Market Insights: Market Commentary

Milestone Wealth Management Ltd. - Jun 26, 2020

Market developments North American equity markets proved volatile this week, reacting to increasing numbers of COVID-19 infections in 27 states and fears of new lockdowns and decreased economic activity. In particular, cases continued to soar in

- North American equity markets proved volatile this week, reacting to increasing numbers of COVID-19 infections in 27 states and fears of new lockdowns and decreased economic activity. In particular, cases continued to soar in Florida, Texas, Arizona and California.

- The price of West Texas crude was trading around $38 on Friday, with the Canadian WCS price trading around $28.

- The International Monetary Fund (IMF) now expects global economic output to contract 4.9% in 2020, with U.S. output contracting 8.0% and Canadian output 8.4%.

- Ratings agency Fitch Ratings downgraded Canada's credit rating to 'AA+' from 'AAA' to reflect the deterioration of public finances due to COVID-19. However, S&P and Moody’s have maintained Canada’s bond rating.

- New Bank of Canada Governor Tiff Macklem said that Canada’s economy will take a long time to fully recover from lockdowns, requiring the central bank to continue purchasing government bonds to keep interest rates low indefinitely.

- President Donald Trump said that a second stimulus bill was coming and would likely be announced in the next few weeks. Weekly jobless claims in the U.S. were 1.48 million, and real gross domestic product (GDP) contracted at an annual rate of 5.0% in the first quarter of 2020.

How does this affect my investments?

A resurgence of COVID-19 cases across the United States has caused investors to consider the implications of a second series of lockdowns, something many hoped would be unnecessary moving forward. As economic forecasts continue to show the damage caused by the pandemic, it is understandable that sentiment may turn bearish in the short term. With that said, our decision to stick with our long-term plan even when markets hit their lows in March ultimately proved prudent, and our advice is to continue to do so, even when sentiment appears to change.

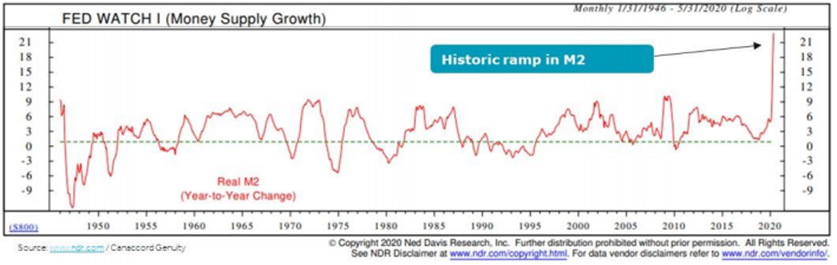

As the market consolidation continues, we want to be mindful that the speed and breadth of support for the credit markets has differentiated the current U.S. Fed compared to prior ones being more reserved in their initial response. The current Fed Chair Jerome Powell has stated they will continue to act “forcefully, proactively and aggressively” to support the recovery. The historic action by the Fed has caused an unprecedented response in Money Supply (M2 - includes all currency in circulation plus savings and checking account deposits), Real Liquidity, a record 33% Personal Savings Rate and a fast reversal in tightening financial conditions. In the past, long-term trouble for the market occurs when households and companies need money and can’t access it, however, that is clearly not the case in the current environment. The charts below show an historic level of Money Supply and excess liquidity (more real liquidity available relative to what is needed for economic growth), which typically happens as an economy comes out recession and a new bull market has already started. In the near-term, we continue to think a further period of consolidation is likely before markets move higher again.