Market Insights: Presidential Cycle Update

Milestone Wealth Management Ltd. - Jul 12, 2019

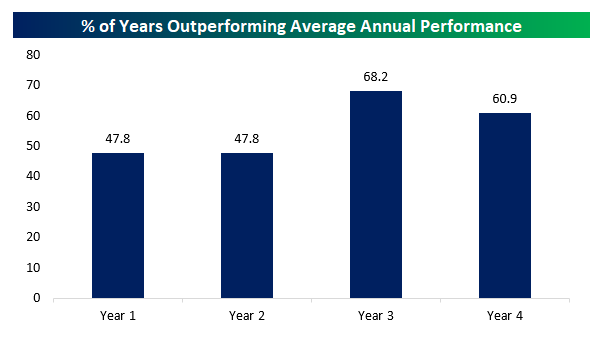

In a commentary we posted last November titled Market Performance Following Mid-Term U.S. Elections, we noted at the time that the upcoming 2019 year would be the third year of the Presidential cycle, and that in the past, the third year has been by

In a commentary we posted last November titled Market Performance Following Mid-Term U.S. Elections, we noted at the time that the upcoming 2019 year would be the third year of the Presidential cycle, and that in the past, the third year has been by far the strongest on average. We thought we would provide an update on this, and how this year is progressing intra-year versus prior year-threes. Based on this track record in isolation, we put forth the following equation: Midterm Elections + Equities = Buy! We will post these charts again for reference to show the past strength of the third year:

Source: Bespoke Investment Group, www.bespokepremium.com

Although we had to endure a very difficult fourth quarter of last year, markets have again shown their resiliency and have posted strong numbers this year, so far backing up this 'third year' statistic. Since the U.S. Midterm Election on November 6th, the S&P 500 price index is up 6.8% to mid-year, and on year-to-date basis to mid-year it is up 17.3% (12.7% in CAD).

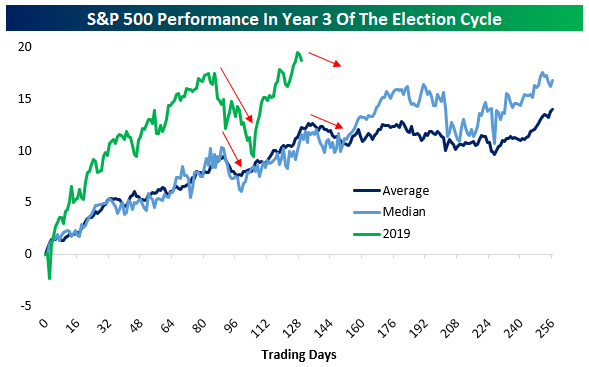

But how is the market doing compared to past third years? The below chart shows the progress thus far compared to the average and median third years of a presidential cycle.

Source: Bespoke Investment Group, www.bespokepremium.com

Although there has been more up and down volatility, this year has been tracking the overall pattern pretty well. The key difference of course being that so far this year the performance has been even stronger than usual on average. One note of caution here is that in the past the third year of the Presidential cycle has been front-end loaded, in other words, most of the returns have come in the first half. If that patterns holds for this year as well, then one shouldn't expect a repeat of the first half.

The pattern for the second half of the year has typically been mostly flat with a nice year-end rally. Based on our intermediate term technical signals, we think the market could be set up more like the median line below as opposed to the average line, with markets moving higher into late summer after a bit of a cool off at present, then some correcting following by a year-end push. We will update this at year end to see what pattern actually unfolds.