Market Insights: A potential bottom for Emerging Markets?

Milestone Wealth Management Ltd. - Aug 29, 2015

It is our contention that a great deal of the enormous volatility and capitulation in the markets we saw early last week was as a result of China and Emerging Markets (EM) weakness.

A potential bottom for Emerging Markets?

It is our contention that a great deal of the enormous volatility and capitulation in the markets we saw early last week was as a result of China and Emerging Markets (EM) weakness. At this point in time, whereas the U.S. stock market is still likely fairly or even overvalued, by some metrics the EM region could be much closer to a short or even intermediate-term valuation bottom. We refrain from stating a long-term trend change, as a potential looming recession in China is an ominous threat. It is never our intention with these comments to mark an outright forecast, but when we see certain metrics like we have seen of late, the probabilities of a market that is at or getting close to a bottom begin to look much more favorable.

Early last week, the CBOE Market Volatility (VIX) index moved above the 50 level. This volatility measure is based on U.S. equity markets, but nonetheless shows how volatile markets around the world have been of late. To put that into context, over the last 25 years, the VIX has only spiked above 50 once and that was during the period of October 2008 to March 2009.

By one metric, you would have to go back a whopping 75 years to show how abrupt this market drawdown was. At the close last Tuesday, the S&P500 was more than four standard deviations below its 50-day moving average for three consecutive days. The last time we saw this occurrence was in 1940. In relation to its previous range, not even the 2008 or 1987 collapses were as abrupt over a three-day period.

We have noted in previous posts that we believe the U.S. markets are in a correction mode within an ongoing cyclical bull market, and although this past week has heightened our caution on this stance, it has not changed our view.

In turning back to the EM region, although we do not see equity valuations quite as enticing in the U.S., they do seem to be approaching long-term low valuation levels here.

Source: Short Side of Long

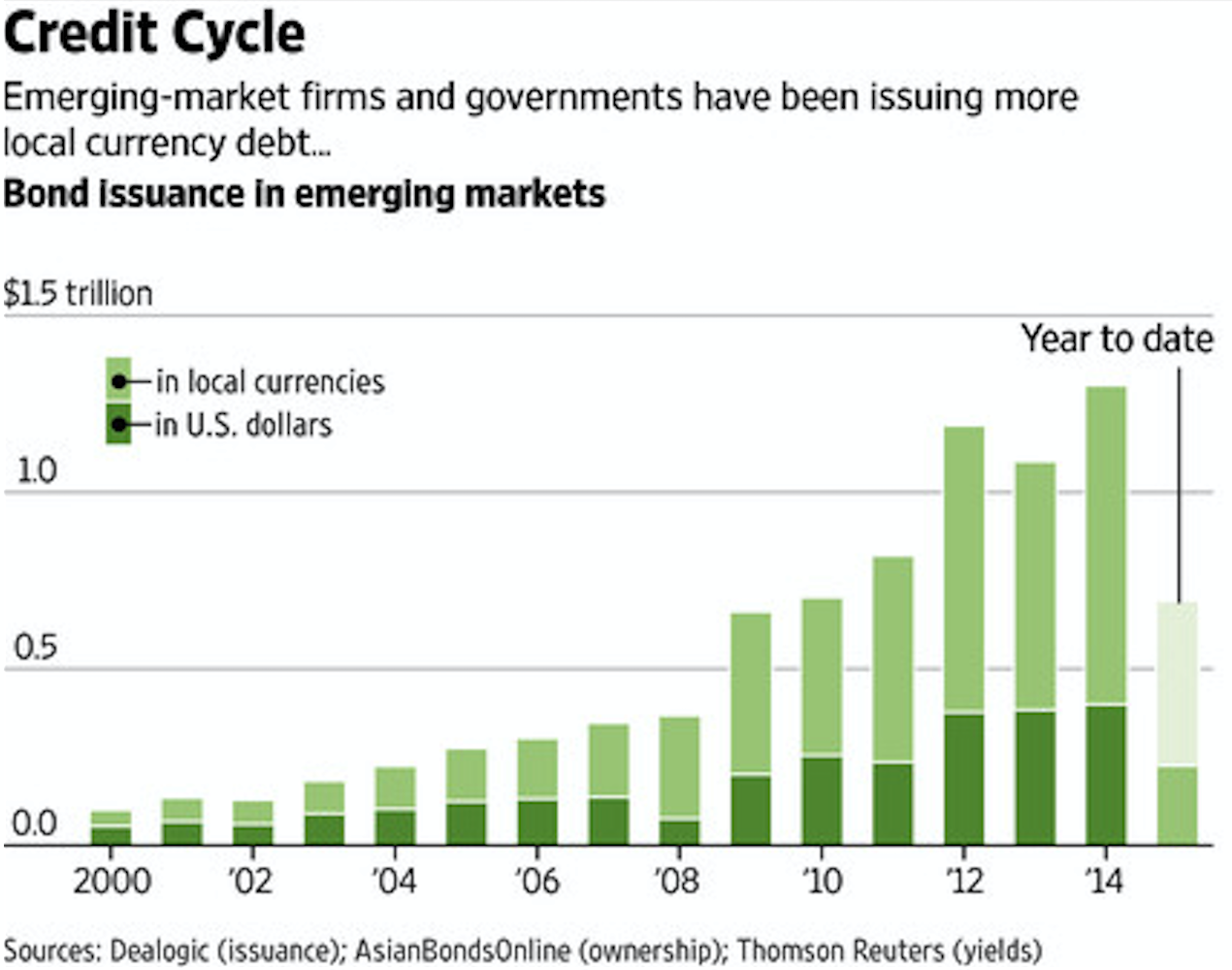

In the past, a VIX in the range of 35-40 has marked very important lows in this market (green circles). The only exception being the 1997 Asian Financial Crisis; however, at this point we do not believe that will occur again due to the fact that EM countries have learned from that experience and have borrowed more in local currencies. In fact, since the 2008/2009 recession, EM countries have borrowed far more than half in local currency which should help against a rising U.S. dollar in comparison to 1997. That being said, as with most regions of the world, debt levels are still increasing at an alarming rate and therefore this U.S. dollar denominated debt is still a big concern.

Source: Wall Street Journal

Our last point will bring this back around to valuations in the EM zone. In past cycles, the price-book ratio of EM equities has typically bottomed at around the 1.2-1.3 level. The exception to this was again during the Asian Financial Crisis. We are now at the level of 1.3 and at the same time approaching a very long-term trend line.

Source: Short Side of Long

In looking at historical metrics like we have illustrated here, we would suggest that based on probabilities we would have to lean in favor of the potential possibility that we are not far off at least a short to intermediate-term cyclical low in these markets. An outright recession in China could of course threaten this stance. With the EM region being the primary driver of world GDP growth, we believe this will also be an important driver in returning to a positive cycle back closer to home.