Market Insights: Big Gains in Small Caps

Milestone Wealth Management Ltd. - Nov 28, 2025

Macroeconomic and Market Developments:

- North American markets were up significantly this week. In Canada, the S&P/TSX Composite Index closed 4% higher. In the U.S., the Dow Jones Industrial Average jumped 4.29% and the S&P 500 Index increased 4.75%.

- The Canadian dollar increased this week, closing at 71.58 cents vs 70.92 cents USD last week.

- Oil prices were up this week, with U.S. West Texas crude closing at US$58.55 vs US$57.91 last week.

- The price of gold spiked this week, closing at US$4,218 vs US$4,060 last week.

- U.S. retail sales rose 0.2% in September — the fourth straight monthly increase but softer than the 0.4% expected — with gains led by gas stations and restaurants/bars while non-store retailers pulled back; “core” sales rose just 0.1% but still ran at a strong 6.3% annualized pace in Q3, pointing to roughly 3.5% real GDP growth, though economists caution that tight monetary policy could slow spending ahead despite solid restaurant activity and steady year-over-year gains.

- U.S. producer prices rose 0.3% in September — driven by a 3.5% jump in energy and a 1.1% rise in food — while core PPI increased just 0.1%, leaving annual producer inflation at 2.7% and core at 2.6%; despite volatility, six-month trends show overall PPI running near the Fed’s 2% target, reinforcing expectations for another rate cut in December as tariff-driven goods inflation is being offset by softer services prices.

- Canada’s economy posted a headline rebound of 2.6% annualized in Q3 — far above the BoC’s 0.5% forecast — but economists stress the strength was almost entirely a “trade-driven mirage,” as an 8.6% drop in imports inflated GDP while domestic demand was 0%, with household spending, business investment, and government outlays showing no underlying momentum; StatCan also revised prior-year GDP figures higher and noted September grew 0.2%, but an early estimate points to a 0.3% contraction in October, reinforcing expectations that the BoC will hold rates in December despite the noisy Q3 data.

- PM Mark Carney and Alberta Premier Danielle Smith signed a major energy Memorandum of Understanding that lays out conditions for a new Alberta-to-Asia pipeline, with Ottawa offering fast-track treatment and pausing key regulations (clean-electricity rules, the emissions cap, and possibly the tanker ban) in exchange for Alberta adopting a $130/tonne industrial carbon price and major methane cuts. Any pipeline must have a private-sector proponent and advance alongside the Pathways carbon-capture project, while the agreement also aims to expand AI infrastructure and interprovincial transmission lines. Carney called it the start of an “industrial transformation,” Smith said it marks a reset in cooperation, and critics — including B.C. Premier David Eby, Indigenous nations, and environmental groups — warned they will oppose any west-coast route, keeping the pipeline’s future uncertain.

- Nutrien confirmed plans to pursue a US$1-billion potash export terminal at the Port of Longview, Washington—prompting pushback from Ottawa but support from some economists—as the company cites rail bottlenecks, labour disruptions, and limited port capacity in Canada as drivers behind choosing the U.S.; Transport Minister Steven MacKinnon says the federal government is working to convince Nutrien to reconsider, while University of Saskatchewan economist Joel Bruneau argues the firm is acting rationally in seeking the most efficient route to Asia and warns that Canada’s infrastructure lag, not Nutrien’s strategy, is the real problem. Nutrien says the Longview site best meets technical and commercial needs, with a final investment decision expected in 2027. The project would add 5–6 million tonnes of export capacity and complement existing shipments through Vancouver and Portland. Bruneau adds that increased global potash competition makes efficiency crucial, and Nutrien’s move should serve as a wake-up call for federal and provincial governments to fix supply-chain constraints if they want future investment to stay in Canada.

Weekly Diversion:

Check out this video: Where can I buy one?

Charts of the Week:

Small-cap equities can transition from neglected to in-demand portfolio holdings in remarkably short periods, especially when price momentum clusters into powerful multi-day surges. Recent index behavior illustrates how sequences of large daily gains are not just eye-catching headlines, but historically meaningful signals that often coincide with improved forward return odds and potential shifts in market leadership.

Three days of outsized gains

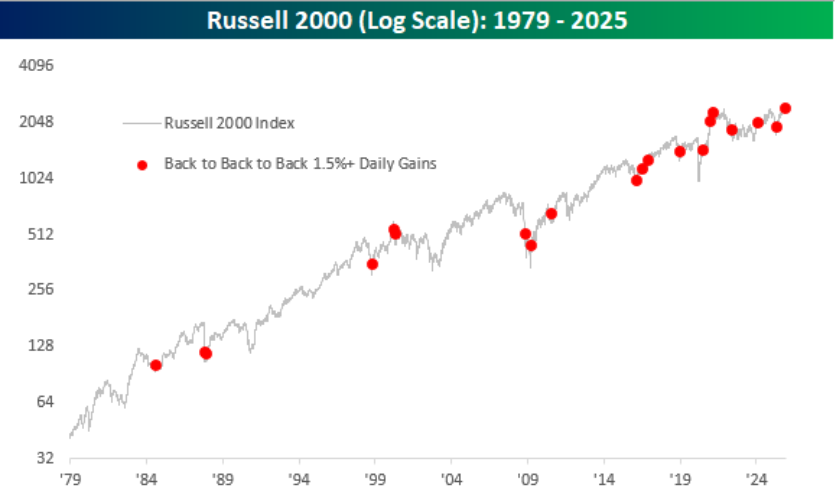

The first chart tracks every instance in which the Russell 2000 Index (U.S. small-cap benchmark) has advanced more than 1.5% for three consecutive sessions as it did on Tuesday, then plots the subsequent returns over multiple horizons. Another notable feature of the chart is the clustering of these streaks in the last quarter century. From the late 1970s through the end of the 1990s, only a handful of three-day 1.5%+ runs occurred, whereas the number of episodes has risen sharply in the years since, suggesting a regime where volatility, liquidity conditions, and policy responses make intense rallies more common.

Source: Bespoke Investment Group

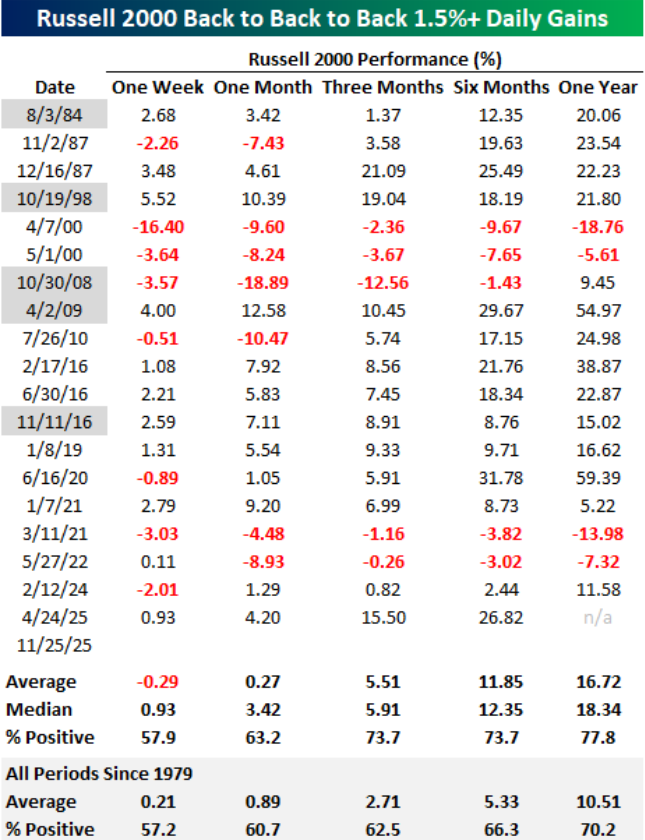

The accompanying table below shows that after such streaks, median returns at three, six, and twelve months are materially higher and more consistently positive than the long-term averages for all periods since the late 1970s. While single episodes can still disappoint, the pattern across nearly two dozen events points to a tendency for strong short-term momentum to bleed into the medium-term rather than immediately mean-revert.

Source: Bespoke Investment Group

Four days of broad strength

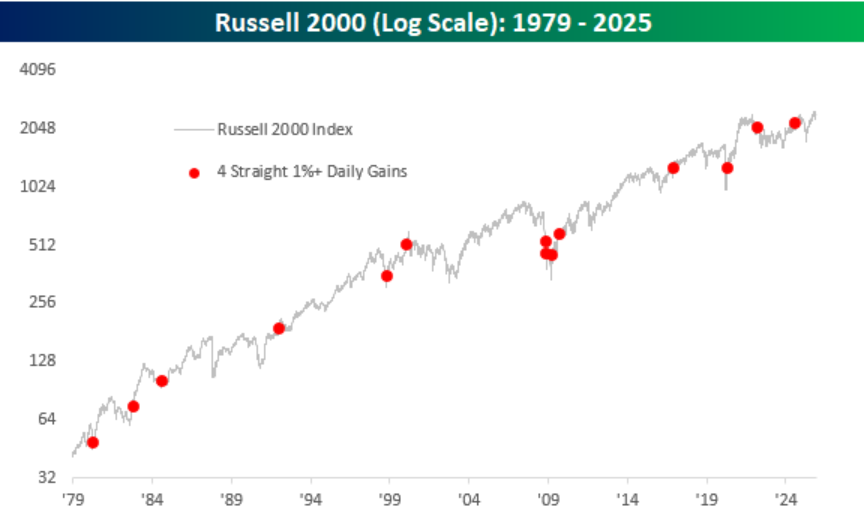

The next chart overlays the index’s full historical path on a log scale and highlights each episode in which it has posted four straight daily gains of at least 1%. These points of concentrated upside appear at various stages over the long-term but more often coincide with the early or middle phases of durable advances rather than marking ultimate exhaustion. The visual emphasizes that even after sharp short-term rallies, the index has frequently had ample room to compound further over the ensuing months and years.

Source: Bespoke Investment Group

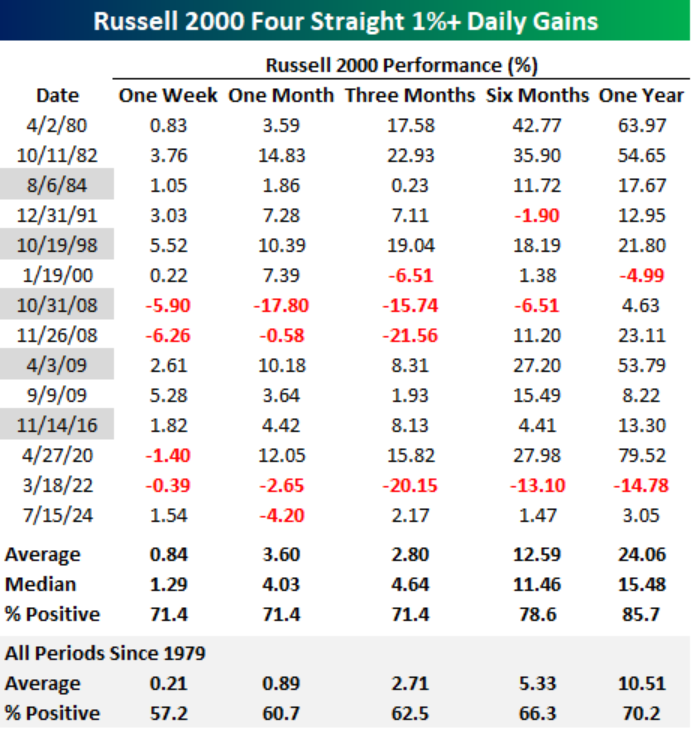

The last accompanying table below quantifies forward performance after these four-day 1%+ streaks and again compares it with the distribution for all periods since 1979. Average and median returns at six and twelve months are noticeably much higher, and the percentage of positive outcomes rises into the high seventies and mid-eighties, far above the base rates for the index’s full history. This suggests that such sequences have historically been associated with improving breadth and risk appetite rather than fleeting squeezes that immediately unwind.

Source: Bespoke Investment Group

Implications for positioning and breadth

Taken together, the charts and tables present a consistent message: when small caps deliver multiple consecutive days of large gains, the balance of probabilities has tended to tilt toward better-than-normal forward returns. Episodes where four-day streaks of 1%+ gains overlap with three-day stretches of 1.5%+ moves appear especially potent in the historical record, often preceding double-digit advances over the next three, six, and twelve months. The historical context embedded in these visuals also speaks to the broader theme of market broadening. When an index representing smaller, more economically sensitive companies begins to print repeated, high-magnitude up days and those bursts have a track record of leading to sustained gains, it suggests that participation in the equity advance may be widening beyond a narrow cohort of large-cap winners.

Sources: Yahoo Finance, The Canadian Press, First Trust, Bespoke Investment Group, The Star Phoenix, @DrJStrategy

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.