Market Insights: First Quarter wrap-up

Milestone Wealth Management Ltd. - Apr 11, 2015

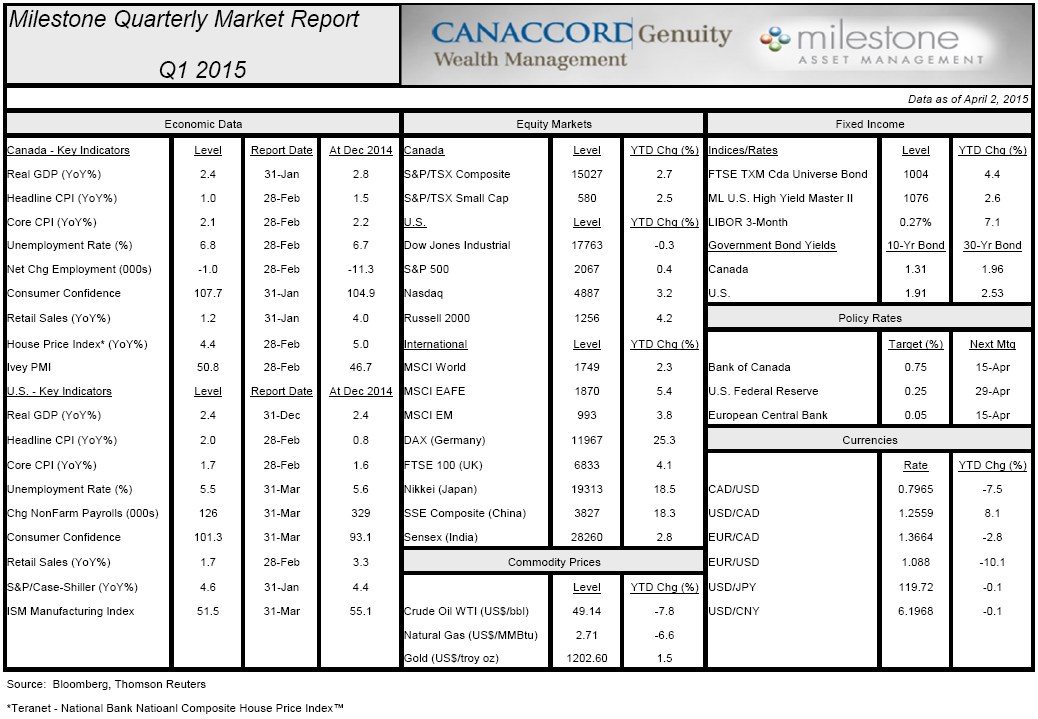

The start of 2015 has seen mixed results for equity markets and strong results for fixed income markets. In North America, the TSX Composite rose 1.85% while the U.S. S&P500 was only up 0.44% in local currency.

All Eyes on the Fed

The start of 2015 has seen mixed results for equity markets and strong results for fixed income markets. In North America, the TSX Composite rose 1.85% while the U.S. S&P500 was only up 0.44% in local currency. On the other hand, we experienced very strong equity returns in parts of Europe and in Japan, led by a 22% rise in the DAX (Germany) and an 18% rise in the Nikkei (Japan). The stimulus from European and Japanese Central Banks is likely behind this strength.

With long-term yields continuing to compress, the FTSE TMX Canada Universe Bond index advanced a strong 4.15% in the first quarter. High Yield bonds continue to struggle in relation to government and investment-grade corporates; however, they have stabilized this year in relation to the second half of last year.

The U.S. Dollar has continued its rise against most currencies around the world. Our Loonie fell another 7-8% to below 80 cents U.S. in the first quarter. The Euro declined 10% against the U.S. Dollar to a fresh 13-year low. In commodities, the price of oil seems to have stabilized around US$50 since mid-January. Energy is currently in its seasonally strong period until mid-May, so we will see if this stabilization continues. The relative strength index on the price of oil seems to indicate a bottom has occurred but we will not know if this is the case for many months.

In recent economic news, the Bank of Canada lowered its target rate from 1% to 0.75% in January. There are many who believe this may move even lower. With Canada essentially in a more accommodative stance and the U.S. set to embark on a tightening bias likely later this year, the Loonie continues to be under pressure. While the energy markets have been difficult for Western Canada, the lower Loonie has benefited eastern manufacturing.

South of the border, the strength in employment has suddenly taken a turn for the worse with the recent soft U.S. employment report. It will take longer to determine if this is a short-term negative or an indication of things to come, but with consumer confidence near or at recovery highs, we remain positive on consumer spending which makes up the bulk of the nation's economy.

Markets have been closely watching the words and behavior of the U.S. Federal Reserve, and rightfully so as their guidance continues to play an important role in markets. It has been our view that the first rate hike would come later than anticipated. With the continued strength in the U.S. Dollar, inflation well below target and some softening economic data of late, we believe the first rate hike to likely be in the last quarter of 2015 and perhaps even into early 2016. The current Fed Funds Futures are pricing in a 51% chance of a rate hike at the October meeting and a 63% chance at the December meeting.

Milestone continues to view the equity markets favorably and believes the current positive business cycle is still intact. Although overall corporate profit growth has recently declined (primarily due to the energy sector), equity multiples continue to expand. We are currently in the third year of the presidential cycle which has generally been a strong tailwind for equity markets in the past. Equities shift from a seasonally strong bias to a seasonally weak bias midway through the quarter, so we will be monitoring economic leading indicators as well as market internals. If warranted, we will make adjustments to our asset allocation as we head towards the summer months.

We would like to thank our clients for their continued trust in us.

Here is our Milestone Market Report on economic data, equity & fixed Income markets, commodities and currencies: