Market Insights: Dr. Copper Breaking Out?

Milestone Wealth Management Ltd. - Dec 04, 2020

Macroeconomic and Market Developments: North American stock markets were slightly positive this week. In Canada, the TSX Composite index was up 0.72% and in the US, the Dow was up 1.03% and the S&P500 was up 1.68%. The Canadian dollar continued its

Macroeconomic and Market Developments:

- North American stock markets were slightly positive this week. In Canada, the TSX Composite index was up 0.72% and in the US, the Dow was up 1.03% and the S&P500 was up 1.68%.

- The Canadian dollar continued its strong uptrend, closing at 78.3 cents from 77.0 cents last Friday, its highest level since May 2018.

- Oil prices were mixed this week. US WTI increased slightly from roughly $45.50 last Friday to $46.00 this Friday. Canadian WCS dropped slightly to around $32.50 from $33.00 last week.

- Gold recovered somewhat this week, jumping to $1,840 from $1,790.

- Finance Minister Freeland delivered the long awaited fiscal update on Monday. The fiscal update increased the earlier projected deficit up to C$381.6B. In the event that the pandemic worsens, the government estimates the deficit could hit C$400B.

- On Monday, Imperial Oil announced that it would write down up to $1.2 billion of Canadian assets, stating that it has reassessed the long-term development plans of its unconventional natural gas portfolio in Alberta and no longer plans to develop a “significant portion” of those assets. It says that the move will result in a non-cash write-down of between $900 million and $1.2 billion in the current quarter.

- Canadian GDP grew 8.9% in Q3 (quarter-over-quarter), following an 11.3% drop in the second quarter and a 1.9% decline in the first. Despite the strong growth in the third quarter, which was the steepest since quarterly data were first recorded in 1961, real GDP was still down 5.3% compared with the fourth quarter of 2019. Monthly GDP grew 0.8% in September and Statistics Canada estimates a 0.2% increase for October.

- On Tuesday, Salesforce (CRM) announced that it is making the biggest acquisition in its 21-year history, buying chat software developer Slack (WORK) for $27.7 billion through a combination of cash and stock. Rumours of the deal surfaced last week when the stock was trading at under $30, which led to a 38% pop in Slack’s shares. The purchase marks one of the largest ever for the software industry; before this deal, the biggest was IBM’s 2018 purchase of Red Hat for $34 billion, followed by Microsoft’s 2018 purchase of LinkedIn for $27 billion.

- This week saw the big Canadian banks report earnings. On Tuesday, BMO reported better than expected Q4 EPS of C$2.41 ex-items vs estimates of C$1.91 and Bank of Nova Scotia reported a Q4 earnings beat with EPS of C$1.45 ex-items vs estimates of C$1.22. On Wednesday, National Bank reported better than expected Q4 EPS of C$1.69 ex-items vs estimates of C$1.51 and Royal Bank reported better than expected Q4 EPS of C$2.23 vs estimates of C$2.03. On Thursday, CIBC reported better than forecast Q4 EPS of C$2.79 ex-items vs estimates of C$2.52 and TD reported better than expected Q4 adjusted EPS of C$1.60 vs estimates of C$1.27.

- On Friday, employment numbers for November were released. Statistics Canada reported that our economy gained 62,000 jobs in November, beating analyst estimates. The unemployment rate ticked lower to 8.5%, down from 8.9% and also better than consensus. In the US, nonfarm payrolls increased by just 245,000 in November, well below expectations as economists surveyed by Dow Jones had been looking for 440,000. The US unemployment rate dropped to 6.7%.

- Total COVID-19 cases globally rose to roughly 65.6 million, with the total death toll at approximately 1.51 million. In Canada, total cases increased to 396,270, with active cases at 69,255. In Alberta, total cases are at 63,023, with active cases now at 17,743.

- For a deeper dive, the US investment company First Trust has put out a US COVID-19 Tracker. Click here: COVID TRACKER

Charts of the Week:

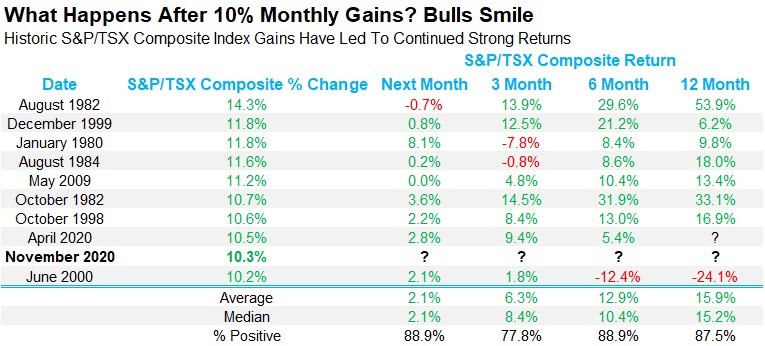

November wrapped up a very positive month on Monday. Taking a look back at some of the largest positive months on the TSX, going back to 1977, big months like November 2020 on the S&P/TSX have tended to be the start of a new bull move, not the end. Here are all the >10% monthly moves which clearly demonstrates continued strength 1, 3, 6 and 12 months later. As you can see, there have actually been two +10% months in 2020, April and November. With the exception of the year 2000, all other instances have shown to have big gains in the following year.

Source: Sam Poon, Canaccord Genuity, S&P Capital IQ

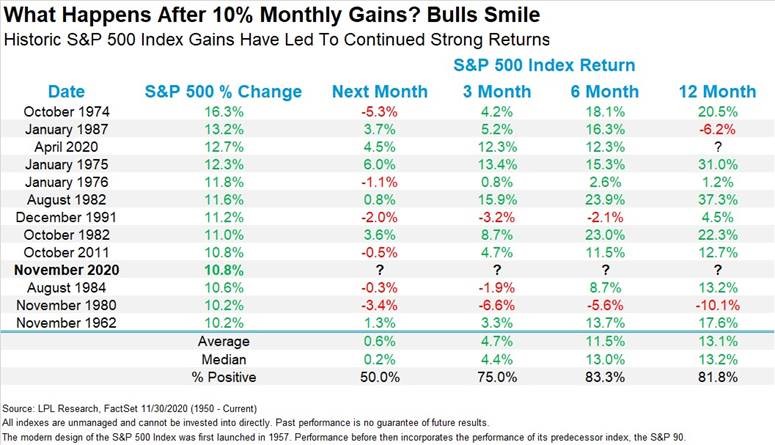

If we take a look at the S&P500 index in the US, we see a lot of similarities. The S&P also has had two +10% months this year, April and November. And with the exception of January 1987 and November 1980, the market has been higher (sometimes quite significantly) in all other cases. The caveat in both the TSX and S&P is that, before 2020, there haven’t been that many cases to point to. For the TSX, the most recent instance was May 2009 and for the S&P 500, October 2011. But the good news is, both of those months were closer to the beginning of long-term bull markets, not closer to the end.

Source: Ryan Detrick, CMT, LPL Research

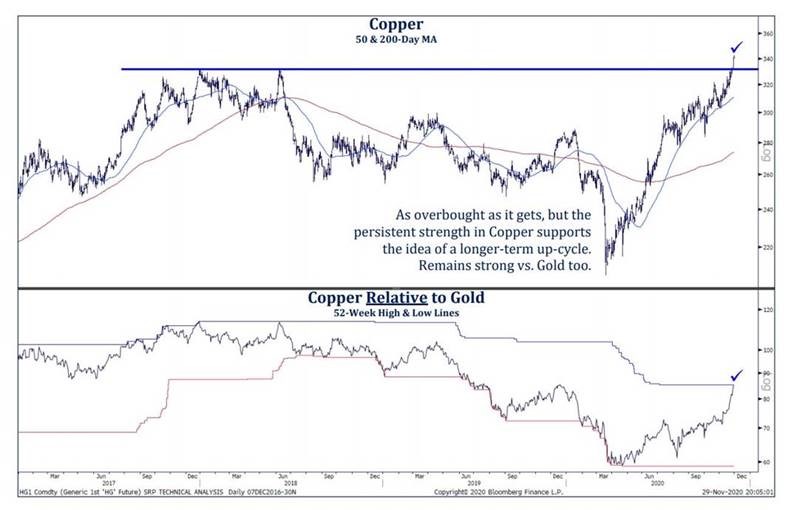

And finally, here is a chart of the price of copper potentially breaking out to a 7-year high. Why is copper significant? Because copper is used in so much of the world’s products and construction, it is generally viewed as an indicator of the health of the global economy. Despite the global pandemic and economies just now beginning to recover from the ensuing recession, copper seems to be indicating better times ahead for the global economy.

Source: Strategas

Sources: CNBC.com, Globe and Mail, Financial Post, Government of Canada, Government of Alberta, Johns Hopkins, oilprice.com, Canaccord Genuity, Bespoke Investment Group LLC, First Trust Portfolios, S&P Capital IQ, LPL Research, Strategas, FactSet