Market Insights: Tailwinds for Markets

Milestone Wealth Management Ltd. - Nov 14, 2025

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index closed 1.38% higher. In the U.S., the Dow Jones Industrial Average rose 0.34% and the S&P 500 Index increased by 0.08%.

- The Canadian dollar increased slightly this week, closing at 71.27 cents vs 71.22 cents USD last week.

- Oil prices inched ahead this week, with U.S. West Texas crude closing at US$59.92 vs US$59.82 last week.

- The price of gold rose this week, closing at US$4,088 vs US$4,013 last week.

- The White House announced new trade deals with Argentina, Ecuador, Guatemala and El Salvador that will lower U.S. tariffs on select goods the country doesn’t produce enough of — including coffee, bananas and cocoa — while keeping reciprocal rates in place. Most imports from these countries will still face tariffs (10% for Argentina, Guatemala and El Salvador; 15% for Ecuador), though Argentina will also see reduced tariffs on beef within existing quotas. The move drew pushback from GOP lawmakers concerned about pressure on U.S. ranchers, while officials highlighted improved market access for U.S. exports and commitments to reduce regulatory and environmental barriers.

- Alberta Premier Danielle Smith endorsed Ottawa’s newly expanded list of fast-tracked major projects — largely resource and infrastructure builds — but confirmed that negotiations with the federal government on a bitumen pipeline are still ongoing. Smith is pushing for regulatory overhauls to attract private energy investment, while PM Carney says Alberta must show progress on lowering emissions intensity to secure long-term approvals. B.C. Premier David Eby criticized the pipeline idea as unrealistic without massive taxpayer funding, but Smith said regulatory clarity could unlock private proponents. Both governments say talks remain productive, with more work ahead before any final agreement.

- Canadian manufacturing sales jumped 3.3% in September to $72.1B — the strongest level since February — with broad gains led by transportation equipment (+9.2%) and petroleum & coal (+5.3%), while wholesale sales (ex-energy and grains) rose 0.6% as food, building materials, and auto-related categories all posted solid increases.

- The Parliamentary Budget Officer says Ottawa is on track to significantly overshoot its new fiscal anchors, projecting average annual deficits of $64.3B over the next five years — twice last year’s forecast — as increased operating (not capital) spending drives deeper shortfalls and leaves the government unlikely to balance its operating budget or meet its deficit-to-GDP targets.

- Russia’s Lukoil says it is in talks to sell its foreign assets after new U.S. and U.K. sanctions and the collapse of a proposed deal with Swiss trader Gunvor. The company says any sale will ensure uninterrupted operations and energy supply in affected countries. Washington has given firms until Nov. 21 to wind down dealings with Lukoil under a temporary OFAC licence, increasing pressure on the firm as sanctions target major Russian producers Lukoil and Rosneft.

Weekly Diversion:

Check out this video: Hopefully that doesn’t land him on the IR

Charts of the Week:

Markets are frequently shaped by a combination of broad economic forces, policy developments, and behavioral patterns that can propel equities upward or downward. Currently, there are several converging factors that serve as positive drivers for equity and economic growth, each impacting sentiment, profitability, and future expectations in distinct but complementary ways.

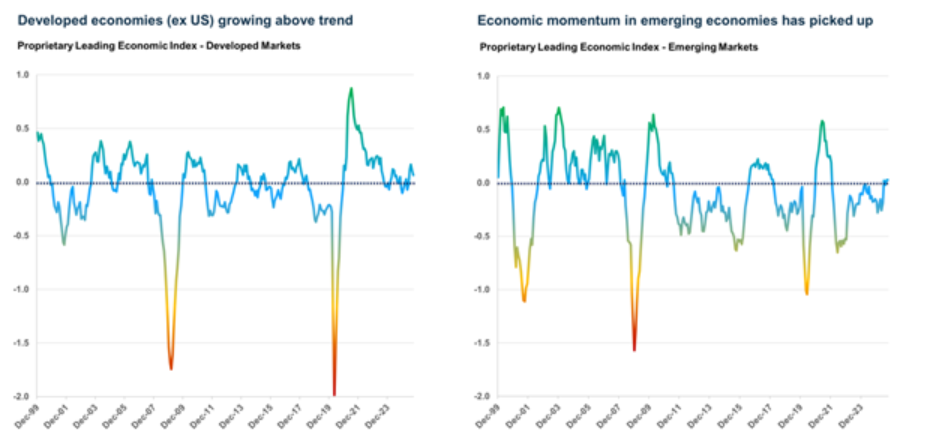

Global Economic Recovery

A resurgence in economic activity across international developed and emerging markets is a powerful catalyst for growth, as shown in these two charts. When international economies start to pick up, global demand for goods and services increases, boosting corporate revenues—particularly for U.S. or Canadian firms with significant overseas exposure. Historically, such synchronized global recoveries have supported expanding revenue bases and earnings growth, directly translating into stronger equity performance.

Source: Carson Investment Research

Fiscal Stimulus and Tax Policy

Aggressive fiscal stimulus—most notably through deficit-financed tax cuts—has immediate and tangible effects on both consumer behavior and corporate profitability. Front-loaded tax benefits and increased deductions can lead to higher disposable household income, which often gets funneled into consumption and investment. For corporations, persistent government deficits often help keep profits elevated, at least in the short-term, reinforcing bullish market conditions.

Trade Policy Stability

Resolution or reduction of trade disputes and tariff uncertainty supports equity valuations by lowering input costs and restoring confidence in supply chains. When trade-related chaos recedes, companies can forecast, invest, and operate with greater certainty, diminishing volatility and stimulating market momentum.

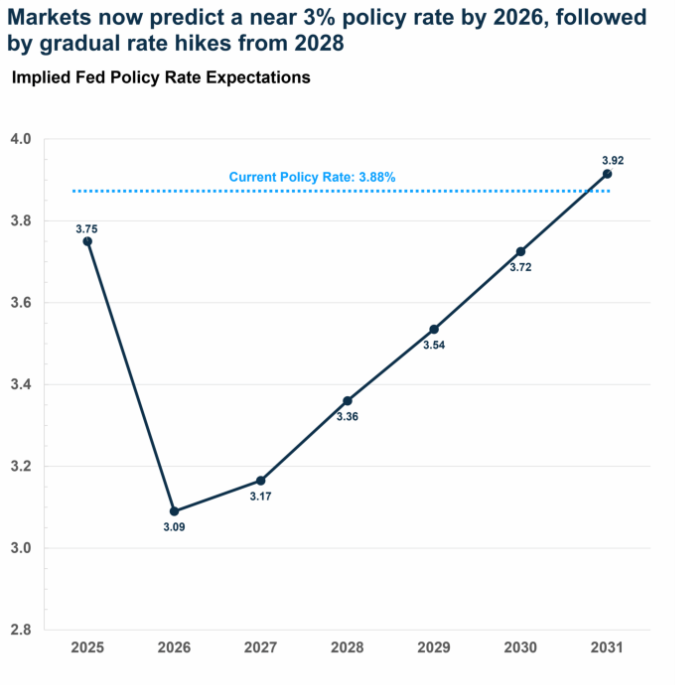

Lower Interest Rates

Central banks cutting policy rates—or signaling dovish intent—directly eases financial conditions. Lower rates drive down the cost of capital, spur cyclical sectors, support higher asset valuations, and foster positive sentiment in equity markets. The expectation of accommodative monetary policy frequently ignites rallies and supports sustained periods of market gains. The following chart shows that the futures markets are predicting the U.S. Fed policy rate to drop from a current rate of 3.88% to as low as 3.09% by early next year, providing a near-term boost.

Source: Carson Investment Research, Bloomberg

Market Momentum

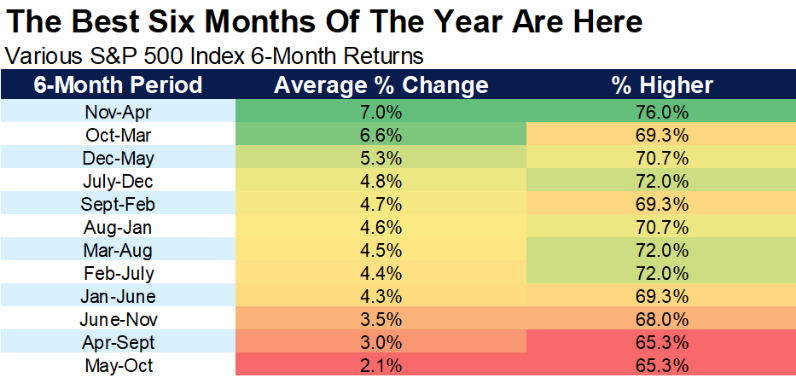

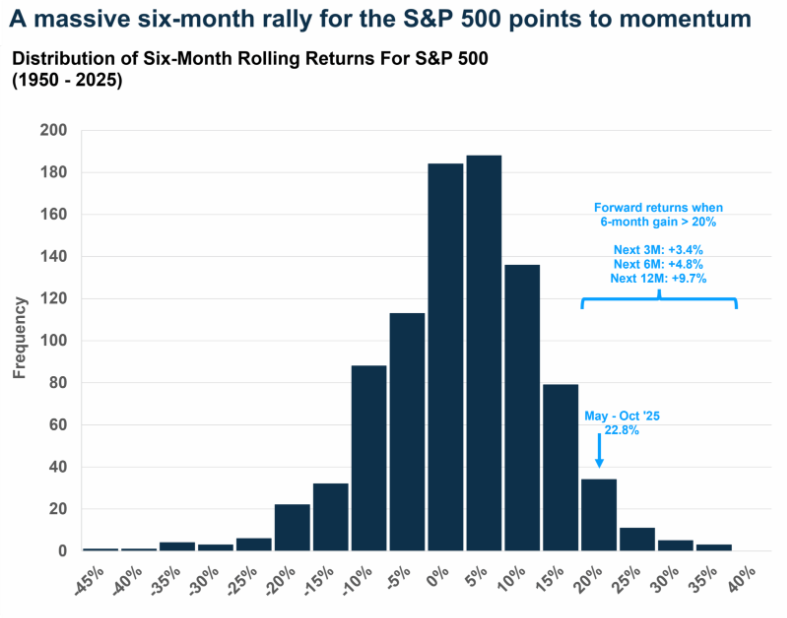

A backdrop of positive momentum—especially following significant market rallies—can generate powerful feedback loops. Historical trends show that strong past performance often supports further gains as investors extrapolate recent upward movement, increasing participation and risk appetite. This self-reinforcing dynamic underscores how psychological factors can amplify economic and policy tailwinds.

As we can see in the first chart below observing historical six-month performance data for the S&P 500 Index, the November to April timeframe has consistently provided the strongest returns, with both the highest average percentage gain and likelihood of positive outcomes. The second chart illustrates six-month rolling returns for the S&P 500 index over several decades. Most returns cluster around the 0% to 10% range, highlighting a typical positive but modest outcome, while extreme negative and positive returns are much less frequent. Notably, when the index has rallied more than 20% over six months—as has occurred recently, see chart notes in light blue—historical patterns suggest continued strong performance over the following months, pointing to underlying momentum in the equity market.

Source: Carson Investment Group, FactSet, @ryandetrick

Source: Carson Investment Research, Bloomberg

Ultimately, when these forces align, they create fertile ground for sustained market progress in the near-term, turning previous headwinds into supportive trends for investors and the underlying economy.

Sources: Yahoo Finance, The Canadian Press, Fox Business, Reuters, Carson Investment Research, Factset, @ryandetrick

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.