Market Insights: Are rising rates bad for equities?

Milestone Wealth Management Ltd. - Dec 09, 2016

There is definitely no shortage of media sources showering listeners with the tenet that rising interest rates are bad for stocks. There is some truth to that.

Are rising rates bad for equities?

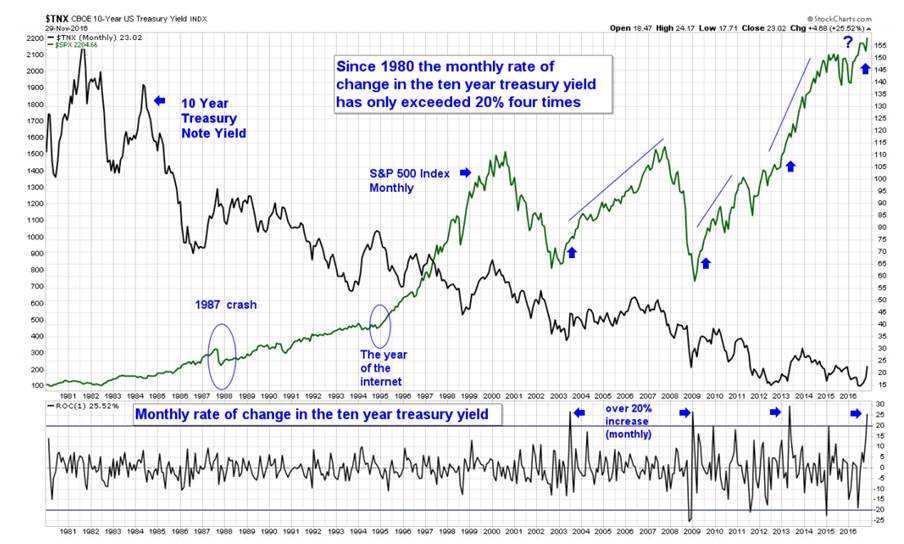

There is definitely no shortage of media sources showering listeners with the tenet that rising interest rates are bad for stocks. There is some truth to that. However, stocks are actually considered to be one of the best investments against inflation, and the rising interest rates associated with it, because companies can pass cost increases onto consumers, whose salaries presumably are also rising. While this protection generally holds true in the long run, there are certainly concerns about the effect in the short-term. This is why we find the following statistic interesting. In early December, the one-month rate of change of the U.S. 10-yr Treasury yield just rose above 20%. This is just the fourth time that has happened in the last 36 years. One would think that is a bad omen for stocks, but as you can see from the chart below, the last three times this type of increase occurred, it actually kicked off a considerable rally that lasted years. Let's hope the signal holds true this time around.

Source: StockCharts.com