Market Insights: Is crude oil tracking the 1986 roadmap?

Milestone Wealth Management Ltd. - Mar 28, 2015

Is crude oil tracking the 1986 roadmap? Last week, Canaccord Genuity's North Amercian Portfolio Stategist Martin Roberge made some very interesting comments about the price of crude oil along with an accompanying chart...

Is crude oil tracking the 1986 roadmap?

Last week, Canaccord Genuity's North Amercian Portfolio Stategist Martin Roberge made some very interesting comments about the price of crude oil along with an accompanying chart:

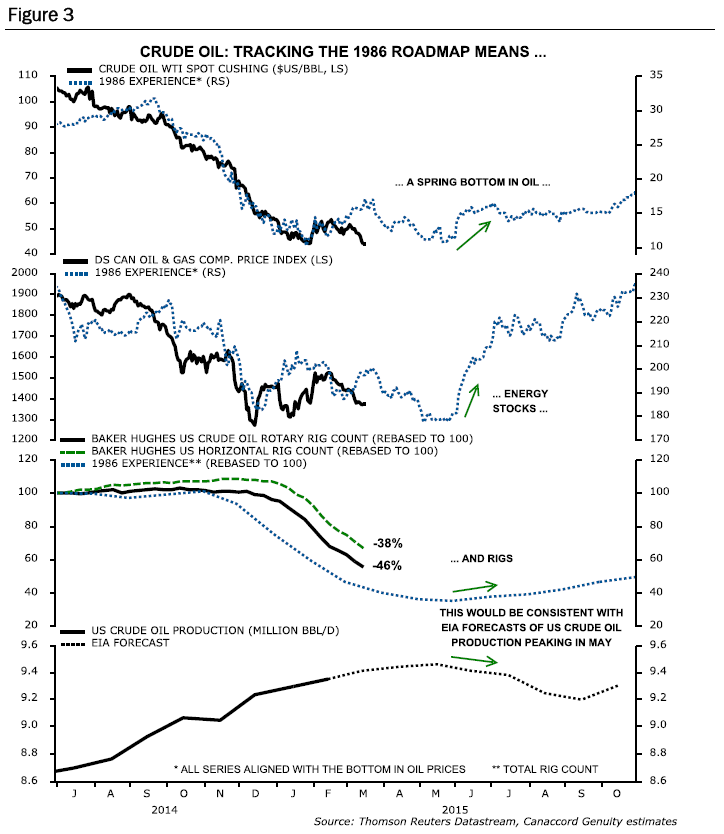

"Like it or not, bottoms in commodity and resource stocks are rarely V-shaped. It takes more than a few weeks/months for expectations of a balanced market to form. When it comes to oil and energy stocks, Figure 3 shows that so far, the current cycle closely tracks the 1986 roadmap where the bottoming process lasted nearly six months. Crude oil bottomed in January 1986 but a re-test was seen in May. Upon a successful re-test, Canadian energy stocks rose 25% in H2/86 and strongly led the S&P/TSX. The sector rose another 65% in 1987 before the market crash in October.

This time around, the re-test is happening sooner because a of stronger oil inventory build. Time will tell if new lows are made. After all, a 65% peak-to-trough decline in oil rigs was needed in 1986 for oil prices to bottom. So far, total oil rigs are down 46% but horizontal rigs are down 38% only (Figure 3, third panel). However, projecting the current downtrend in rigs, a ~60-70% haircut would be seen in late April/early May. This is consistent with the new IEA forecast of US crude production peaking in May at ~9.46 mb/d (Figure 3, fourth panel).

The energy trade is a real “pain” trade and accumulating dips is easier said than done. While it may take more rig cuts to balance the global oil market, this equilibrium, we believe, should be achieved in late Q2 at the latest. In the meantime, valuation provides a margin of safety. The Canadian energy sector bottomed at 1.4x book value in July 1986 vs. 1.5x in December last year. Obviously, should crude oil prices make new lows without corresponding lows for the energy sector, this would be unambiguously bullish for energy stocks. Stay overweight!"

This opinion echoes our ealier blog remark in January that we felt the current movement in the price of oil and the economic supply/demand backdrop more closely resembled that of 1986 than other downturns. Only time will tell how this shakes out.