consolidate two of the larger players and help give TD a leading share of the market.

- On Thursday, president-elect Joe Biden announced his ‘American Rescue Plan’. Details include direct payments of $1,400 to qualifying Americans (bringing the total to $2,000 when including December's $600 payment), increasing unemployment benefits to $400 per week through the end of September, and increasing the federal minimum wage to $15/hr. In terms of dealing with COVID, the plan includes $350B in state and local aid, $50B in COVID-19 testing, and $20B earmarked for a national vaccine program.

- On Friday, three large US banks released quarterly earnings. JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) all beat forecasted earnings, however all three stocks were down in trading on Friday.

- Total global cases of COVID-19 finished this week at 93.58 million, with the total deaths at 2.00 million. In Canada, total cases now stand at 688,891, with active cases at 77,956. In Alberta, total cases are 114,585, with active cases of 12,434.

Chart of the Week:

There is an old saying in our business “As January goes, so does the rest of the year”. Also known as the January Barometer, the phrase implies that if the S&P 500 is positive in January, then it will continue to go up through the rest of the year; and of course, the opposite would imply that markets would decline the rest of the year. The signal has shown that 86% of the years in which January has been positive, there has been a positive return the rest of the year. That sounds like an impressive signal; however, one must realize that independent of whether January is up or down, the probability of the market being up in any given year is 74%. What this means is that the market has been positive almost every 3 out of 4 years. So, while this signal may give us a bit of an edge, it is not as impressive as it may look at first.

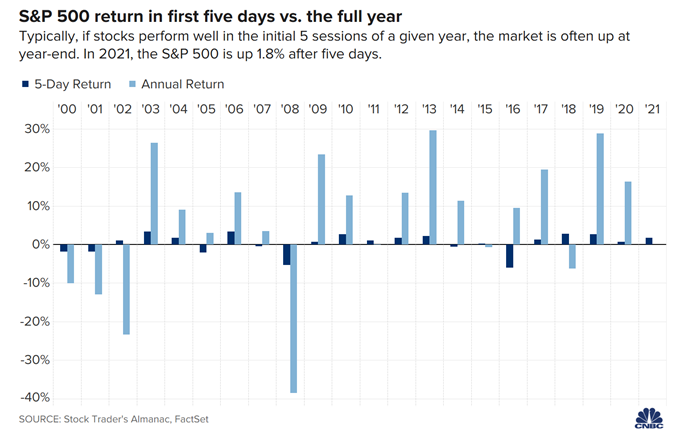

But what about the first five days of January? The so called “first five days signal”, another classic Wall Street signal similar to the January Barometer, says that if the market is up the first five trading days of the year, then the rest of the year will be positive as well. As you can see in the following chart, in the last 20 years the signal has been accurate about 75% of the time, not really providing any predictive edge over the average year. If we look further back, according to the Stock Trader’s Almanac since 1950, when stocks finish higher the first five days, the S&P 500 has been positive 82% of the time at year-end with an average gain of 13.6%. Like the January Barometer, this signal provides a bit of a predictive edge compared to the average year, but not quite as strong as the January Barometer.

We see a lot of these ‘old adage’ early year signals every year, with another one being the “Santa Claus rally” which says that if the last week of the year and first two trading days of the year are positive, so goes the rest of the year. However, while these are all certainly interesting as stand-alone signals, they don’t provide a huge predictive edge on whether the S&P 500 will be positive or not in any given year. But what if all three are positive? The Trifecta? For now, we are two for three this year with the S&P 500 gaining 1.1% during the Santa Claus rally and up 1.8% in the first five days of this year. Going back to 1950, there have been 31 Trifectas. In a Trifecta year, the S&P 500 has advanced 87.1% of time over the next 11 months and 90.3% of the time for the full calendar year. Finally! A signal that just may give us a worthy predictive signal of above 90%. At the time of this writing the S&P 500 is only slightly positive, so let’s hope we will get another Trifecta for 2021.

Source: CNBC

Sources: CNBC.com, Globe and Mail, Financial Post, Government of Canada, Government of Alberta, Johns Hopkins, oilprice.com, Canaccord Genuity, CNBC, Stock Trader’s Almanac, FactSet