Market Insights: December Outlook

Milestone Wealth Management Ltd. - Dec 05, 2025

Macroeconomic and Market Developments:

- North American markets were relatively calm this week. In Canada, the S&P/TSX Composite Index closed 0.23% lower. In the U.S., the Dow Jones Industrial Average rose 0.50% and the S&P 500 Index advanced 0.31%.

- The Canadian dollar increased this week, closing at 72.26 cents vs 71.58 USD cents last week.

- Oil prices were up this week, with U.S. West Texas crude closing at US$60.15 vs US$58.55 last week.

- The price of gold was stagnant this week, closing at US$4,205 vs US$4,218 last week.

- In the U.S., the ISM Services Index rose to 52.6 in November (a nine-month high), signaling continued expansion in the sector that drives most U.S. economic output. The gain was driven by sharply slower supplier delivery times—likely tied to air-traffic disruptions from the government shutdown—while new orders eased but remained expansionary. Hiring remains the sector’s weak spot, with the employment index (48.9) still in contraction for the eighth time in nine months as service firms stay cautious amid tariff uncertainty and a potential January shutdown. Price pressures eased but stayed elevated (prices paid fell to 65.4), consistent with still-sticky—but moderating—inflation as slow M2 growth points to softer inflation and economic momentum in 2026. ADP data showing a 32K drop in private payrolls suggests a softer official jobs report ahead.

- U.S. consumers ended Q3 on solid footing, with personal income up 0.4% in September and spending up 0.3%, while the Fed’s preferred inflation gauge (core PCE) rose a moderate 0.2% and held at 2.8% year-over-year. Income growth continues to outpace inflation, supported by a 0.4% gain in private-sector wages, though real spending was flat as most of the month’s consumption increase came from higher prices. With easing rent pressures, slow money-supply growth, and a softening labour market, economists expect inflation to drift lower and the Fed to continue its rate-cutting cycle next week.

- Canada added 53,600 jobs in November, pushing the unemployment rate down to 6.5% (vs. expectations for a rise to 7%), marking a third straight month of stronger-than-expected hiring and effectively closing the door on near-term BoC rate cuts. Economists caution, however, that the report’s strength was surface-level: all gains came from part-time work (+63K) while full-time jobs actually fell (-9K), and a drop in the participation rate helped “flatter” the unemployment rate as people became frustrated and gave up looking. November’s gains concentrated in youth employment and sectors like healthcare (+46K), accommodation & food services (+14K), and natural resources (+11K), while wholesale and retail trade shed 34K jobs. Regionally, Alberta led with 29K new jobs and a 1.3-ppt drop in unemployment to 6.5%, its lowest since early 2024. Wage growth held steady at 3.6% y/y. Overall, economists note the labour market is not as strong as the headline suggests, but the upside surprise reinforces expectations that the BoC’s rate-cutting cycle may have ended.

- Netflix announced a landmark USD $72B acquisition of Warner Bros.’ film/TV studios and HBO/HBO Max, marking the biggest entertainment deal in years and Netflix’s first major takeover—combining Netflix’s global streaming scale with Warner Bros.’ deep library (“Harry Potter,” DC, “Game of Thrones,” “Friends,” etc.). The deal, expected to close after WBD spins off its Global Networks division in 2026, positions Netflix to secure premium IP as industry consolidation accelerates, while regulators prepare for intense scrutiny given Netflix’s size. Paramount and Comcast had also bid, but Netflix’s cash advantage ultimately won out, with WBD shareholders set to receive $23.25 in cash and $4.50 in Netflix stock.

- Ford CEO Jim Farley praised the Trump administration’s reset of federal fuel-economy standards as a “victory for affordability,” arguing the previous CAFE rules forced automakers to push EVs regardless of consumer demand; the revised standards, which the White House says will save Americans $109B, allow Ford to launch more lower-cost U.S.-built vehicles and offer customers broader choice. Farley said the shift, combined with tariff adjustments, should help bring car prices down into early 2026—though he emphasized Ford isn’t returning to “gas-guzzlers,” but rather aligning EVs, hybrids, and gas models with real market preferences.

- Meta announced a series of commercial AI data deals with major news publishers—including USA Today, CNN, Fox News, People, and Le Monde—that will feed “real-time” news into its AI chatbot, while separately revealing that starting Dec. 16 it will use users’ interactions with Meta AI to further personalize content and ads across Facebook and Instagram (with no opt-out for users who engage with Meta AI). The company says sensitive topics won’t be used for ad targeting; the move comes as Meta races to scale its AI ecosystem, now over 1B monthly users, amid intensifying competition from Google, Amazon, and OpenAI.

Weekly Diversion:

Check out this video: It was on the way!

Charts of the Week:

Equity markets often enter December with a unique blend of seasonal tendencies, sentiment dynamics, and macro context that can create fertile ground for further gains after a strong year-to-date run. Historical evidence suggests that December has tended to be one of the more constructive months for stocks, even if it is not usually the single strongest month, and this backdrop shapes how investors interpret late-year pullbacks and rallies.

Seasonality and win streaks

Long-term data shows that December has posted positive returns more often than most other months, reinforcing its reputation as a supportive period for risk assets. However, the month stands out less for spectacular upside and more for its relatively low frequency of being the worst month of the year, as shown in the chart below, implying a bias toward stability rather than extremes.

Source: Carson Investment Research, FactSet, @ryandetrick

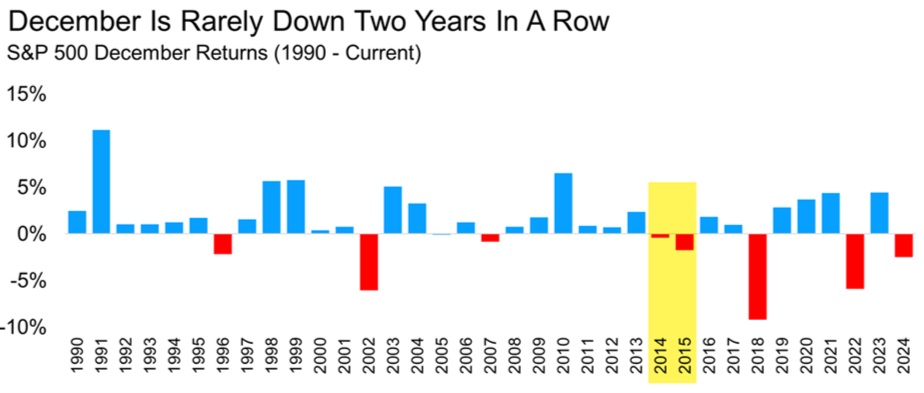

Recent history adds an important nuance: over the past decade, December’s average performance has been more muted, reminding investors that seasonality is a tendency rather than a sure thing. Even so, back-to-back negative Decembers have been very uncommon, as the next chart shows, which keeps the statistical odds tilted away from another weak outcome following a down December last year.

Source: Carson Investment Research, FactSet, @ryandetrick

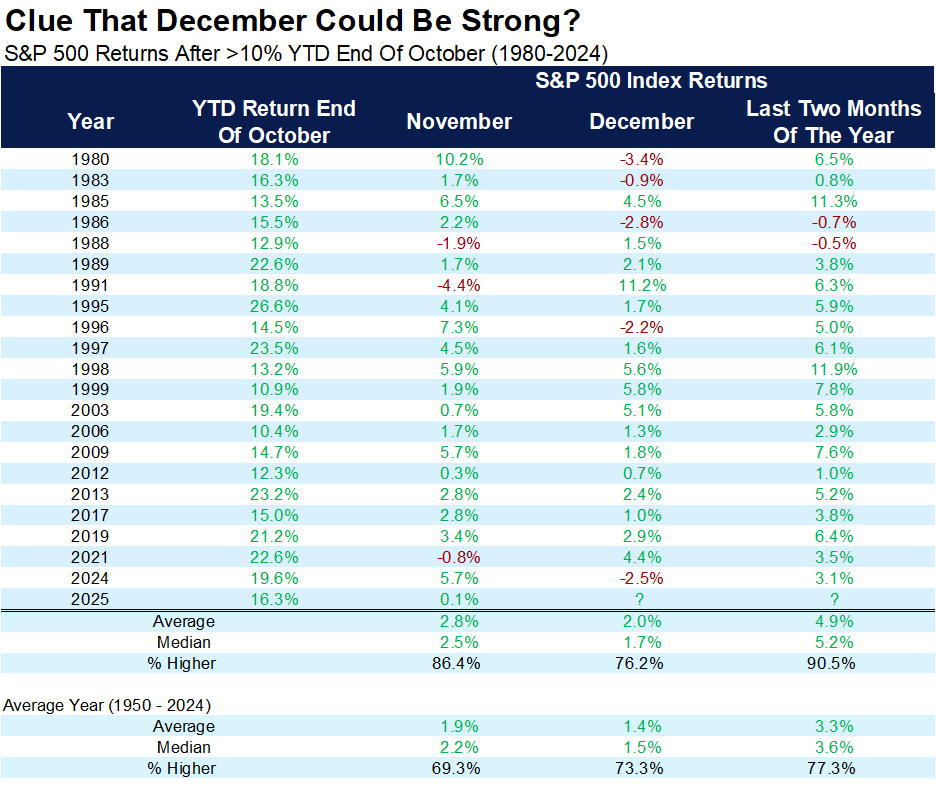

Chasing performance into year-end

Another recurring late-year dynamic is performance chasing, especially when the first ten months of the year have delivered double-digit gains. In such environments, market history shows that the final two months have frequently added to earlier strength as investors and allocators attempt to close performance gaps and fully participate in the prevailing trend. As we can see in the chart below, after such an occurrence, average returns were 4.9% for the last two months of the year compared to the all year average (since 1950) of just 3.3%.

Source: Carson Investment Research, FactSet, @ryandetrick

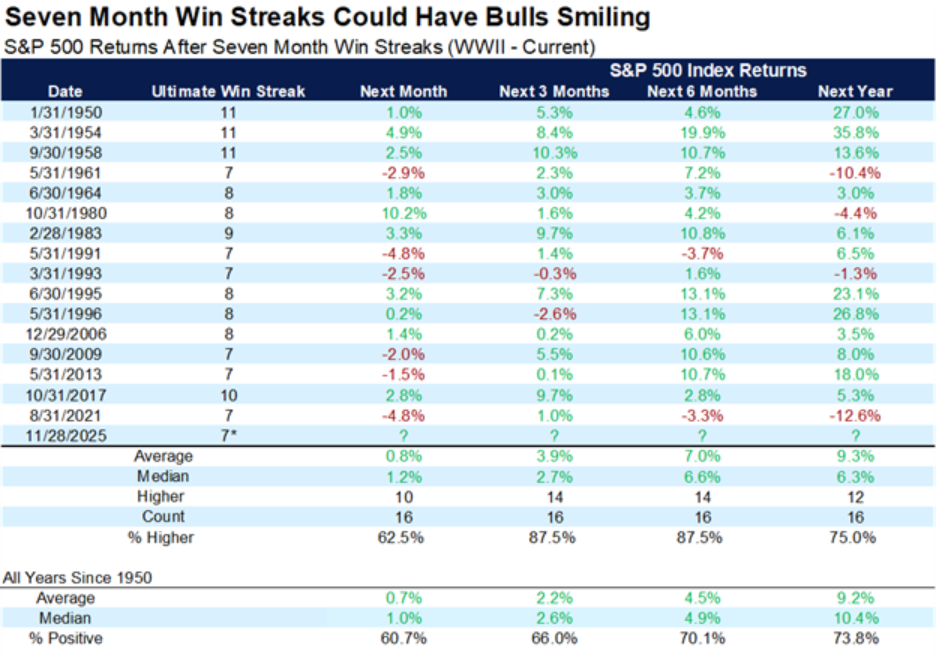

This chase effect can be amplified when the index has already strung together multiple consecutive positive months. Past episodes of extended monthly win streaks often saw further gains in the following months, indicating that momentum, once established on a multi-month horizon, tends to persist more often than it abruptly reverses, as shown in the following chart. As we can see, the shorter term forward returns (3-months and 6-months) significantly outperform the all-years average since 1950 before coming back in line with long-term averages when observing the next year’s forward returns.

Source: Carson Investment Research, FactSet, @ryandetrick

Policy backdrop and tail risks

Monetary policy acts as an important swing factor in how seasonal and momentum forces express themselves. Episodes where central banks are perceived as too restrictive have historically coincided with outsized downside in December, whereas an environment tilted toward rate cuts or at least policy support tends to reduce the odds of a severe late-year drawdown.

Against this backdrop, the probability distribution for December outcomes often skews toward moderate gains rather than dramatic losses or blowoff rallies. For investors, this suggests an emphasis on staying aligned with the underlying trend, respecting historical tendencies, and avoiding emotionally driven decisions in response to routine volatility that may simply be part of a healthier, longer advance.

Sources: Yahoo Finance, Reuters, Fox Business, First Trust, Carson Investment Research, FactSet, @ryandetrick

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.