Market Insights: Fourth Quarter Wrap-up

Milestone Wealth Management Ltd. - Jan 10, 2020

Welcome to a new year and a new decade!

Market Update

Overall, global capital markets exhibited remarkable resilience in 2019, rebounding from a severe 20% decline that occurred in late 2018. Despite starting the year on a tentative note, they ultimately shrugged off a stream of negative headlines and uneasy sentiment to stage a robust recovery, with the fourth quarter capping off a year of broad-based gains across most equity and income asset classes.

Supported by low interest rates, slow global economic progress and healthy corporate fundamentals, global equity markets advanced in the fourth quarter and registered solid results for 2019, with many finishing the year just off their all-time highs. The MSCI World Price Index rose 5.9% in Canadian dollar terms during the last three months of 2019, bringing its price gain for the year to 18.9%. And despite ongoing trade uncertainty and the developing impeachment drama, the S&P 500 Index, a broad measure of the U.S. equity market, finished 2019 with an increase of 22.8% (CAD).

Canadian equities also advanced in 2019, with supportive business conditions and stronger commodity prices boosting results for many sectors. The benchmark S&P/TSX Composite Index climbed 2.4% in the fourth quarter, capping off an impressive 22.9% total return (including dividends) for the year after losing 8.9% in 2018. Overseas, markets showed a similar trajectory, with European developed market equities advancing amid an environment of easy monetary policy and Brexit uncertainty, and many markets in Asia posting positive results (not as strong as North America) for the fourth quarter and the year as well. Emerging markets only managed a 9.8% (CAD) price increase for 2019, however, almost all of that was in the fourth quarter so we are now starting to see accelerated gains there.

After moving to raise interest rates to a more “neutral” level from their record lows in 2018, the U.S. Federal Reserve reacted to weaker global economic growth and tepid inflation in 2019 by easing monetary policy. The central bank made three 25 basis-point cuts to its target rate through the course of the year, while many other international peers also lowered rates based on global economic concerns. The Bank of Canada, however, charted a divergent course, keeping its policy interest rate steady at 1.75% throughout the year. In this environment, 10-year U.S. and Canada government bond yields drifted higher in the fourth quarter, rebounding from their yearly lows in the third quarter. The FTSE TMX Universe Bond Index, which broadly reflects results for the Canadian government and corporate bond market, registered slightly negative returns for the fourth quarter but a total return of close of 7% for the year.

The Loonie had a strong year relative to the Greenback, rising 5% to finish the year at $0.7698 per USD. The Loonie was even stronger against the Euro as it dropped almost 7% to our dollar. In Commodities, the price of WTI crude oil rose 34.5% in US dollars to close the year at just over US$61/bbl while we saw a 27% decline in Natural Gas prices to finish at US$2.19/MMBtu. Meanwhile, gold saw a nice rebound last year climbing to US$1517/troy oz after falling 2% last year. Gold peaked out at around US$1900 back in the summer of 2011.

Milestone strategy and outlook

In 2019, virtually every category of risk asset generated positive returns in what was the mirror image of what happened in 2018. It is certainly not the norm to have either of these extreme scenarios, and especially in back to back years. Even though we continue to focus on our core fundamental thesis which remains constructive (please revisit past commentaries for more details on the fundamental drivers behind it), it is our view there could be a bigger mix this year in terms of asset performers and non-performers which could favor active over passive management. We may begin to see later stage cycle asset classes and sectors starting to outperform; if this were to come to fruition, the Canadian stock market could benefit from a relative perspective with a higher weighting towards cyclical and real asset sectors. That being said, we certainly are not going to underestimate the resiliency of the U.S. consumer which continues show strength, helped by a strong labor market with the unemployment rate at a 50+ year low and very low interest rates. In addition, inflation rates remain stubbornly low, below the U.S. Federal Reserve target (core PCE currently at 1.67% vs. their 2% target), which should continue to keep equity valuations at above average levels.

For 2020, we expect the environment for risk assets to remain healthy. While it would be extremely difficult for equity markets to replicate or better last year's very strong returns, we do expect modestly positive returns for most equity markets as our base case and a favorable backdrop for active management vs. passive. A combination of a healthy credit market, a strong and resilient U.S. consumer and low global interest rates, as well as inflation remaining at or below central bank targets should continue to push the U.S. economy further into what is currently the longest expansion in history (126 straight months as of December). As shown in the following chart, one thing to note is that while this is the longest expansion in terms of time, it has been weaker than past expansions in terms of strength from the bottom.

Months from start of expansion

Source: St. Louis Federal Reserve, CNBC

Interestingly, for the first time ever, the U.S. economy started and ended an entire decade without entering a recession. While we expect slow growth of around 1.5 to 2% this year, we don't expect the expansion to end and it will likely be back-stopped by a continued spending from the current U.S. administration (this year is an election year) and a monetary backstop from the Federal Reserve where we likely won't see their target rate increased this year. Both scenarios have historically been positive for risk assets.

Equity returns for 2020 should be more of a combination of dividends, earnings growth and multiple expansion, whereas most of the gains last year were from the latter (current 2019 earnings growth projections for the S&P 500 are only slightly positive). We expect positive but more muted overall returns this year due to multiple expansion easing off and earnings growth remaining weak but recovering to perhaps 5% growth assuming no major relapse in the US-China trade deal. So far, we have seen strong underlying market breadth from the recent push to new highs, with the NYSE advance/decline line (an important indicator we have discussed in past missives) confirming the move, and we are beginning to see better participation from the small and mid-cap sector.

Speaking to credit, there simply hasn't been any of the meaningful deterioration in the credit markets that typically takes place well ahead of a steep economic retrenchment and subsequent bear market, and therefore another positive signal for markets. Our fixed income allocations remain well below benchmark in terms of maturity/duration and government to corporate credit. With long-term interest rates currently building out a 40-year low and likely to slowly climb higher over the coming years, we prefer to focus on clipping higher coupons from strong corporate credit and keeping our duration relatively low to benchmark. This should insulate our portfolios from any surprise increase in long-term rates and keeps this part of our asset allocation with a lower interest rate risk than benchmark. We don't expect a repeat performance from last year for fixed income where long-term interest rates dropped much further than we envisioned. If rates do start to slowly climb from here, our shorter duration and credit-focused fixed income allocation should benefit. In addition, preferred shares, which have been historically cheap recently, could begin to reap the rewards as well.

To conclude, the U.S. consumer continues to show resiliency, and the U.S. economy remains on solid footing for now and likely backstopped by both accommodative fiscal and monetary measures. Despite some recession fears of slow global growth (especially early last year), the positive influences that drive our fundamental core thesis are still present today. While some geopolitical risks have risen of late and macro-economic data continues to indicate slow growth, we have yet to see any major cracks in the credit market, which remains robust, and the flow of capital remains positive. We also know that the Fed is focused on a soft landing for their economy and will use all the tools at their disposal, which we have seen time and time again this cycle act as an important tailwind for equities. Our Milestone Recession Risk Composite™ is currently at an 8.0/10 level, up one point from last quarter, indicating a low level of U.S. recession risk this year. From our standpoint, the global economy appears to be emerging from the third 'mini-recession' of the current secular bull market driven by the lagged effect of lower interest rates, a solid domestic economy, and a positive inflection in the outlook for global manufacturing. The bullish story for 2020 is that of continued domestic (U.S.) growth based on credit, confidence, and employment.

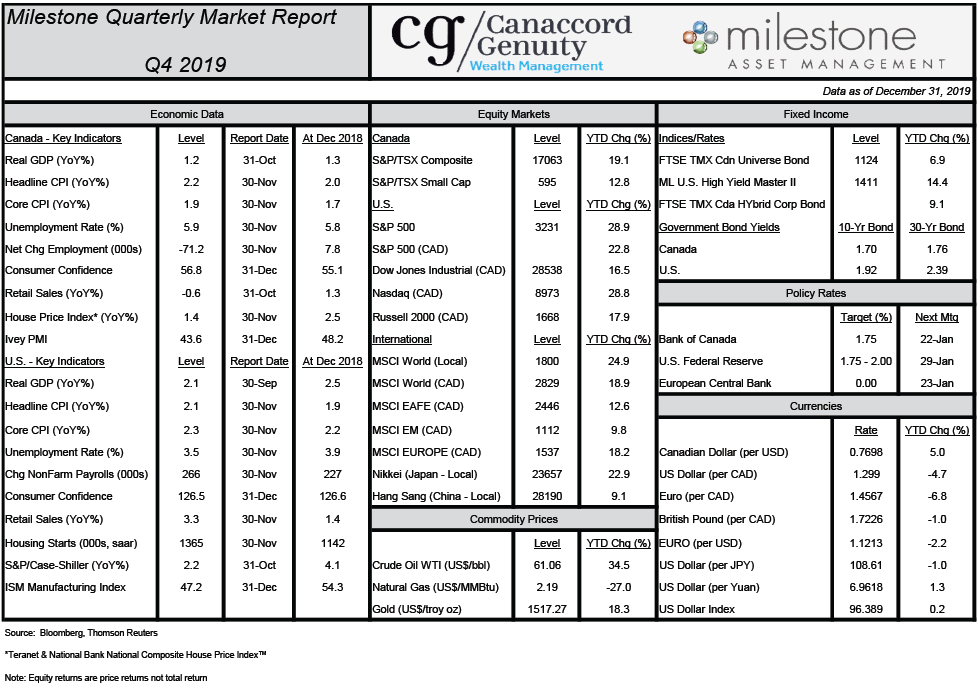

Here is our Milestone Market Report on economic data, capital markets, commodities and currencies through December 31st, 2019: (click image for PDF version)