Market Insights: Market Commentary

Milestone Wealth Management Ltd. - Jul 03, 2020

Market developments In a shortened week, North American equity markets rebounded from last week’s decline, weighing positive vaccine data from Pfizer and BioNTech against growing COVID-19 outbreaks in the U.S. The Supreme Court of Canada dismissed an

Market developments

- In a shortened week, North American equity markets rebounded from last week’s decline, weighing positive vaccine data from Pfizer and BioNTech against growing COVID-19 outbreaks in the U.S.

- The Supreme Court of Canada dismissed an appeal of the Trans Mountain Pipeline this week, paving the way for the pipeline to move forward with construction.

- Oil prices stayed relatively stable this week, with US WTI trading around $40 and Canadian WCS trading around $29.

- The new NAFTA 2.0 agreement came in effect on Canada Day.

- More than 50% of states decided to halt or reverse their reopening plans, as health officials expressed concerns about the continued spread of the coronavirus. Dr. Anthony Fauci, Director of the U.S. National Institute of Allergy and Infectious Diseases, stated that he “would not be surprised” to see the daily number of new cases rise to 100,000 from the current 40,000. Dr. Anne Schuchat, Principal Deputy Director of the Centers for Disease Control and Prevention, said the pandemic is out of control and that “This is really the beginning.”

- Statistics Canada announced that real gross domestic product (GDP) by industry decreased 11.6% in April, and that building permits issued by Canadian municipalities bounced back 20.2% in May, following declines of 13.4% in March and 15.4% in April.

- U.S. jobs increased by 4.8 million in June, while weekly jobless claims totalled 1.4 million. Given the re-shuttering of activity in some regions, the July figures may see a reversal of the May and June gains.

How does this affect my investments?

The next few weeks may prove pivotal as to how the market reacts both to the surge of COVID-19 cases in the U.S. and the new government economic stimulus measures. While Canada seems to have contained its outbreak for the time being, how its southern neighbour handles the situation will have a significant impact on the country.

So far, the Fed has proven it is willing to use all of the tools at its disposal to mitigate the economic threats of the virus, and the markets’ strong recovery from their March lows are evidence of that. However, we cannot be sure that this support will have the same effect going forward as the pandemic escalates in the U.S. This is why it is important not to deviate from our plan, which was built to handle markets’ ups and downs.

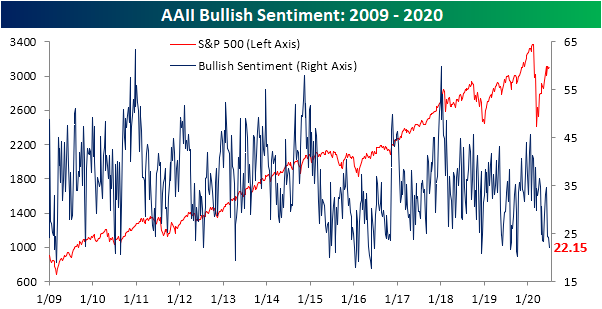

This week we wanted to share an interesting side to the market right now. Despite generally positive price action over the last three weeks, but especially after an extremely strong rebound since mid-March, bullish (positive) sentiment has not been strong at all of late. There is a widely followed weekly survey by market strategists and financial professionals from the American Association of Individual Investors (AAII) called the AAII Sentiment Survey. This survey measures of the mood of individual investors by the percentage of investors who are bullish, bearish or neutral. This week’s survey saw just 22% of respondents as being optimistic over the next six months which is down now for four consecutive weeks and three straight weeks below 25%.

Source: Bespoke Investment Group www.bespokepremium.com

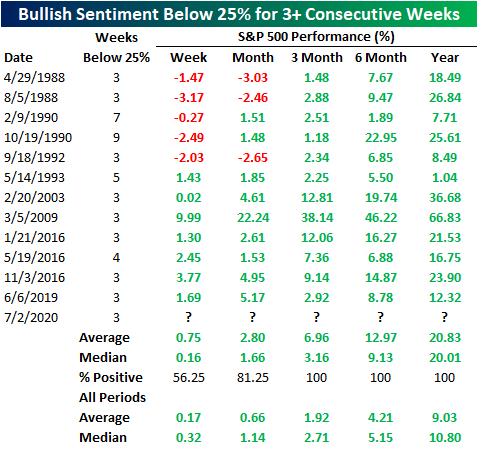

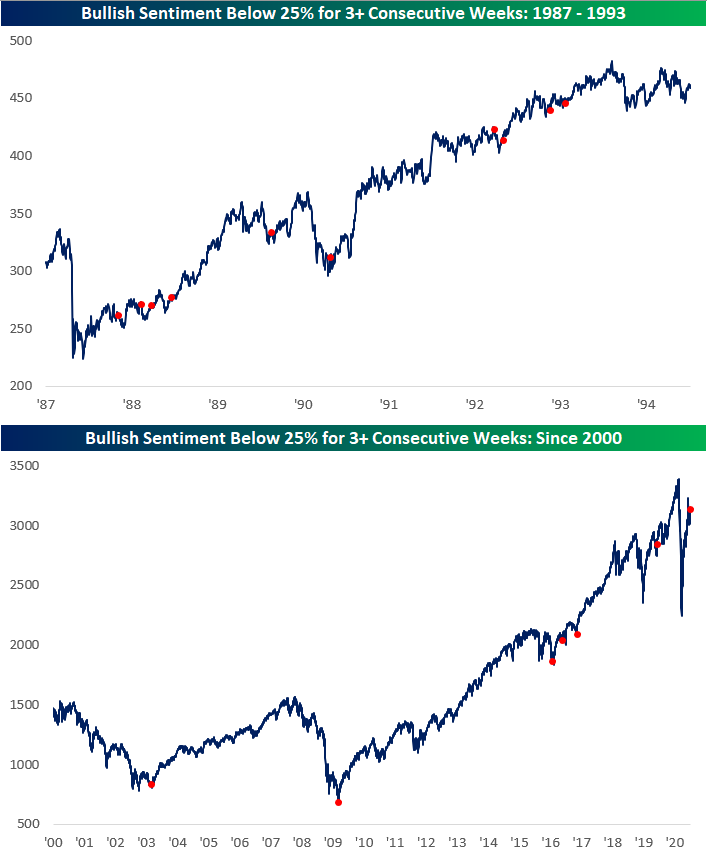

This level of bearishness is in the bottom 5% of all readings since the beginning of the survey in 1987. There have only been 13 other times where the level of bearishness has been below 25% for three or more weeks without another occurrence in the previous three months. The last occurrences were the spring of last year, three times in 2016 in advance of a strong period for markets, and March of 2009 at the very end of the Great Recession. Although this survey indicates that investors hold a pessimistic view of the direction of markets, historically, it has led to strong forward returns. As you can see in the table below, in the prior instances of 3+ consecutive weeks of bullish sentiment below 25%, forward returns have been positive 100% of the time over 3, 6 and 1-year periods, and far stronger than all periods. We have also included two charts showing the points in time this occurred on the S&P 500 chart.

Source: Bespoke Investment Group www.bespokepremium.com

Source: Bespoke Investment Group www.bespokepremium.com.