Market Insights: Should we be worried about lagging Small Caps?

Milestone Wealth Management Ltd. - Nov 06, 2015

Recently, many sources have cited the lack of breadth of the sharp stock market rise seen in the U.S. since the September 29 low.

Should we be worried about lagging Small Caps?

Recently, many sources have cited the lack of breadth of the sharp stock market rise seen in the U.S. since the September 29 low. Meanwhile, the large cap space has seen what technical analysts call a "W" formation. This is a positive formation whereby you have a partial recovery from a steep low, then a retest of that low which holds, followed by a strong move higher above the middle peak of the "W". This "W" signal has a strong history of indicating the end of a correction, especially when accompanied by historically extreme levels of sentiment at the lows. Unfortunately, these sources correctly note that small caps have not had this same technical breakthrough, resulting in comments that the recovery won't last if that doesn't rectify itself very soon.

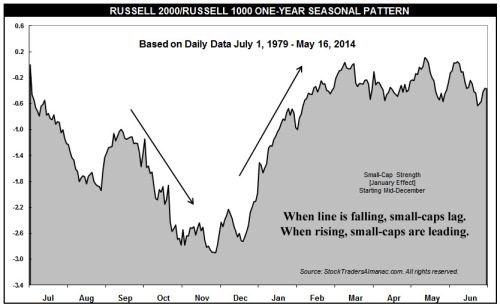

We currently have the S&P500 (large caps) only about 2% below its all-time high in May while the Russell 2000 (small caps) is 8.5% below its June all-time high. While we agree that this is problematic, we asked ourselves if there might be an explanation for this. Could equity seasonality offer a potential explanation? In other words, is it normal for small caps to lag the large caps at this time of the year? If you look at the following chart, it is evident that it is indeed a normal occurrence (on average) for this seasonality disparity. In fact, on average, small caps don't start to lead large caps until late November.

Source: Stock Trader's Almanac

We realize that looking at one seasonal trend to explain a complex pricing system likely doesn't have much merit in itself. However, it is interesting that large caps could continue to rally without the small caps responding in kind, as small caps tend to lag from mid-September until late November or mid-December when the "January Effect" can take hold. As long as the large caps can hold on for a few weeks, past seasonal trends history shows that the small caps will follow and push markets even higher into year-end.