Market Insights: What Round-Number Breaks Reveal About the S&P 500

Milestone Wealth Management Ltd. - Jan 30, 2026

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index closed 3.69% lower, while in the U.S., the Dow Jones Industrial Average decreased 0.42% and the S&P 500 Index rose 0.34%.

- The Canadian Dollar increased this week, closing at 73.46 cents USD vs. 72.95 last week.

- Oil prices rose again, with U.S. West Texas Crude closing at US$65.80 vs. US$61.29 last week.

- The price of Gold fell this week closing at US$4,857 vs. US$4,981 last week.

- The U.S. PPI rose 0.5% in December, above expectations, but the increase was narrow and margin-driven, with over 40% coming from a temporary surge in machinery and equipment wholesaling margins. Importantly, headline producer inflation slowed to 3.0% year-over-year, an improvement from 3.5% in 2024, while goods prices rose a modest 2.5% despite higher tariffs, underscoring limited tariff pass-through. With energy and food prices falling, money supply growth still restrained, and past margin spikes typically reversing quickly, the broader trend points to inflation remaining manageable, keeping the door open for rate cuts later in 2026. Furthermore, Chicago PMI jumped sharply into expansion territory (54.0), signaling renewed momentum in U.S. business activity.

- President Trump nominated Kevin Warsh to succeed Jerome Powell as Federal Reserve chair, reinforcing expectations of a more pro-growth and pragmatic Fed stance. Warsh, a former Fed governor with deep Wall Street and crisis-management experience, has been openly critical of past Fed policy missteps and is widely viewed as more willing to normalize rates as inflation pressures ease. If confirmed, his appointment could mark a meaningful shift in tone at the central bank, with greater emphasis on economic growth, market stability, and aligning monetary policy with a stronger investment and business backdrop under Trump’s economic agenda.

- German prosecutors searched Deutsche Bank offices in Frankfurt and Berlin as part of an investigation into suspected money-laundering tied to past dealings with foreign entities. The bank said it is cooperating fully, and the probe comes just ahead of its 2025 earnings release, adding near-term scrutiny but not yet alleging wrongdoing by senior management. The bank has had several run-ins with overseers over the years, subjecting them to large fines. The investigation fits a wider pattern of enforcement in Germany: in November 2025, regulators fined JPMorgan Chase €45 million for failures to promptly report suspicious transactions — the largest AML fine ever issued by BaFin (Germany’s financial watch dog) — highlighting that authorities are applying tougher standards across both European and U.S. global banks.

- Canada posted a $26.4B deficit from April–November, modestly wider than last year, but driven by deliberate policy choices rather than fiscal stress. Revenues rose to $317.2B, supported by stronger personal and corporate tax receipts and higher customs duties tied to tariff countermeasures, helping offset elevated spending. Program expenses increased due to higher transfers to individuals and provinces, but public debt charges edged slightly lower as short-term interest rates eased.

- Zijin Gold International Co. Ltd. agreed to acquire Allied Gold Corp. in a $5.5 billion all-cash deal, paying $44 per share, an all-time high for Allied’s stock. The transaction highlights strong global demand for high-quality gold assets, provides immediate liquidity and certainty for shareholders, and underscores Canada’s continued ability to attract large-scale foreign investment—pending shareholder and Investment Canada Act approval, with closing.

- A growing number of large companies — including Amazon, UPS, Microsoft, Intel, Nestlé, Verizon, and HP — have announced significant job cuts in recent months, led by UPS cutting up to 30,000 additional jobs in 2026 and Amazon slashing 16,000 jobs this week; largely tied to cost control, organizational simplification, and increased investment in artificial intelligence rather than a broad-based economic downturn. Economists describe the current environment as a “no-hire, no-fire” labor market, where overall employment growth has slowed but remains positive, and firms are reallocating resources toward productivity, automation, and long-term competitiveness amid higher costs, tariff uncertainty, and shifting consumer demand.

Weekly Diversion:

Check out this video: No Fear, Just Fun

Charts of the Week

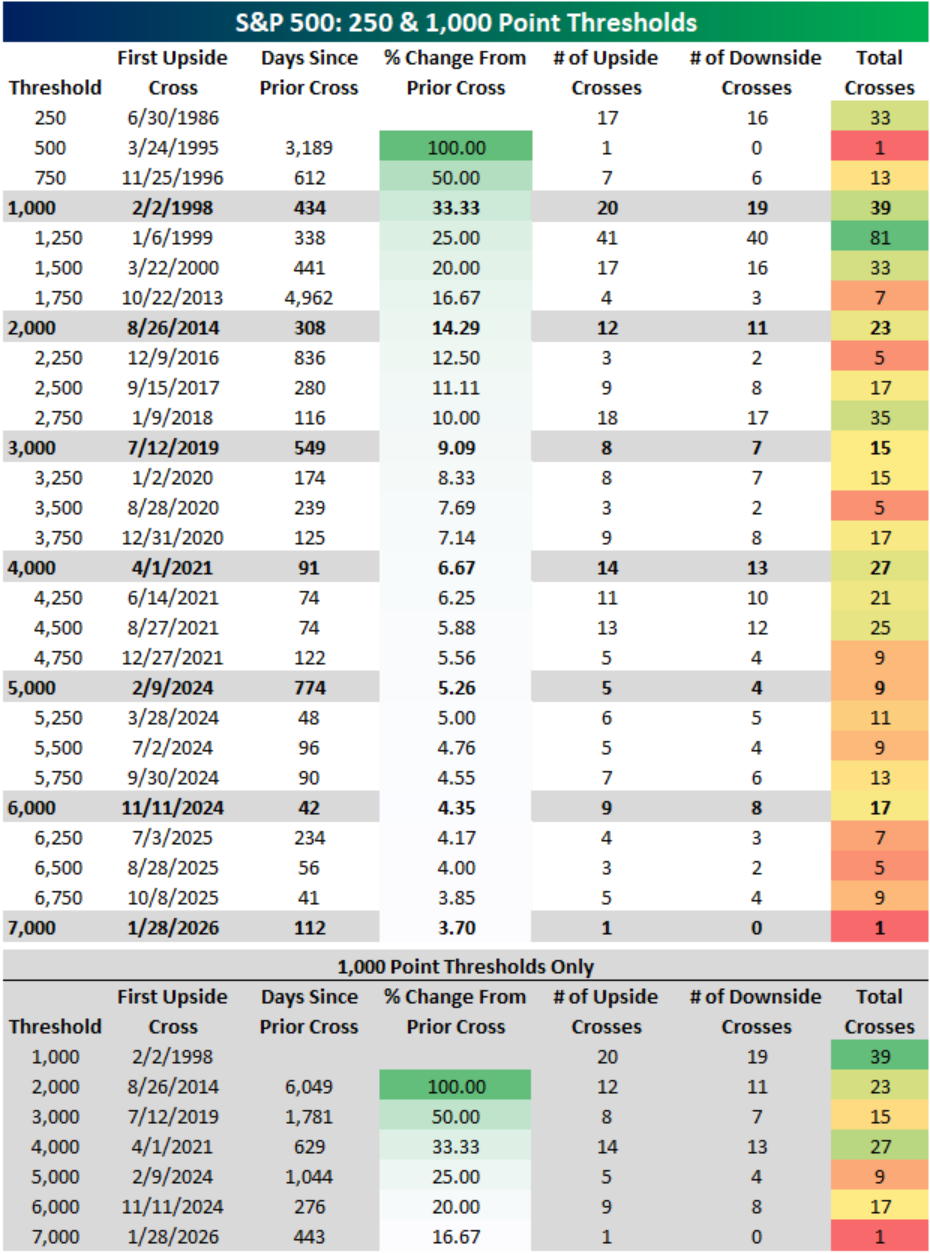

Psychological milestones in markets often attract more attention than their economic significance would seem to justify. The progression of equity indices through round-number thresholds is a clear example. While headlines may frame each crossing as a turning point, as we saw on Wednesday when the S&P 500 crossed 7000 for the first time, the data in the tables tell a more nuanced story about both diminishing percentage impact and surprisingly resilient forward performance.

The first chart below, which lists index levels in 250-point increments along with the dates of initial upside crosses, illustrates how nominal moves have grown less meaningful in percentage terms as the index has risen. Early thresholds show gains of 33% between rungs 750 and 1,000, whereas recent transitions from 6,750 to 7,000 amount to less than 4%. This declining marginal impact reflects the arithmetic reality that fixed point changes become smaller fractions of a larger base, even though they may feel dramatic to investors.

Source: Bespoke Investment Group

The second table above isolates only the 1,000-point thresholds and tracks the days elapsed between each first upside cross, the percentage gain from the prior level, and the total number of subsequent crosses. Here the compression of time between major milestones stands out: the gap between 1,000 and 2,000 spans many years, while later steps from 4,000 to 7,000 occur on increasingly shorter calendars. The percentage change required to climb each successive 1,000-point rung also declines, underscoring how compounding and index composition can accelerate nominal gains even when percentage returns are more modest.

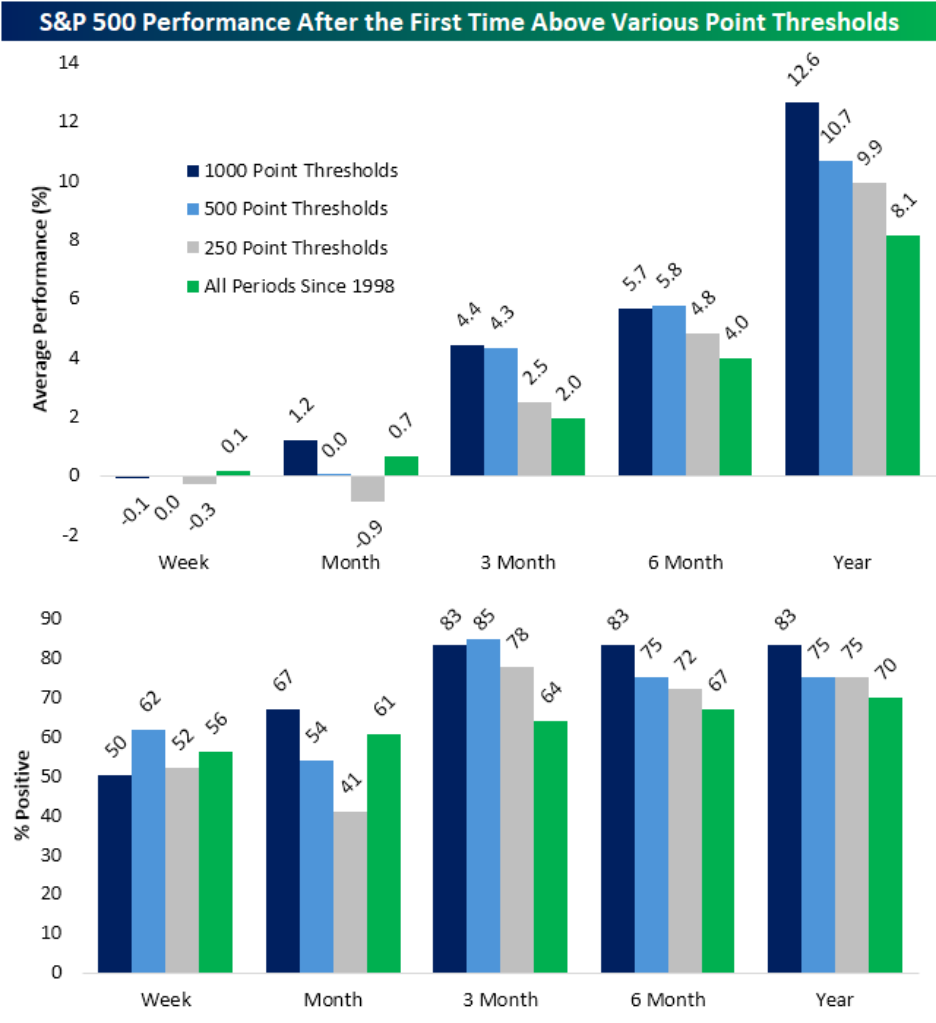

The final set of charts below, which compare average forward returns after first crossing various thresholds, offers a counterpoint to the notion that round numbers are purely cosmetic. Across weeks and months, the differences between 250, 500, and 1,000-point milestones are modest, but over three, six, and twelve months, the 1,000-point group shows meaningfully higher average gains and a greater proportion of positive outcomes than both smaller thresholds and the full sample of rolling periods since the late 1990s. For example, the one-year column indicates double-digit average returns following initial 1,000-point breaks, alongside a higher hit rate of positive years compared with the long-run baseline. While the sample size is small, these charts suggest that powerful enough trends to push an index into a new four-digit band have historically tended to persist rather than immediately reverse.

Source: Bespoke Investment Group

Source: Bespoke Investment Group

Taken together, the charts present a layered view of market milestones: visually striking steps in nominal terms that mask shrinking percentage moves, repeated crosscurrents around each level, and yet a tendency for strong trends to carry on beyond the first breach. For investors, this implies that round numbers are best treated neither as magical barriers nor as meaningless trivia, but as convenient markers for contextualizing risk, gauging investor sentiment, and framing discussions of trend durability.

Sources: Yahoo Finance, First Trust, Fox Business, Associated Press, The Canadian Press, EuroNews, Bespoke Investment Group

©2026 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.