Market Insights: Second Quarter Wrap-up

Milestone Wealth Management Ltd. - Jul 13, 2020

Market Update While the first quarter of 2020 was dominated by anxiety surrounding the initial outbreak of COVID-19 and the ensuing lockdowns and capital market declines, the second quarter demonstrated a remarkable bounce back in those markets

Market Update

While the first quarter of 2020 was dominated by anxiety surrounding the initial outbreak of COVID-19 and the ensuing lockdowns and capital market declines, the second quarter demonstrated a remarkable bounce back in those markets – even with a resurgence of the virus in the U.S. and renewed lockdown measures.

The S&P 500 Index, a broad measure of U.S. equities, had its best quarter in over 20 years, gaining 19.95% (in U.S. dollars), while the Canadian S&P/TSX Composite Index gained almost 16% (in Canadian dollars) in the three months ending June 30. This was quite a recovery from the sharp declines by the end of Q1, bringing year-to-date returns to -4.04% (S&P 500) and -9.07% (S&P/TSX Composite). However, these levels are still 4% and 3% below their June 8th recovery highs, respectively. Government bond yields declined as both the Federal Reserve (the Fed) and Bank of Canada indicated rates would remain low for a lengthy period.

The good news is that historically we see continued strength after big quarterly gains:

Source: Ryan Derrick, LPL Research

Energy prices rose as the economy began slowly re-opening and production cuts trimmed inventory, but not before prices fell below zero for the first time in history on April 20, ending the day at -US$37.63. This served as a microcosm of the quarter. While virus data, economic numbers and other headlines seemed bearish, markets remained optimistic and continued to climb.

Much of the market’s enthusiasm has been attributed to government and central bank intervention designed to support global economies. In particular, the U.S. Federal Reserve’s introduction of vast quantitative easing measures, emergency lending and purchases of corporate bonds and exchange-traded funds are believed to have played a vital part in this rise. The Bank of Canada matched the Fed’s willingness to purchase corporate bonds to assist credit markets, while indicating it believes the economy will return to growth in the third quarter. The Fed said it expects 5% GDP growth in 2021, and as for the support it has been providing to the system, Fed Chairman Jay Powell said the agency was, “not out of ammunition by a long shot.”

Headlines concerning vaccine progress and phased economic re-openings also seemed to support market moves to the upside. Promising vaccine data from various companies continued to be announced, while in early May the U.S. Food and Drug Administration granted emergency use authorization for Gilead Sciences’ antiviral drug Remdesivir as a treatment for COVID-19 patients.

Investors also weighed more negative developments as the quarter ended, but these had little impact on the markets’ recovery. These included escalating tensions between China and both the U.S. and India, rising infections in 37 U.S. states (with 50 per cent of states halting or rolling back their reopening plans), and data showing 31.5 million Americans collecting unemployment cheques as of mid-June. The Fed said it expects U.S. gross domestic product (GDP) to shrink by 6.5% in 2020, and the International Monetary Fund (IMF) expects global economic output to contract 4.9%. Ratings agency Fitch Ratings, meanwhile, downgraded Canada's credit rating to AA+ from AAA to reflect the deterioration of public finances due to COVID-19.

Milestone strategy and outlook

If anything, the last two quarters have proven just how important it is to stick with a long-term, diversified plan to withstand market shocks. It would have been almost impossible to predict that shortly following the close of the first quarter, the S&P 500 would have the best 50-day period in its history. Had we chosen to change course and attempt to time the market, we may have missed out on this rapid recovery. We continue to believe that at times of great uncertainty, discipline, and the ability to remove emotion from one’s financial decisions become an investor’s most valuable assets. These characteristics, combined with your trust in us to manage your portfolio objectively, has allowed us to navigate that uncertainty in an effective manner.

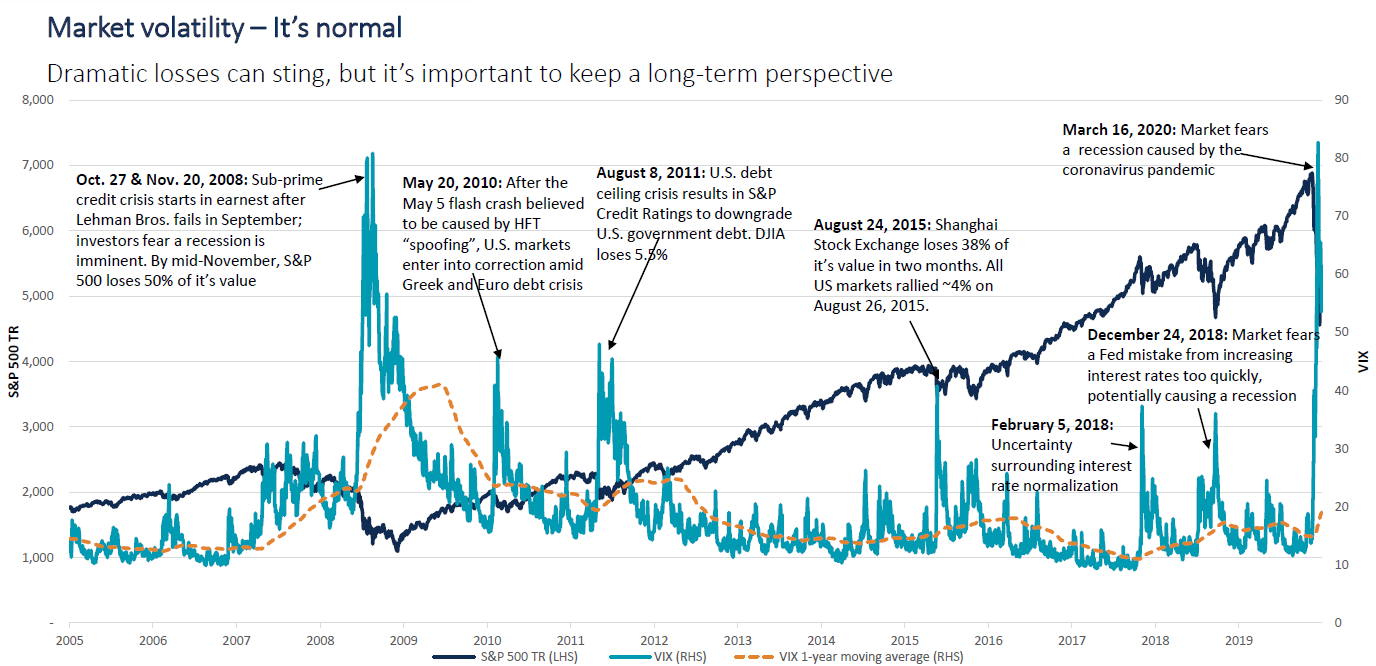

As we begin the third quarter, there is no way of predicting how the markets will react, and whether monetary and fiscal support will outweigh future outbreaks of COVID-19 and any subsequent economic disruptions. What we do know is that volatility remains a distinct possibility, and that history shows continuing to stick to a well-constructed, long-term plan has been the right move. The chart below illustrates this point nicely.

Source: Bloomberg Finance L.P., CI Investments. As of March 31, 2020, using daily returns.

From a longer-term perspective, we continue to believe we are in a secular bull market that began eleven years ago. The strength of the recent event-driven correction and subsequent recession began to put that long-term trend in question; however, the market has proved to be very resilient. This resiliency is a key characteristic of this secular bull, and there are likely years left to run in this cycle with inflation and interest rates very supportive of further growth.

The historic monetary and fiscal stimulus since the COVID-19 recession began has been nothing short of breathtaking. The U.S. Fed has recently said that they continue to act “forcefully, proactively and aggressively.” Due to this unlimited support, we believe our core fundamental thesis driven by credit remains positive, despite the recent setback. We have discussed this thesis in past commentaries, but we will elaborate on the key points to see where we are at after such a volatile quarter. We base this on the U.S. economy as it is the largest in the world. Inflation and forward inflation expectations drive Fed Policy, which in turn drives the availability of money/credit, which in turn drives the economy, which lastly in turn drives corporate earnings and eventually the full economic reopening should drive sector performance.

The Fed will be providing excess monetary stimulus through 2021 due to the collapse in core inflation and a historically low 10-year Inflation Breakeven rate. These two measures are currently at just 1% and 1.3% respectively. This is approaching the core inflation rate low of 0.9% during the Great Recession. Based on their actions and words, it seems likely that there has been a generation change in how the Fed views inflation, that low inflation is the bigger risk vs. high inflation. They have clearly stated they would want the core inflation at an average of 2%. Being well short of their target suggests historically accommodative monetary policy for the foreseeable future.

This should continue to support a Fed Policy that drives the availability of credit, and as a result, money supply, excess liquidity, and easing financial conditions will help the economy recover from the COVID-19 recession. The credit market indicators which we follow closely are showing continued improvement and suggest a stronger economic recovery once a vaccine is approved. As the following chart depicts, periods of excess liquidity following insufficient liquidity have historically been very good for equity returns going forward once the recover begins.

Source: Canaccord Genuity Corp., Ned Davis Research, Inc.

The economy appears to be emerging from the COVID-19 shutdown, and this availability of money driven by Fed policy should drive the economic recovery through the back half of this year and 2021. What we have witnessed over the last three months has never been seen before. Nearly every economic indicator we can look at has seen its worst drop followed by the sharpest improvement in history. At this point in time, it is still too difficult to determine what these indicators are informing us until there is some period of normalization. We may see a potential slowing pace to the recovery with the recent increase in COVID cases, however, we do not anticipate any sustained period of economic weakness as this typically only happens when households and businesses have a need for money but with limited access to it. This is not currently the case give excess liquidity and an inflection in the global outlook off historically bad readings.

With this inflection, the economy should drive corporate earnings. The direction of earnings should reaccelerate in the second half of this year, and we anticipate a full recovery by the end of 2021. We fully understand the reality will be completely dependent on the progress of a COVID-19 treatment and a vaccine, however, we have seen many positive developments of late that we have been sharing to you in our weekly letters. We remain hopeful. When we look at equity valuations, we believe we should see continued price multiple expansion due to low core inflation which dictates Fed Policy.

From a technical perspective, we are seeing many positive developments as well. Just in our last weekly letter, we noted the level of bullishness among individual investors remains very low, with AAII Bullish Sentiment indicator below 25% for three consecutive weeks. When this has occurred since the survey started in 1987, forward equity returns have been positive 100% of the time over the next 3, 6 and 1-year periods, and drastically stronger than all other periods. We also know that investors in the U.S. have parked nearly $5 trillion in cash/money markets surpassing the peak of the 2008 Financial Crisis. If we see just a glimpse of more positive developments with treatment and a vaccine, this should support further support stock markets for weeks and months ahead.

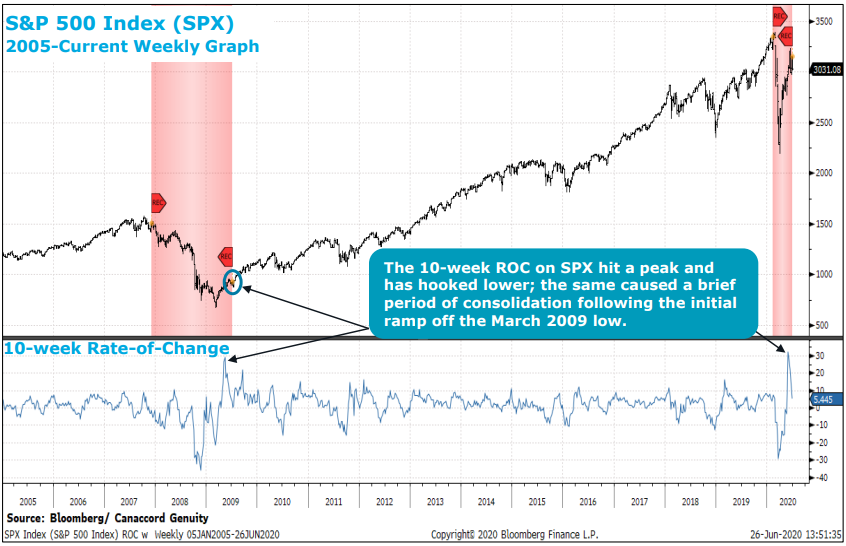

We have also seen the 10-week rate of change on the S&P 500 have a similar look to 2009, with a move from below -20 (severe weakness) to above 20 (extreme strength). After a period of consolidation, which we believe we are in right now, it suggests the beginning of the next leg higher.

The last positive technical we want to highlight is the fact that we have had two breadth thrusts occur recently on the S&P 500. In the past, this broad participation post weakness we have seen in the markets has been a consistent indicator of above average returns going forward after a short period of consolidation. These indicators are greater than 90% of the S&P 500 stocks trading above their 10 and 50-day moving averages and 90% of stocks above their 50-day moving average for at least 10 days.

To finish this quarter’s comments, we wanted to highlight two key elements that we are witnessing in markets and to be aware of the risks and opportunities that may arise from them. The first is the performance gap between the largest mega cap growth stocks and the rest of the market, and the second is the lurking duration and interest rate risk in some areas of fixed income markets.

To illustrate, the chart below shows the year-to-date performance between the S&P 500 Index (which is market capitalization weighted) and the S&P 500 Equal Weight Index. There is normally a positive correlation between the two as the dots tend to hug the trend line. However, in the case of 2020 (red dot), there has been an extreme disparity as the dot is nowhere near the trend line. The Equal Weight Index closed the second quarter down almost 12% vs. down just 4% for the Market Cap-weighted Index. In fact, in the last thirty years, at a current spread of over ten percentage points, there has never been another year where one of the indices was outperforming the other by a wider margin.

Source: Bespoke Investment Group LLC

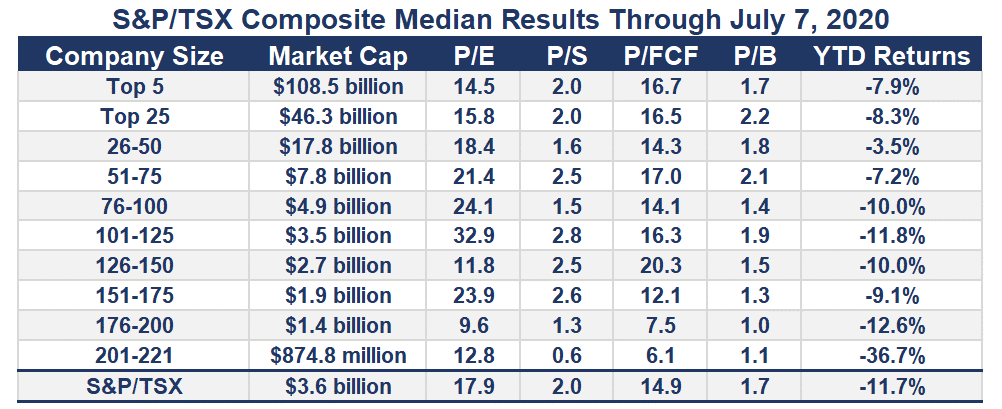

Although not as extreme, there is similar situation in Canada where the median return of the S&P/TSX Composite is more than 3% lower than the index itself.

Source: Sam Poon, Canaccord Genuity & Bloomberg

Understanding the U.S. stock market performance in 2020 is simple then — the bigger, more expensive companies are performing better than the smaller less expensive companies. This makes it difficult for an active manager in the short-term, however, we believe there are great opportunities going forward with solid undervalued companies.

In fixed income markets, we have also seen a wide gap in performance with long maturity government bonds posting by far the strongest returns this year because of severely compressed yields and their longer dated maturities. Bond prices and interest rates have an inverse relationship, and the longer the maturity (duration), the more it is affected by those interest rate changes. With 10-year Government of Canada yields hovering just above 0.5%, there is now very little upside at this point for those bond prices.

For those holding many of the largest bond funds in Canada, we believe most investors are not aware of the inherent duration risk these funds now have. The 20 largest fixed income funds in Canada holding approximately $6 Billion dollars, mostly with the big banks, currently have bond holdings with a yield to maturity after fees of 1% and an effective duration of close to 9 years. All else being equal, this means all you can hope for is to earn 1% a year for the next decade, but what many will not anticipate is how these funds will perform if rates were to rise again.

With an unprecedented amount of stimulus and increase in the money supply, we may see higher inflation and interest rates down the road post recovery. We will use a simplistic example to highlight this risk. A 10-year Gov’t of Canada bond also has duration very similar to these funds. If the 10-year treasury bond yield were to go back to 2% which is where it was just in early 2019, the price of the bond would fall 12%. This would also happen to many of these bond funds which many investors consider safe. So not only is the future return profile below inflation, you also own something that is increasingly at risk of severe drawdowns. This duration risk is prevalent in not only some of the largest bond funds but also many balanced funds in Canada. If this transpired, we could see huge outflows from these bond funds, with investors seeking the higher income they need from corporate bonds and dividend paying equities, which could provide a tailwind to equity markets.

Reputable investment firm BlackRock recently said is now prefers reduced allocations to government bonds and moving to overweight credit, “we think in a world where nominal Treasuries are going to be less capable of providing ballast or resilience in your portfolio, you’re going to have to look for it in other places.”

We focus most of our fixed income exposure on higher yielding corporate bond exposure with lower duration. Although there is credit risk, corporate bonds, particularly higher yielding corporate bonds, have offered outsized returns over the long-term, and we believe that we can add meaningful value by picking the businesses we choose to lend to and the managed investments with teams that we believe have the strongest credit teams to bring long-term benefits to our clients.

In closing, we have just been through an unprecedented time in the markets, yet we need to remain focused on the long-term path. Investors tend to make decisions about their long-term goals (Point B) based on how they feel today (Point A). With history as a guide, making long-term investment decisions on how you feel in the middle of a market crisis will usually result in not attaining their Point B goal. It is our mandate to guide you from Point A to Point B through our long-term investment process, and we would like to thank you for your continued trust.

Here is our Milestone Market Report on capital markets, commodities, and currencies through June 30th and economic data through July 3rd, 2020: (click image for PDF version)

Sources: CI Investments, cnbc.com, Bloomberg Finance L.P, oilprice.com, marketwatch.com, The Globe and Mail, reuters.com, the U.S. Food and Drug Administration, Yahoo! Canada Finance, Canaccord Genuity, Bespoke Investment Group, BlackRock, Trading Economics, TD Newcrest, EdgePoint Investment Group, Ned Davis Research, ThomsonReuters, and PC Bond.