Market Insights: Estimating crash-risk potential

Milestone Wealth Management Ltd. - Jul 04, 2015

This is an interesting and insightful piece from The Capital Spectator that examines potential crash-risk and where the U.S. equity market currently stands.

Estimating Crash-Risk Potential For The US Stock Market

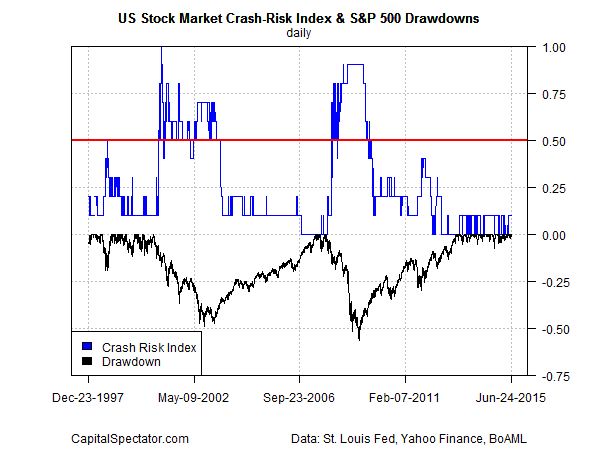

This is an interesting and insightful piece from The Capital Spectator that examines potential crash-risk and where the U.S. equity market currently stands. You can read the full piece to understand the dynamics behind the index, but to get to the conclusion we can say that this barometer is currently pointing to very low risk of a significant drawdown. This is not overly surprising given our current sense of the markets; however, there has been heightened volatility of late. When volatility starts to pick up our vigilance in looking at indicators like this one picks up as well. Although our long-term stance remains positive, we are continually looking for evidence that would change that. It is prudent to re-examine leading indicators when we see some short-term concerns like we are presently observing. The resulting chart of this index is displayed below. In the past, when this index moves above 0.5 (half of its underlying components are flashing red) it precedes major market downturns. The result is not always a crash, but it surely is worth a more defensive stance during those periods. Right now, the index is concluding that a potential major downturn is highly unlikely.

Source: www.capitalspectator.com