Market Insights: Second Quarter wrap-up

Milestone Wealth Management Ltd. - Jul 14, 2015

The second quarter was characterized by uneven global economic progress and rising bond yields softening deflationary fears, all resulting in nearly flat performance across most major asset classes.

Crosswinds amid rising global bond yields

The second quarter was characterized by uneven global economic progress and rising bond yields softening deflationary fears, all resulting in nearly flat performance across most major asset classes. We also witnessed an increase in volatility for capital markets with China, Greece and Puerto Rico collectively dominating headlines over the past few weeks and causing tension for global equity markets. At mid-year, our own TSX Composite was essentially unchanged while the U.S. equity market was up slightly. Overseas, we have seen pockets of higher returns, but most of these returns were in the first quarter followed by, in some cases, dramatic pullbacks in the second quarter. International developed markets continue to hold an edge over domestic markets amid continued accommodative monetary policies in Europe and Japan.

In Canada, our economy continues to lag the U.S. with negative GDP growth in five of the last six months. The damage from lower oil prices has shrunk our economy modestly in the first half and likely pushes a full recovery with our economy back to full capacity a couple years away. We are likely to see another rate cut later this week by the Bank of Canada to support capital markets. The prevailing view is that we will avoid a recession, but the environment will continue to be challenging for perhaps a longer expected period of time. It is in these times where active management and stock selection is paramount.

Although we continue to believe that we are in a secular bull market, we are likely gradually pushing towards the more mature stages. This may result in more muted returns going forward than what we have seen in the U.S. the last few years. However, with attractive earnings yields our stance on equities remains positive. For the rest of this year, we expect an environment of modest global cyclical improvement and low inflation to provide a continued reasonable backdrop for risk assets. The Federal Reserve seems to be on track to raise rates off the 0-0.25% floor later this year for the first time in almost seven years. However, it remains our view that we may see this rate hike pushed into 2016.

“We may never know where we’re going, but we’d better have a good idea of where we are.” Howard Marks

Our baseline expectation is an environment of continued subnormal economic growth domestically and an accelerating global economy. We do not view the first rate hike for the U.S. to be a concern as that is usually indicative of a stronger economy and fundamentals. In addition, historically equity markets have been higher a year after a first rate increase. Even with recent volatility overseas, we continue to view international markets favorably and are allocated to these areas with a positive bias. A combination of accommodative monetary policies, improving fundamentals and valuation remain supportive of solid long-term returns in many of these regions. For our fixed income allocations, we continue to focus more on various components of corporate credit than government bonds, and we maintain a low duration due to potential risks from a rising yield environment. As always, risk management is paramount so we continue to monitor various economic leading indicators as well as market internals and we will make adjustments to our asset allocation if warranted.

We would like to thank our clients for their continued trust in us as we navigate our way together.

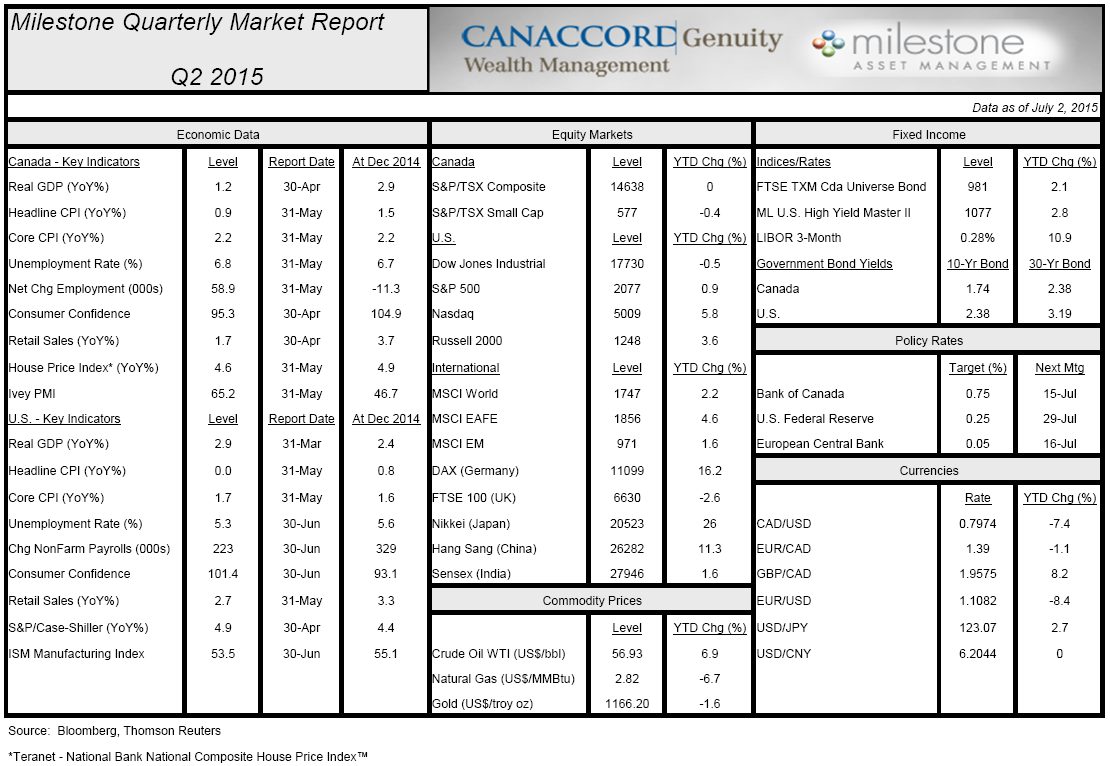

Here is our Milestone Market Report on economic data, capital markets, commodities and currencies through July 2nd: