Market Insights: Year-End Seasonality

Milestone Wealth Management Ltd. - Oct 31, 2025

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index closed 0.30% lower. In the U.S., the Dow Jones Industrial Average rose 0.75% and the S&P 500 Index increased 0.71%.

- The Canadian dollar decreased slightly this week, closing at 71.30 cents vs 71.40 cents USD last week.

- Oil prices fell this week, with U.S. West Texas crude closing at US$60.89 vs US$61.47 last week.

- The price of gold fell again this week, closing at US$4,010 vs US$4,118 last week.

- The Federal Reserve cut interest rates by 0.25% and announced an end to its balance sheet reduction program, signaling a cautious shift amid limited economic data due to the ongoing government shutdown. Chair Jerome Powell likened the current policy environment to “driving in the fog,” emphasizing the Fed’s deliberate, data-limited approach. Powell said the Fed views its $6.6 trillion balance sheet as “ample”, moving toward a more neutral stance while keeping future cuts on the table. Analysts expect another rate cut in December and potentially more in 2026 as inflation eases and job growth remains soft. Despite policy uncertainty, business investment driven by AI, tariffs, and productivity gains continues to support optimism for long-term U.S. growth.

- The Bank of Canada delivered its second straight quarter-point rate cut, lowering the policy rate to 2.25%, but signaled that the easing cycle is likely over for now, calling the current level “about right” to balance inflation control with economic support. Governor Tiff Macklem described Canada’s slowdown as a “structural transition” rather than a typical downturn, citing lasting damage from U.S. tariffs on autos, steel, aluminum, and lumber that have reduced the nation’s productive capacity. The Bank’s new forecast sees GDP growth near 1.2% in 2025 and inflation hovering around 2%, while the job market remains soft at 7.1% unemployment. Economists largely view the decision as a pause, though some say continued weakness could justify another cut in early 2026.

- Canada’s economy contracted 0.3% in August, marking another weak month as both goods-producing and service industries declined, according to Statistics Canada. The drop — largely due to an Air Canada flight attendant strike, drought-hit hydroelectric generation, and softer manufacturing activity — nearly erased July’s 0.3% gain. Early estimates point to just 0.4% annualized growth in Q3, slightly below the Bank of Canada’s forecast, suggesting the economy is hovering near a technical recession after a 1.6% contraction in Q2. Economists expect modest rebounds in manufacturing and energy output, but warn that tariff pressures and sluggish exports continue to weigh on growth. The Bank of Canada, which cut rates to 2.25% this week, signaled it’s likely done easing unless economic conditions deteriorate materially.

- TD Bank economists warn that excessive taxes and regulatory red tape have become the “silent killer” of Canada’s competitiveness, arguing that Prime Minister Mark Carney’s economic agenda overlooks the urgent need for structural reform. In a new report, TD’s Beata Caranci and Francis Fong say that without a major overhaul, Canada will continue to lag in productivity and investment, noting that investment per worker ranks near the bottom of OECD countries and that industrial regulations have surged 36% since 2006. The economists urge Ottawa to broaden the tax base, lower rates, and streamline regulations, emphasizing that current policies discourage business growth and make it harder to attract skilled talent. Calling this a “turning point in Canada’s history,” they caution that failure to act could lead to “death by a thousand cuts” to the nation’s economic competitiveness.

- Job vacancies in Canada fell to their lowest level since 2017, with 457,400 openings in August, down 2.4% from July and 15.2% year-over-year, according to Statistics Canada. The job vacancy rate held steady at 2.6%, but the number of unemployed people per vacancy rose to 3.5 — the highest ratio since 2016, highlighting continued labour market softening amid weak hiring.

Weekly Diversion:

Check out this video: Happy Halloween!

Charts of the Week:

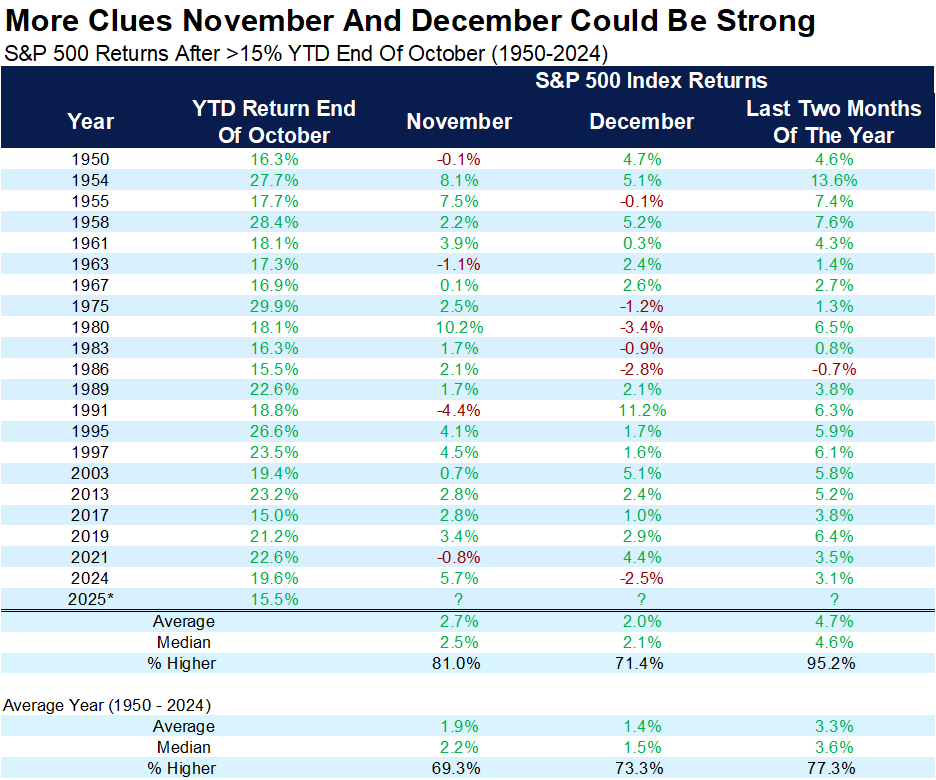

The stock market has historically exhibited a pattern of strengthened performance toward the end of the year, particularly in November and December. Data spanning many decades reveal that the final two months often deliver returns significantly above the average for the entire year. This seasonal trend, commonly referred to as the "year-end rally," tends to follow a period of increased volatility and investor apprehension typically seen in October.

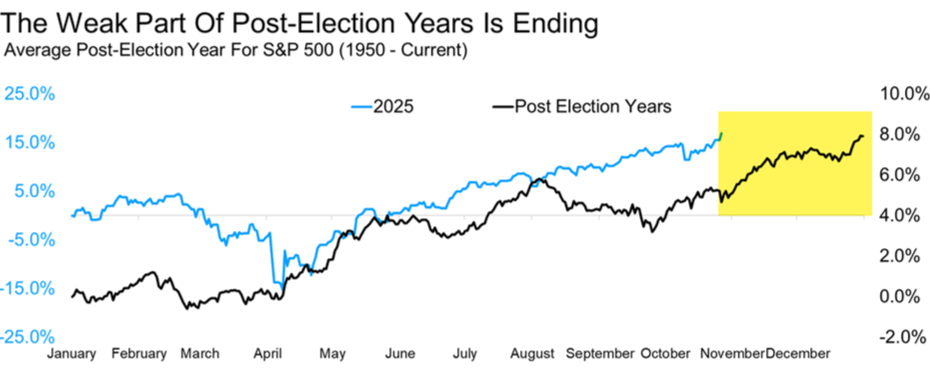

This seasonality is reinforced by historical averages and medians, where markets frequently show near double the returns in November and December compared to other times of the year, as highlighted in the table below. Additionally, statistical evidence suggests that when markets have posted gains leading into October, this momentum carries through the year-end period with even stronger performance. This is especially notable in post-election years, which traditionally experience a volatility dip earlier in the year followed by sustained gains as confidence rebuilds, as shown in the last chart.

Source (both): Carson Investment Research, Factset, @ryandetrick

In essence, while market threats and fears may rise during the autumn months, the historical evidence suggests that investors can often expect a robust rally toward the year's end, rewarding patience and disciplined investment strategies. This insight encourages a fact-based approach to market analysis, emphasizing the importance of seasonality and cycle patterns in guiding expectations for portfolio performance.

Sources: Yahoo Finance, First Trust, The Canadian Press, Carson Investment Research, Factset, @ryandetrick

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past results are not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.